|

MARKET HIGHLIGHT, OCTOBER 2005

NEW JERSEY MARKET HIGHLIGHT

New Jersey Retail Market

As one of the most densely populated states in the nation boasting one of the highest per capita incomes, it is no wonder New Jersey has been targeted for entry and expansion by many of the United States' premier retailers. To satisfy this enormous thirst for storefronts, retailers, developers and brokers alike have scoured the countryside looking for opportunities.

Unfortunately, New Jersey is also one of the most difficult places to find buildable sites zoned for retail development. If one is lucky enough to locate such an opportunity, chances are the land cost is astronomical and the approval process is daunting. Northern New Jersey and, to a lesser extent, Central New Jersey are “old markets.” A large portion of these areas have been developed and redeveloped. Due to the Highlands Act and anti-development sentiment found in the suburban areas of the state, the development of raw land has become a near impossibility. So what is the answer? Either eminent domain, the highly controversial taking of properties from home and business owners for the “greater good,” or the redevelopment of defunct office and industrial properties into vibrant mixed-use projects in urban and suburban settings.

Over the past few years, the redevelopment of such underutilized office and industrial properties into retail complexes has grown dramatically. A number of years ago, an outmoded office building on Route 3 in Clifton was combined with an adjacent tract to develop the 300,000-square-foot Clifton Commons Retail/Entertainment center. A few months ago, the 125-acre Ford Plant in Edison was sold to a major New Jersey developer with plans for a mixed-use project including a significant retail component. CB Richard Ellis (CBRE) is currently in the process of selling an 80-acre tract for General Motors in Ewing Township — again for redevelopment as a retail project with perhaps a housing complex. A 17-acre industrial complex is under contract in East Newark for redevelopment as a retail complex and CBRE is in the process of marketing a 28-acre office/industrial complex in a Central New Jersey municipality for redevelopment as a retail center.

Based upon retailers' apparently insatiable appetite for space in New Jersey and the lack of developable land in all but the southern counties, we can expect the trend of redeveloping old industrial and office properties into new retail and mixed-use projects in the more mature markets in the state to continue into the foreseeable future.

— Arthur Weiss, a vice president with CB Richard Ellis, specializes in retail sales, leasing and land development in the Northern and Central New Jersey markets.

Southern New Jersey Office Market

Southern New Jersey continues to be the diesel-powered submarket in the Delaware Valley region. Steady, efficient and providing long term value, it offers stable rates that are seldom witnessed in today's markets. In addition to attractiveness from an investor and landlord's perspective, the region continues to be a compelling alternative to the Philadelphia central business district (CBD) when tenants compare total occupancy costs, including business taxes and parking costs. As access to talent remains a key driver in corporate searches for regional operations, employers are seeing the positive impact on their recruiting and retention due to the market's high percentage of well-educated employees, affordable cost of living and strong population growth.

Redevelopment of existing assets continues to remain a strong theme in the market, in addition to the large quantities of new product being built. The purchase of Class B and C assets at compelling prices and redevelopment into Class A products competes with new development. The combination has created a competitive atmosphere of new high-quality office space throughout Southern New Jersey. New Class A product has come on line in the past year in Marlton and Mount Laurel, while Cherry Hill and Camden are poised to deliver new space in the near future. Real estate investment trusts (REITs) remain the most active developers, while local and regional owners have been aggressive in their development, redevelopment and leasing. When asked about trends witnessed by these developers, Brandywine Realty Trust noted that flexibility in leasing has become paramount even for larger corporations. Tenants are demanding in some cases shorter terms and the ability to move to different size spaces and product during their existing lease term. Projects to watch include the Bishops Gate development in Mount Laurel, the race track in Cherry Hill and the untapped potential that Camden offers.

This cost-effective and convenient market finished the first half of 2005 with a 11.9 percent vacancy rate and a weighted average rental rate of $19.04. As the market is projected to post additional absorption gains in the short term, expect these statistics to look even stronger through the third and fourth quarter of this year. Furthermore, the Federal Reserve expects increased growth in the real GDP for the second half of this calendar year.

— Jeff Tertel is an office specialist with Grubb & Ellis in Marlton, New Jersey.

Northern & Central New Jersey Office Market

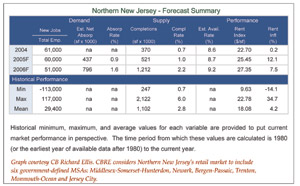

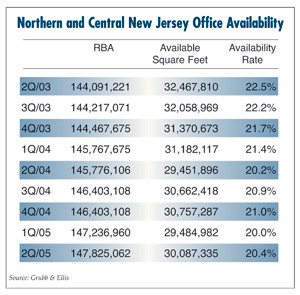

After posting more than 2.1 million square feet of positive absorption during the first 3 months of 2005, it appeared that the Northern and Central New Jersey office market's long-awaited and highly anticipated recovery would be gaining speed in the coming year. After all, not since the second quarter of 2000 had there been such a large volume of positive net absorption during a single quarter in the office market. However, the office market seemed to struggle for additional horsepower to climb the next hill on the road to recovery, as just more than 14,000 square feet of negative absorption occurred during the second quarter of 2005. The overall office availability rate subsequently climbed to approximately 20.4 percent at mid-year, compared to 20 percent in the first quarter. Positive leasing momentum led to approximately 420,000 square feet being absorbed in Central New Jersey during the second quarter. This was in contrast to the Northern New Jersey region, where corporate consolidations resulted in nearly 434,000 square feet of negative net absorption. A large portion of this negative absorption in Northern New Jersey can be traced to activity along the Hudson River waterfront, which recorded more than 360,000 square feet of negative net absorption alone. This effectively countered the positive absorption that occurred in Central New Jersey during the second quarter.

