|

MARKET HIGHLIGHT, NOVEMBER 2008

BOSTON MARKET HIGHLIGHTS

Boston Industrial Market

Demand Off After Solid Years in Suburban Boston Industrial Market

Although the Boston suburban industrial market’s fundamentals remain healthy, demand has eased this year after 3 very strong years of leasing activity between 2005 and 2007.

The Greater Boston economy has yet to feel the full impact of the national downturn, and has weathered the financial crisis particularly well. Macroeconomic trends, however, have certainly had an impact. Skyrocketing gas prices, turmoil in the credit markets, and the upcoming presidential election have all contributed to the slowdown. This uncertainty has made prospective tenants in all property classes hesitant to commit to any long-term spending, which would have an effect on leasing strategy.

During the active years, the market saw large blocks of space leased that sat vacant for many years. The largest signings included: Autopart International’s lease of 350,000 square feet at 192 Mansfield Street in Norton; Trader Joe’s and World Publications combining to take 520,000 square feet at 140 Laurel Street in East Bridgewater; Victory Packaging and IKON Office Solutions combining for 320,000 square feet at 1 Holmes Way in Milford; FedEx and Siegel Egg Company for a total of 286,000 square feet at 90 Salem Road in Billerica; and Rexel Electrical’s lease of 105,000 square feet at 145 Plymouth Street in Mansfield. Not including renewals, the Boston suburban industrial market recorded 17 new lease signings more than 100,000 square feet since the beginning of 2006.

After 3 straight years of positive net absorption totaling more than 2.5 million square feet, 2008 has seen the return of negative net absorption. Year-to-date the market has experienced approximately 1.6 million square feet of negative net absorption, although the third quarter recorded an essentially flat 80,000 square feet of positive net absorption.

Despite the ease in demand, the vacancy rate of 16.2 percent, and the availability rate at 20.6 percent, remain historically low at 400 and 300 basis points below cyclical highs reached in 2005. Tenants remain active in the market. We are currently tracking more than 1.5 million square feet of requirements with a median size of 95,000 square feet.

Tight debt markets, declining consumer confidence, and liquidity concerns have complicated the financing process for some buyers. The sales volume is off 66 percent through August of this year. Nonetheless, $335 million of deals in the Greater Boston region have closed year-to-date. While overall Greater Boston industrial sales have dropped in volume, the supply of prime industrial buildings is limited and continues to attract buyers despite this challenging environment. Stable pricing is still being achieved, with the recent sales of 145 Plymouth Street, I-290 Industrial Park, and 17 Forge Parkway averaging in the $68 to $81 per square foot range.

— Richard Schuhwerk is a vice president at Jones Lang LaSalle. Jones Lang LaSalle’s Investment Sales and Research groups also contributed to this article.

Boston Multifamily Market

Cautious Optimism in the Boston Multifamily Market

While some areas have been hit harder than others by the credit crunch’s impact on the real estate market, the Boston market has proved particularly resilient, and the multifamily sector continues to be a comparatively strong segment. A number of institutional players have recently built communities in the North Shore area, in places like Woburn and Peabody, and in the South Shore, in Braintree. With these communities leasing up well and construction costs stabilizing, the present and future look optimistic for apartments in the Greater Boston area.

Several factors combine to insulate Boston somewhat from the challenges facing other markets. Rental demand remains high, especially for student housing. With dozens of schools and a quarter of a million students in the area, we expect that demand to stay high. Boston University, Northeastern University and Boston College have all been expanding, building new properties and buying land specifically for the construction of even more student housing.

The students in the area also contribute to a well-educated, diverse workforce. Where some locations have seen demand decrease after a downturn in a specific sector, such as investment banking, Boston’s breadth of employers in varied fields such as biotech, money management, hospitals and universities make the market somewhat recession-proof. The IBMs and Googles of the world are attracted to this highly educated pool of human capital, and unemployment is currently lower than in other markets. This economic diversity will continue to help Boston avoid the devastating effects of a company or industry collapse that have wounded other local economies.

Additionally, the challenges the national economy faces can be viewed as opportunities for the local multifamily space. Decreases in consumer spending and increases in cost of living have caused many to choose to rent rather than buy, driving up rental demand. In part because of the credit crunch, supply for rental housing has been somewhat constrained by limited availability of financing for home buyers and owners of apartment buildings alike. With fewer projects on the boards as a result, and more potential renters, building owners can look forward to less competition for occupancy. With fewer owned but unoccupied homes than most other markets, Boston is less likely to experience an increase in apartment supply from condo conversions.

