|

MARKET HIGHLIGHT, OCTOBER 2006

NEW JERSEY MARKET HIGHLIGHT

New Jersey Retail Market

The Northern New Jersey and Hudson County retail markets are flourishing. This area boasts a growing residential population with a burgeoning household income, major improvements in the public transportation systems, urban renewal and rezoning, and a substantial and stand-alone market with office, retail and residential inventories rivaling those of most major cities known as New Jersey’s Gold Coast.

Several factors have attributed to the strong state of this ever-expanding marketplace. For one, residential growth remains a primary demand driver for retail. During the last 6 years, approximately 27,000 units have been constructed in Hoboken, Jersey City, Union City and Weehawken combined. The retention of well-educated 20-somethings within the Gold Coast as they mature to wealthy 30-somethings is a relatively new phenomenon. These young professionals, enjoying the Gold Coast’s energy and sense of place, are bolstering the retail market by electing to raise families in this urban market rather than move to suburban New Jersey locations. As each additional luxury condominium and rental development becomes occupied, the need for retail outlets expands.

To address this unmet demand, and with foreknowledge that this growing population segment values convenience and a pleasant shopping experience, some developers are taking New Urbanism initiatives and including retail components in their developments. Examples of this include Roseland Property Company’s Port Imperial development which spans 2 two miles of the Hudson Riverfront property through three municipalities, and the ambitious Liberty Harbor North development in Jersey City.

For cities along the Hudson River waterfront in particular, the expansion of the New Jersey Transit Lightrail lines has opened up previously undesirable locations to development, facilitated the rediscovery of beautiful, yet neglected urban downtowns, and supported the health of construction and leasing occurring in redevelopment zones that now permit retail.

However, spaces within primary retail corridors remains difficult to find. With a lack of neighborhood and community strip center spaces (whose rents average $26.50 per square foot with a vacancy rate under 4 percent), retailers are being forced out of the more traditional retail locations. This has fueled the growth of urban markets (with rents averaging between $18 per square foot and $85 per square foot depending on the market).

Smaller shops and franchises are readily absorbing urban space and leading the way for many regional and national tenants to follow. This has encouraged the redevelopment of old urban locations and redevelopment zones. For example, rents within Hoboken’s mature Washington Street corridor range between $70 per square foot triple net lease and $105 per square foot triple net lease with limited available space. While some retailers continue seek space on Washington Street near the W Hotel, which is under construction, or within Toll Brothers’ Maxwell Place waterfront development (asking rents in the mid-$50s per square foot triple net lease), others are considering alternative locations adjacent to their customers in one of Hoboken’s burgeoning submarkets.

Monroe Center, flanking the 9th Street Lightrail Station within Hoboken’s northwest redevelopment zone, exemplifies this trend. This transit friendly village, which features 435 luxury condominiums, 200 small business/artist spaces (95 percent leased), and 125,000 square feet of retail (50 percent pre-leased), is providing the first large contiguous delivery of retail space to Hoboken’s retail market in years, and has been visited by more than 600 retailers.

In the next 2 years, within the Gold Coast and its surrounding markets, retail vacancies are expected to increase slightly due to the addition of more than 1.7 million square feet of new space to the market in the form of mixed-use developments, retail strip locations and expansions to existing centers.

In the intermediate term, several considerable projects are in the pipeline, including Xanadu Meadowlands, LCOR’s Hoboken Terminal redevelopment, and Tern Landing’s New Bay City in Elizabeth. These large developments all promise to create new regional retail destinations and much needed venues for larger nationals and big box retailers.

Upon completion of these developments, it is likely that the Gold Coast’s retail market will garnish similar respect from retailers and shoppers as New York City, Paramus, and the Route 22 corridor. Retailers are now viewing the Gold Coast as more than a suburb of Manhattan. Some see it as an extension of the world’s largest CBD, others see it as a wealthy and densely populated freestanding metropolis. Either way, the New Jersey Gold Coast has garnered the respect of the retail market and is preparing to bloom.

