|

MARKET HIGHLIGHT, SEPTEMBER 2005

GREATER PHILADELPHIA MARKET HIGHLIGHT

Retail Market

According to Troy Peple, the president of Fameco Real Estate, and Brandon Famous, the CEO and founder of the company, the Philadelphia retail market thus far in 2005 has continued to perform exceptionally well. A lack of suitable space for retailers expanding in the area is driving the leasing market, while investment sales are very high and supply is increasing in response to demand.

“You just can’t get product to the market fast enough,” says Peple of new developments.

Pensions, real estate investment trusts (REITs) and other institutional investors are pushing sales activity, while many individual owners who might have not sold in the past are taking advantage of this seller’s market.

“Right now, cap rates are getting so low and prices are getting so high that family trusts and individual investors are really looking more to be sellers than buyers,” says Peple. “We’ve also been able to work with some of our purchasers and put together some really creative tax-deferred structuring techniques that have made salability or partial salability a lot more attractive to investors that typically would like to sell at the top of the market but can’t afford the tax consequences.”

Despite the strong seller’s market, the retail market has not seen a strong trend of sale-leasebacks, as in some other sectors of commercial real estate.

“I think because real estate is so much more central to retail performance as a company — where in the office sector, it’s a cost, but in retail, real estate really affects your sales — you have retailers that are comfortable with it and retailers who aren’t, and they tend to stay relatively stable,” says Peple. “You don’t see a lot of them switching back and forth the same way you do in the office environment.”

Philadelphia Industrial Market

Sites available for development in Philadelphia County and the established suburban parks are limited. Numerous former and potential industrial locations have been acquired for retail and residential conversion. We are beginning to see an increase in expansions of existing buildings with excess land, and developers are also considering building or converting existing structures to condominiums to meet the continued strong demand to purchase buildings. Superior interstate access and larger parcels continue to drive bulk distribution requirements to the Lehigh Valley and Interstate 81 corridors. However, there are several projects in the pipeline that will boost construction in the “metro area” suburban counties such as Bucks County in Pennsylvania and Burlington and Gloucester counties in New Jersey.

Several significant developments have impacted the market lately. Catellus Development Corporation (which is being acquired by ProLogis) will be developing a 900,000-square-foot building for Georgia Pacific at the Quakertown Interchange of Interstate 476 (northeast extension of the Pennsylvania Turnpike). This will be the largest project outside of the I-81 corridor or the Lehigh Valley. DP Partners has acquired 1,000 acres in Gloucester County, and plans the first spec development at the Interstate 295 exits 10 and 11 market in more than 4 years. The project will be similar to the company’s LogistiCenter projects in the Lehigh Valley and I-81 corridor.

Liberty Property Trust, DP Partners, Whitesell, Opus East, and IDI/Rockefeller Group are the most active developers in the area, or will become more active in the immediate Philadelphia area. Liberty, Equilibrium Equities, ProLogis, Mericle, DP Partners, USAA and Higgins Development have major projects planned or underway in the Lehigh Valley and I-81 corridors.

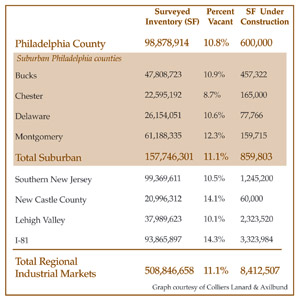

Regionally, the vacancy rate is down almost 14 percent from 1 year ago. The vacancy rate for the Philadelphia and the suburban counties is 11.0 percent.

Asking rents for warehouse space average in the $4.00 to $4.25 per square foot range, and are between $3.50 and $4.00 per square foot for bulk space. Rents, which have remained flat, will begin to increase, particularly as more new development commences. This will be driven in part by the increase in construction costs. In addition, tenants will be signing longer-term leases, and concessions will be diminishing.

As the Central New Jersey Turnpike markets at exits 7A to 8A become increasingly built-out, there has been a corresponding increase in interest by local and national developers at Exit 6 of the New Jersey Turnpike.

— Robert B. Steinhart, SIOR, is a senior executive vice president with Colliers Lanard & Axilbund in Philadelphia, Pennsylvania.

Philadelphia Region Industrial Market: Lehigh Valley

While there is some industrial development in the city of Philadelphia driven by adaptive reuse and the spot zoning of Keystone Opportunity Zones providing state and local tax abatements, the most significant industrial development activity is occurring in the outlying areas of the Philadelphia region. The Lehigh Valley, to the north, and the Interstate 81 corridor to the west, have seen continued development supported by strong tenant demand given the area’s strategic location to major Mid-Atlantic and Northeast markets. Big box retailers and regionally focused distribution and logistic providers have been the target market for the majority of the development both planned and underway in the area.

The Lehigh Valley industrial market arrived at the midyear mark with vacancy at 3.5 percent, having shed a considerable 6.5 percentage points from vacancy levels seen at the end of 2004. Significant transactions impacting vacancy include Wakefern’s long-term lease of a 1 million-square-foot distribution facility developed by Liberty Property Trust. The company will use the building as a food distribution facility serving its ShopRite supermarket locations located throughout the Northeast and Mid-Atlantic. Additionally, Opus East fully leased the first of three buildings at Bethlehem Crossing, a 42-acre distribution complex which, when finished, will place 460,000 square feet of space onto the inventory. Opus East is also currently constructing a 502,000-square-foot, build-to-suit distribution center fully leased to DHL.