While there are some cracks in the market, thus far, Boston has managed to weather the real estate storm better than many other markets. Going forward, we are likely to see continued constrained supply coupled with rising demand in the multifamily market in Boston. While there are a few pockets of vacancy, the fundamentals remain and are expected to remain sound for the foreseeable future.

The disappearance of the CMBS market knocked many lenders out of the game, but banks with a diverse client base and a variety of permanent lending sources will continue to be able to take advantage of the solid dynamic in the Boston area and will continue to finance projects for experienced developers offering projects that are fundamentally strong.

— Todd Goulet is a senior vice president with KeyBank Real Estate Capital in their Boston office. He is responsible for the management of commercial mortgage loan production in the Northeast U.S.

Boston Retail Market

The overriding trends in retail development in Greater Boston emphasize the following: smart growth, green/sustainable development, mixed use, life-style center, joint venture developers, and of course location. Though challenged today by the current credit crisis and the curtailment in retailers’ expansion plans, the market should maintain its relative health. Projects underway may experience delays, but due to their emphasis on the trends above, they should succeed in their construction and lease-up phase. Despite the challenging entitlement process in many Massachusetts communities, projects that survived were also aided by strained local municipal budgets and their need to raise alternative sources of revenue. The market remains stable from a supply/demand perspective. A recent Keypoint Report for the Eastern Massachusetts retail market indicated overall retail vacancy at 7 percent as of March 2008, and modest growth in rents. There were nominal (1.4 percent) additions to supply, which now is tracked at 181 million square feet. A few of the more prominent projects underway in the market include:

Westwood Station — A 4.5 million-square-foot mixed-use development in Westwood at the intersection of I-95 and University Avenue. Located next to the Route 128 commuter rail station with direct access to Boston’s CBD, the project’s location in proximity to a major suburban commuter rail train station enhanced its ability to gain local approval and increased density. The increased property tax base for the Town of Westwood and job creation were key considerations in achieving its approval. The development team is comprised of a well-heeled and experienced group including Common Fund Realty as the financial partner and CC&F and New England Development as operating partners. The retail component includes a lifestyle retail center of 1.35 million-square-foot, amidst a plan that will also include two hotels, an office building and 500 residential units. Infrastructure is currently underway.

The Launch at Hingham Shipyard — This development represents 240,000 square feet of retail as part of the 1.2 million-square-foot, mixed-use redevelopment of the Hingham Shipyard, located in a high demographic suburb south of Boston. The project is located near a 1,700-car parking garage, and the MBTA Water Shuttle terminal, a Commuter Boat ferry, which provides transportation to Boston’s CBD. The project will also include office and residential. The all-star development team includes Samuels & Associates (retail), Lennar (residential condo) and Avalon (multifamily). The project is well on its way with tenants of Fresh Market (NC-based Company operating a 24,000-square-foot grocery store), Bed Bath & Beyond, Old Navy, Patriot Cinema’s and Body Scapes. Avalon has also recently opened its 235-unit residential rental project.

Linden Square — Located in the high end community of Wellesley, and sponsored by Federal Realty, this lifestyle center includes 250,000 square feet of retail, as well as a residential component. The project is quite far along and is anchored by a Roche Bros grocery store. Other tenants include: CVS, Kenzie Kids, Starbucks, Beacon Hill Athletic Club, Bella Sante Day Spa, California Pizza Kitchen, Coldstone Creamery and the Cottage Restaurant. The residential townhouse development opened in September with an affordable housing component, and was LEED Platinum certified, the highest level of achievement in US Green Building Council Leadership in Energy and Environmental Design Green Building rating system.

Legacy Place — A 675,000-square-foot lifestyle center at the Route 1 and I-95 interchange. A joint venture of National Amusements and W/S Development located in Dedham, Massachusetts, this project is scheduled to open in the summer of 2009 and will be anchored by a 60,000-square-foot Whole Foods Market, a 30,000-square-foot L.L. Bean, a Border’s Books and, a Showcase Cinema De Lux 15-screen theatre.

— Dennis Walsh is a senior director at Tremont Realty Capital.

Boston Investment Sales Market

Return to Fundamentals Lengthens the Commercial Sale Process

Greater Boston’s commercial real estate market has been witness to marked changes in the past 12 months. With the onset of turmoil in the capital markets stemming from the sub prime residential mortgage fallout, commercial sales transaction volume has fallen precipitously, loan underwriting standards have been tightened, interest spreads on loan quotes have widened, and buyers have become much more cautious in their underwriting of acquisitions. As a result, the length of time between the purchase and sale agreement and closing has increased sharply.