— Seth Kestenbaum is the director of Monroe Center Development.

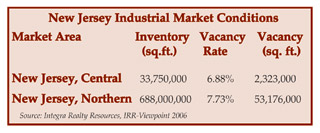

New Jersey Industrial Market

The overall industrial market is very strong in New Jersey; however, the number of developable sites has become scarce. Developers have now turned to brownfields as the new site for industrial development. Brownfields were once dismissed by developers and insurance companies, but recent new remediation solutions have attracted developers to brownfields in prime locations. ProLogis is developing a brownfields site in Woodbridge. The development includes eight warehouses totaling more than 3.2 million square feet on a 290-acre tract of land. Panattoni is developing on a 70-acre existing dump site in Carteret; and The Cameron Group is building a 400,000-square-foot shopping center on 55 acres of remediated industrial property.

Another hot area for industrial development is by New Jersey’s ports because of their prime access to products coming in from overseas. Many argue about the higher cost of land close to the ports; however, the high cost of double goods transportation can justify these increased costs. Following the new development trend, The Port Authority has been working to remove unused containers from the port itself, allowing for more developable space in the port area. As New Jersey’s ports become congested, areas such as Exit 7A and south on the New Jersey Turnpike will see an increase in industrial development. This location has convenient access to the ports and all major highways.

Overall, statistics prove that this is the tightest industrial market in 6 years. Vacancy rates continue to shrink nationwide as industrial production keeps its steady pace, and advancements in supply chain management create efficiencies in warehousing and distribution processes. Furthermore, opportunities for new development have decreased, which pushes the use of existing product, such as brownfields. This trend supports the notion that vacancy rates will continue to drop in major hubs and where development is constrained.

Historically, as vacancy rates drop, rental rates increase as a result of limited product availabilities. Midway through 2006, rental rates have followed similar trends by increasing by more than 6 percent in the wake of the collective drop in vacancy nationwide. Moving forward, look for landlords to benefit from market constraints; however, if the economy slows further, rates could begin to stabilize.

Overall, the industrial market is strong and is reinventing ways to continue development. Key areas such as New Jersey’s ports and brownfields are essential to the growth and productivity of the market. New Jersey is one of the largest industrial states and it will continue to find new ways to thrive.

— Mitchell Katz, SIOR, is vice president of Trammell Crow Company.

New Jersey Multifamily Market

There has been a considerable increase in multifamily development throughout New Jersey in the past several years, but recently, development has slowed due to an increase in construction costs and the high number of new developments. As a result, New Jersey developers are being cautious where they build and are focusing on more desirable locations, such as middle to high-end waterfront rentals and condominiums that command higher sales and rental rates. Current waterfront development is taking place on New Jersey’s Gold Coast, as well as in towns such as Asbury Park, West Long Branch, Perth Amboy and Atlantic City.

With respect to New Jersey’s multifamily rental rates, the highest rates are on the waterfront where rates range from $2,000 per month and above. Average rental rates away from the waterfront are beginning below $2,000 but remain strong in desirable areas and those that are commutable to New York City. A further decrease is noticed in areas that are more than an hour from New York City.

New Jersey’s vacancy rates remain low, especially in the northern part of the state. From Ocean County north, the vacancy rate is below 5 percent. In South Jersey, the vacancy rate is higher due to more competition for multifamily housing. Vacancy rates are constantly changing and developers look to these statistics to identify trends such as mixed-use developments.

Developers are entering towns that do not have a traditionally walkable downtown area. They are creating the downtown atmosphere with a mix of retail, apartment rentals and condominiums; thus, creating a desirable location for both shopping and living. Livingston Towne Center was recently completed in Livingston, and a similar town center is being considered for Manalapan. Another development, Englewood Towne Centre, complements Englewood’s already vibrant downtown area.

New Jersey’s multifamily market is constantly changing, but the next area people should keep an eye on is the New Jersey to Pennsylvania corridor. New Jersey residents are beginning to move farther away from New York City where there is more affordable housing and land for development. Both residents and developers are discovering the appeal of the area.