As robust demand has driven down vacancy, multiple developers in the region are once again active, with numerous speculative and build-to-suit projects in the pipeline. DP Partners recently completed construction on a 594,000-square-foot facility, the first of two buildings at the 100-acre Allentown LogistiCenter, which will ultimately place 1.2 million square feet of space in the market. Additionally, there is a 1.2 million-square-foot, build-to-suit project being marketed at Allentown Commerce Park. Further west, at the nexus of Interstate 80 and Interstate 81, Higgins Development Partners is highly active, marketing speculative and fully approved build-to-suit projects in the Humboldt Industrial Park located in Hazleton. These buildings leverage the area’s access to major distribution networks, business-friendly tax structure and pool of available labor.

There is currently more than 5 million square feet of demand in the market reflecting continued interest in the region due to its strategic geographic location, economic advantages, and the sustained trend of firms choosing to consolidate their distribution operations into fewer, but larger, distribution facilities.

— Steven Bonge is a senior vice president with Grubb & Ellis in King of Prussia, Pennsylvania.

Philadelphia Investment sales

The investment sales market in the Philadelphia central business district (CBD) in the first half of 2005 is on pace to match the exceptional high volume of sales in 2004.

Eight buildings totaling approximately 2.8 million square feet with a value of $850 million sold during the first half of 2005, compared to a total of 18 buildings comprising 6.75 million square feet and $330 million in value in 2004. To put this in perspective, the entire CBD office market is 37 million square feet, which means that approximately 25 percent of the entire office market traded during the last year and a half.

The second half of 2005 is also forecasted to be active with several buildings currently under agreement, including the 1.2 million-square-foot Two Liberty Place. American Capital, a private Miami-based investor, is paying approximately $144 million (or $120 per square foot) for the 60 percent vacant Class A office tower. We expect at least three Class A buildings totaling over 2 million square feet to be placed on the market after the summer.

Active investors include a diverse mix of public real estate investment trusts (REITs); pension funds; and private local, national and foreign money. As in most markets, the REITs and pension funds are attracted to the larger Class A assets that are priced at more than $50 million, with private investors focused on smaller Class B assets. Competition is fierce among all sectors as Philadelphia continues to be very popular among investors outside of the region. Many of these investors believe Philadelphia is undervalued as compared to New York, Washington, D.C., and Boston. With the explosive residential and retail growth in Center City there is investor sentiment that the Philadelphia office market is well-positioned for substantial appreciation.

|

The Comcast Center and the Philadelphia skyline.

|

|

Concerns still persist due to the looming vacancy attributed to the relocation in 2006 and 2007 of several major office tenants to the two new office towers being constructed (28-story, 728,000-square-foot Cira Centre adjacent to the 30th Street Station; and 57-story, 1.2 million-square-foot Comcast Center at 17th and JFK Boulevard). Cira Centre will be 95percent occupied upon completion in the fall of 2005 with the last 300,000 square feet of leases signed from tenants outside of the city and Comcast’s expected growth should help to offset some of these concerns.

The Philadelphia market will remain dynamic for the next several years as the two new towers reach completion and the residential population grows — thereby changing the shape of the entire city.

— Peter C. Soens is a principal and co-owner of Seligsohn Soens Hess/TCN Worldwide in Philadelphia.

Philadelphia Office Market

Philadelphia is a “steady as she goes” market of more than 38 million square feet of office space in its central business district (CBD). Over the past 19 years of highs and lows, Grubb & Ellis has tracked an average of approximately 400,000 square feet of positive absorption each year. This is in relation to a supply of 5.8 million square feet of vacant space.

Despite the unfortunate bankruptcy of American Business Financial (ABF) at the Wanamaker Building, producing new CBD vacancy of 230,000 square feet, the overall market continued to improve in the second quarter by recording more than 175,000 square feet in positive absorption. Year-to-date absorption of 337,000 square feet has now exceeded our projections. Assuming a strong second half of the year, it is probable the overall vacancy rate will fall to about 15 percent at year-end, despite 952,000 square feet of new supply being added in the fourth quarter. These buildings include 1) the new Cira Centre (727,725 square feet), which was developed in a tax-free zone (Keystone Opportunity Improvement Zone — KOIZ) and is 91 percent occupied prior to opening; and 2) the redevelopment of 901 Market Street (225,000 square feet), which is 62 percent leased.

The statistics for the second quarter show relatively little change from the first quarter. The big story on new construction is the 1.3 million-square-foot corporate headquarters being built for Comcast, which will occupy 534,000 square feet. This 57-story building was designed by A.M. Stern and is LEED certified. This is the first time Philadelphia has seen cranes on the skyline since the early 1990s.

The sublease market remains at more than 1 million square feet, which is consistent with years past. Activity has picked up with more than 100,000 square feet subleased year-to-date within Bell Atlantic Tower, and Comcast has recently signed a sublease for most of the Arkema sublease space (40,000 square feet) at 2000 Market Street.

Major transactions above 75,000 square feet for the first half of 2005 are as follows:

• ACE, USA (156,000 square feet) Penn Mutual Tower (New);

• Deloitte & Touche (122,000 square feet) 1700 Market Street (Renewal);

• Lubert Adler (88,000 square feet) Cira Centre;

• HUD (75,000 square feet) Wanamaker Building (Renewal).

As we move into the second half of the year, it is now clear that the recessionary period of 2001 is behind us, although landlords will probably not experience rental rate growth for a year or two. Most of the competition for deals are in the “trophy” class, which have seen their rates erode by $5 per square foot over the last 5 years. Meanwhile, the typical Class A buildings have held their own through the downturn with rates in the low $20 per square foot, full service. Free rent can be as high as 1 month for every year, and tenant allowances have grown to $30 to $45 per square foot for 5- and 10-year lease terms.

— Craig Scheuerle is a senior vice president with Grubb & Ellis Company in Philadelphia.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|