|

COVER STORY, OCTOBER/NOVEMBER 2010

CAPITAL MARKETS' STATE OF MIND

Investment in New York's office sector continues to show improvement.

By Jaime Lackey

It has been 2 years since the Emergency Economic Stabilization Act of 2008 (better known as “the $700 billion bailout”) and more than a year since the official end of the recession. What does it mean for investment in commercial real estate? To find out, Northeast Real Estate Business talked with Jon Caplan, executive managing director, New York Investment Sales, with Jones Lang LaSalle.

NREB: According to the National Bureau of Economic Research, the recession officially ended in June 2009. What do you think?

Caplan: Most real estate investors believe the real estate sector has hit bottom and fundamentals have stabilized, particularly in major gateway cities. Today, both global and domestic investors are eager to put capital to work in New York, and are frustrated by the dearth of available investment property.

NREB: Where are we in the economic cycle with regard to commercial real estate, specifically office markets? When will office markets rebound in terms of leasing activity?

Caplan: While most economists agree that the nation’s longest recession since World War II ended back in June of 2009, the labor market has yet to experience a robust recovery. New York City’s employment picture brightened a bit during the second and third quarters as the unemployment rate dipped to 9.4 percent, from a cyclical peak of 10.5 percent.

According to the Moody’s Economy.com, New York County employment peaked in the second quarter of 2008, but subsequently shed nearly 135,000 jobs through the end of 2009. While there have been gains in employment during the year, much of the growth has occurred in education services and in the leisure and hospitality sectors, neither of which are traditionally large space occupiers. The beleaguered financial services sector managed some expansion in the last 6 months but the securities sub-sector remains largely flat. Unfortunately, the most recent forecasts do not call for a return to sustained employment growth until mid- to late 2011.

In what is typically the slowest time of the year, the nation’s largest office market continued to show signs of improvement as the third quarter of 2010 drew to a close. Vacancy levels dropped for a third straight quarter after rising for much of 2009 as space returned to the market was offset by leasing activity. Absorption, which gained traction during the period, is on target to end the year in positive territory for the first time since 2007. While in some areas of the city, average asking rental rates moved slightly higher.

Traditionally, the fourth quarter is the busiest time of the year. The trends that marked the second and third quarters are likely to continue as we approach the final three months of 2010. Vacancy rates will slowly tighten while landlord concession packages remain flat. Since the market appears to have bottomed, activity is expected to be brisk as tenants seek to take advantage of current conditions before a rebound begins.

NREB: What are you seeing on the investment side?

Caplan: The New York City investment sales market continued to improve with several significant transactions occurring over the third quarter of 2010. Improving fundamentals and the lack of available product have resulted in pent-up demand for New York City commercial real estate, particularly for core properties.

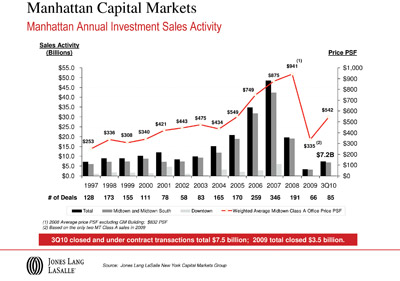

Sales volume for closed and under contract transactions over $10 million through the third quarter totaled $7.5 billion, more than double the 2009 annual total of $3.5 billion. However, annualized sales volume was 79.2 percent below the 2007 historical peak of $48 billion, and 65 percent below the 2004-2008 five-year average of $28.5 billion.

A marked difference between 2009 and 2010 is the nature of sales that have occurred. In 2009, only seven sales were above $100 million, most reflecting some form of distress. In 2010, 23 transactions over $100 million have taken place, several of which were investors electing to sell to take advantage of the improvement in the sales market.

NREB: What are you seeing in terms of foreign investment?

Caplan: Thus far, 2010 has witnessed much greater than anticipated improvements in debt liquidity, equity liquidity and New York City employment and office market fundamentals. This has led to a surge in domestic and foreign capital seeking New York City real estate, accompanied by cap rate compression and more optimistic underwriting. Investors are selectively starting to sell again, contrasting the 2009 market, which was characterized by lender-driven sales or owner-occupants raising capital. Recent Midtown transactions include the sale of 510 Madison Avenue, a newly constructed 100 percent vacant Class A office building at a price of $831 per square foot. In another major sale of a property with significant vacancy, 685 Third Avenue was sold for $293 per square foot and will be delivered 95 percent vacant. Another significant indicator of the quickly rebounding investment sales market was the recapitalization of 1540 Broadway for approximately $586 per square foot, a 50 percent premium over the prior sale price of $392 per square foot in March of 2009.

NREB: Distressed properties didn't hit the market in the numbers that many people expected. How is that affecting the recovery?

Caplan: Many market participants expected a flood of distressed product to enter the market from borrowers that are facing maturities to the tune of $1.4 trillion in commercial mortgages and construction and development loans held by U.S. banks and scheduled to mature between 2010 and 2013. The Federal Reserve’s reported total delinquency rate for commercial real estate loans at banks continues to rise and the list of “problem” bank institutions continues to grow. While we expect financial institutions to dispose of these assets and clear their balance sheets at some point, these bad commercial property legacy loans will continue to pose challenges for the banking sector through 2012.

NREB: Is there anything else you'd like to say about the office markets in the Northeast?

Caplan: We expect the fourth quarter of 2010 and 2011 to see robust investment volumes as more capital is put to work in New York and New Jersey. Competition for product is already heating up and that poses a great deal of opportunity for early movers into the market.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|