Overall, New Jersey’s multifamily market is evolving on all fronts, mostly due to fluctuating rental, sales and vacancy rates, as well as in-demand locations. Although the New Jersey market is hard to predict, the market is strong and will continue to reinvent itself with new trends and developments.

— Jeffrey P. Wiener is the president of The Kislak Company.

New Jersey Investment Market

New Jersey continues to remain an active market for investors, with available properties for sale ranging from Class A to Class B minus. There is no asset class right now more attractive than another, and no different property types on the market than there were a year ago. In fact, we are seeing the same assets that were traded 18 to 24 months ago back on the market today. Buyers that acquired these buildings 18 to 24 months ago are disposing of them for higher sale prices without significant economic improvement during that time frame except for the price tag.

Two of the most significant transactions for 2007 are the privatization of Reckson Associates and Glenborough Realty Trust, with SL Green taking Reckson private and Morgan Stanley taking Glenborough private. We will have to wait and see what impact this will have on the marketplace — which assets will the new owners sell off, and which they will hold for a long-term basis — as the results could present many new opportunities for other marketplace investors.

There is a broad array of institutional, fund and private buyers active in New Jersey. The transaction activity is not being generated by one particular class or investor type.

In the near future, active investors should keep an eye on the Jersey City market, which will always be the pressure relief valve for companies moving out of Manhattan. Also, if New Jersey sees upward rental rate pressure, Jersey City will experience it first, as it is definitely the initial indicator of such a rental rate trend.

Newark is another market to watch in the coming months and years. With the new administration and Mayor Cory Booker taking office, as well as the new arena being built for the New Jersey Devils hockey team and a variety of other performances, a host of interested parties will watch to see if the new administration can move the Newark renaissance into high-gear.

In New Jersey, rising interest rates have not made a significant impact on the investment market. Capital inflows have continued and institutional investors will continue to buy available product without major concerns to borrowing rates. If rates rose significantly, without corresponding rent increases, we would likely see a rise in cap rates, but right now forward interest rate curves show no such rise over the next 12 months.

New Jersey will continue to be an active market for investors and a smart investment market for quality office space.

— Gary Sopko is managing director of acquisitions/dispositions at Advance Realty Group.

New Jersey Office Market

The overall pulse of the New Jersey office market is stable. In Monmouth County, in particular, the construction market is beginning to slow down with a few office projects getting underway. With the uncertainty of the market, people are sitting tight and not making decisions to lease or build space. Other factors driving the hesitation of the market are the on-going war, rising oil prices and the general uncertainties in the air.

Although new development projects are scarce, many projects being developed are in Monmouth County, which currently has 15 office buildings under construction, mostly by private developers. Developers see Monmouth County as a hotbed for new construction because it is one of the most desirable places in the state to live and conduct business. The county offers a healthy supply of modern single-family, and condominium and townhome communities, which increases the number of people living in the area, giving employers a deeper and broader labor pool from which to choose. As this trend continues and people start working closer to their homes, Monmouth County will continue to experience an increase in office development and leasing.

In Monmouth County, we are currently developing Wall Commercial Park, a 300,000-square-foot complex with three office buildings and one flex building, as well as the Wall Medical Arts Building, a 24,000-square-foot medical arts facility with medical suites, finished to tenants’ specifications, from 1,500 square feet and up.

In Monmouth County, the overall vacancy rate is just at 8 percent. This is significantly low compared to other counties, where the vacancy rate is as high as 16 percent. In the future, we will see significant space coming on the market in the Short Hills/Millburn market. Another area where there is a considerable amount of available space, and even more coming on line, is Parsippany.

Rental rates in Monmouth County average $23.50 per square foot for first class space. Medical office space, which is becoming extremely popular, can claim the highest rents in the market.

Overall, the New Jersey office market will continue to see great leasing velocity and the absorption of space with very little new construction.

— Sheldon Gross is the president and CEO of Sheldon Gross Realty.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|