The Greater Boston market sales activity totaled $6.1 billion in the first 6 months of 2007 versus $428 million in the first half of 2008, a drop of more than 93 percent. As deal volume has decreased, due in large part to the tightening of loan underwriting standards and a lack of available debt in the market, buyers are having to be far more conservative in their underwriting of assets than they were just 12 months ago and are having to search the market much harder for the loan amount and terms they need to conclude the transaction.

In the past year, a noticeable lengthening of the time it takes to close a commercial real estate sales transaction has occurred. Over the course of 2007, Richards Barry Joyce & Partners’ average due diligence period was less than 15 business days, a timeframe similar to the typical closing period for commercial property in Greater Boston — or 30 days start to finish. A year ago it was not unheard of to have a buyer require less then a week for both the due diligence and closing periods, respectively. However, through the first half of 2008, buyers, on average, required more than 35 days for the due diligence period and nearly 30 days to close a transaction, more than double the period of 1 year ago.

The return to a more traditional length of due diligence and closing periods is a result of a shift in negotiating leverage from sellers to buyers. A year ago, buyers were taking down deals as quickly as possible in a race against compressing capitalization rates driven by aggressively competitive buyers. With the onset of turmoil in the capital markets in mid to late summer of 2007, the downward movement in cap rates came to an end in the second half of 2007.

As buyers regain the upper hand in purchase/sale negotiations, they are taking the time to more carefully perform many of the fundamental due diligence activities such as detailed physical inspections, thorough environmental review and interviews with existing tenants.

Buyers are also scrutinizing financial models more closely than ever as current in place returns have replaced “projected” returns as the most important indices. As a result, sellers and their representatives have to be more involved in helping buyers understand how a property produces income returns and navigate the dynamic, often cumbersome, process of getting a transaction to close.

Sellers are having to be far more flexible throughout the due diligence process, providing additional time to complete inspections and ensuring that the buyer has access to all information necessary to complete a full review of the asset. Because it is far more difficult to arrange for acceptable financing, sellers’ representatives are having to get more involved in assisting mortgage brokers in assembling loan packages to secure financing and close the transaction.

Despite the significant decrease in deal volume in 2008, the first half of 2009 looks promising. Many of the Greater Boston sales transactions which were scheduled to close earlier in the year will likely close in the fourth quarter of 2008 and first half of 2009 as the lengthy process of loan procurement is concluded. While many prospective sales offerings have been pulled from the market after receiving lackluster reception from the investment community, others are simply taking far longer to finance and close.

— Kim Cinnamond is an associate in Richards Barry Joyce & Partners’ Investment Sales Group. Richards Barry Joyce & Partners is a full-service commercial real estate firm based in Boston.

Boston Office Market

The office leasing market remained stable during the first half of 2008, with the vacancy rate hovering at 8.8 percent. Despite the volatile economy and some cautiousness on the part of tenants, leasing fundamentals remain strong.

Key statistics at the end of the second quarter include:

VELOCITY

Velocity (signed lease activity) slowed slightly during the past two quarters, with an apparent “disconnect” between landlords’ asking rents and tenants’ expected rates.

• Approximately 100 transactions representing more than 2.5 million square feet were executed during the first half, which is on par with the 5 million square feet recorded in each of the last 2 years. However, tenants are taking longer to analyze the market prior to executing leases.

• In April, Wellington Management executed a 15-year lease at Boston Properties’ Russia Wharf development. The 450,000-square foot lease is scheduled to commence in the spring of 2011.

ABSORPTION AND VACANCY

• Absorption was a modest 78,400 square feet during the first half of the year, with results varying by submarket.

• The combined vacancy rate for the core Back Bay and Financial District submarkets is 8.7 percent, compared to 9.2 percent for the peripheral submarkets.

• The vacancy rate is expected to remain close to 10 percent (i.e., equilibrium) through 2012.

RENTAL RATES

• Despite the sluggish economy, landlords are holding firm on rents relying on the solid fundamentals of the market.

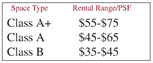

• While the gap between the Class A and Class B vacancy rates is narrowing, a considerable spread exists between asking rents in various segments of the market:

DEVELOPMENT PIPELINE

• Three office developments currently under construction with expected completions ranging from 2009 through 2011 include: Two Financial Center (210,000 square feet), Russia Wharf (550,000 square feet), and the first of three office buildings at Fan Pier (500,000 square feet).

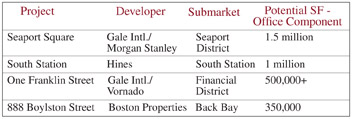

• Although construction financing has become more difficult to secure, additional projects in the pipeline include:

— Ronald K. Perry is an executive vice president and head of brokerage for Colliers Meredith & Grew.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|