The Hudson waterfront has proven to be one of the most volatile submarkets in Northern and Central New Jersey during the past year. This submarket has garnered center stage for either recording the highest volume of positive net absorption or the highest volume of negative net absorption in the state, seemingly during each quarter. After consolidations led to nearly 1.2 million square feet of negative net absorption during the fourth quarter of 2004, the waterfront then posted more than 860,000 square feet of positive absorption in early 2005. By mid-year, the waterfront reported the highest volume of negative net absorption in the state. Contributing to the 360,600 square feet of negative net absorption during the second quarter was JP Morgan Chase's decision to place nearly 332,000 square feet of Class A space on the market for sublease at Newport Office Center 6 in Jersey City. Consolidations within the financial services sector have led to more than 1.7 million square feet of available Class A sublease space in the Waterfront. The Hudson Waterfront maintained the largest supply of Class A sublease space in Northern and Central New Jersey. Sublease space accounted for nearly 70 percent of the 2.5 million square feet of total available space in the waterfront's Class A market. Excluding the sublease space, the waterfront's Class A availability rate for direct space was approximately 5.5 percent mid-year 2005.

The fact that this submarket could single-handedly offset the aggregate gains of the entire market indicates the fragility of the office market recovery. Sustained leasing momentum, spanning multiple submarkets, will be necessary to overcome any consolidations occurring in a single market. Furthermore, there has yet to emerge a high-growth business sector capable of absorbing large blocks of space within the office market. During the late 1990s, the financial, pharmaceutical and telecommunications industries were rapidly expanding, which translated into explosive demand for additional office space in Northern and Central New Jersey.

— Stephen P. Jenco is a client services manager in the Fairfield, New Jersey, office of Grubb & Ellis Company.

New Jersey Industrial Market

For the most part, large tracts of industrial land in Northern New Jersey have been at a premium for the last 25 years. New development of industrial buildings is widespread and limited to infill sites that have been in the approval process for some time, or older sites that have been under remediation. Though, in some cases, these sites are being repositioned for a higher and better use than industrial. This is evidenced in Carteret at Exit 12 of the New Jersey Turnpike with new development on the waterfront. Catellus has neared completion of a 356,000-square-foot building that is replacing a 100,000-square-foot “knock down” at the new Port Reading Business Park and Panattoni Development is proposing more than 1 million square feet at Industrial and Salt Meadow roads. On the western side of the turnpike at Exit 12, a new Days Inn is nearing completion in the middle of an industrial park as a result of combining some old industrial, commercial and residential sites.

The farther north you go in the state, the more common the trend of retrofitting of existing buildings and repositioning of older buildings is and will be in the future. This is demonstrated by the roof raising of the former 600,000-square-foot Ford Motor Company Plant in Teterboro for a state-of-the-art distribution center for Mohawk Carpet Company and the proposed sale of the 125-year-old Goldberg Slipper Company on 7 acres in Hackensack to Bergen County. That property will be repositioned to house the Bergen County Police Station and related services.

The market to watch for future new big box state-of-the-art industrial will be Exit 8 and south on the New Jersey Turnpike. Similar to Exit 8A, there are large vacant areas with favorable building conditions.

— Lee N. Eagles is a senior vice president of NAI James E. Hanson in Hackensack, New Jersey.

New Jersey Multifamily Market

In the New Jersey Gold Coast areas, close-in land costs continue to rise relative to Manhattan and heightened land values are pushing interest inland. Former manufacturing and warehouse sites are being reviewed as offering lesser risk than in the past due to their proximity to good transportation infrastructure. Local governments and citizen groups are showing little dismay due to growth and community betterment being achieved with limited to no population displacement.

All the while Gold Coast professionals are cycling through an extension of the Manhattan housing proposition which, of course, has and continues to be “over the river and I can get more.” Except that the reverse trend of city migration raises a conflict. Professionals both starting out and their older counterparts are desirous of being close to their work for ease of commute and/or to experience the social vitality of an urban address. This has been producing heightened demand for the past years as it's now pulling in a generation that wasn't there in great numbers in previous decades — namely the baby boomers. Particularly, the younger professional is becoming more and more motivated to inch away from high-price waterfront neighborhoods toward the affordability of transitional areas.

— Edward Yorukoff is a director, of sales and marketing with KOR Companies.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|