|

MARKET HIGHLIGHT, NOVEMBER 2006

BOSTON MARKET HIGHLIGHT

Boston Investment Market

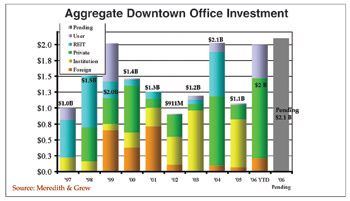

Heading into the fourth quarter, greater Boston investment sales volume — including all property types and submarkets — is at the $6 billion mark. This compares favorably to 2005, when $5.3 billion was recorded through the third quarter and the total transaction volume for the year reached $6.4 billion. Activity during 2006 has been particularly strong in the downtown office market, with $2 billion in property sales.

Pricing for all property types remains aggressive — a function of low cap rates as well as recovering leasing fundamentals. Competition for core assets is fierce — with multiple bids on trophy properties now the norm. With market rents rebounding and vacancies declining across most submarkets, investors are anticipating income growth in near-term lease rollovers and are generally less concerned with vacancy risk. Increases in economic value still lag increases in replacement cost; however, buyers are ever cognizant of rising construction costs and their impact on replacement cost pricing.

Although the 10-year bond is approximately 30 basis points higher than the beginning of 2006, there has been no correlating rise in equity return hurdles. As rates were climbing during the first half of the year, conventional wisdom held that cap rates would follow. The yield on 10-year treasuries trended downward this quarter; however, the momentum required to trigger an increase in cap rates never materialized. Most investors now expect cap rates to hold steady over the next 12 months.

Boston Investment Sales And Aggregate Downtown Office Investment

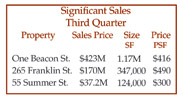

Sales of downtown office properties totaled approximately $.7 billion during the third quarter, with the headline transaction being Beacon Capital Partners’ acquisition of One Beacon Street for $423 million and a reported 6.3 percent cap rate. Beacon Capital purchased the property from The Feil Organization, which bought it only 23 months ago for $340 million.

Also of interest was the acquisition of the 23-acre Boston Seaport Development site from News Corp. for $203.75 million by a partnership between Gale International and Morgan Stanley. Planned development on the site could exceed 6 million square feet of office, residential, retail and hotel space.

With more than $2 billion of pending investment sales in the pipeline, total transaction volume anticipated during 2006 will be well in excess of 2005. All eyes are on the Hancock Tower, which Beacon Capital is selling as part of a multi-region portfolio. There is no doubt the landmark property will garner record pricing.

Cambridge and Suburban Investment Sales

Alexandria Real Estate Equities purchased a leasehold interest in MIT’s Technology Square for $600 million, or $514 per square foot. Tenants in the 1.1-million-square-foot office and lab property include Novartis, MIT and Forrester Research.

Investors continued to be attracted to improving fundamentals in the suburban office markets, although sales volume through the end of the third quarter 2006 was down slightly from the same period last year— with 39 transactions totaling $.8 billion compared to 45 transactions totaling $1.1 billion through September 2005. The two largest suburban transactions to date include Normandy Real Estate Partners’ acquisition of the Saracen Portfolio in April for $86.2 million and RREEF’s acquisition of Crosby Corporate Center, Bedford in June for $70.7 million.

Market At A Glance

• Sales volume is on pace to exceed 2005’s record.

• Several new players are emerging as dominant buyers downtown and in the suburbs.

• Buyers are turning into sellers after relatively short hold periods in order to exploit market dynamics.

• The recent decline in the 10-year treasury yield has stymied the expected rise in cap rates.

— Lisa M. Campoli, executive vice president, Meredith & Grew

Boston Office Market

Overall in 2006, the Boston office market has experienced healthy growth; however, it has been well below the robust activity recorded in 2005.

Several recent large deals such as Eaton Vance's relocation into 230,000 square feet at Two International Place, and Investor Bank and Trust’s expansion into 135,000 square feet at Copley Place have helped the office market record approximately 200,000 square feet of positive net absorption year-to-date. The activity recorded during the third quarter was offset partially by the announcement by Proctor & Gamble/Gillette to vacate the 324,000 square feet of space at 800 Boylston Street in the Back Bay area. The property is now officially available for sublease.

Although the overall pace of leasing activity has slowed, the Boston office market is on track for another year of occupancy gains and it will continue to see tightening conditions. Additionally, steady job growth in key sectors for the downtown market, such as financial and other professional services, indicate sustained near-term demand for office space.

Positive leasing conditions during the first half of 2006 pushed the overall availability rate down to 14 percent, a 4-year low. Meanwhile, the direct vacancy rate in Boston dipped below 10 percent for the first time since 2002, reaching 9.7 percent at mid-year 2006. Asking rents in the Boston office market continued to trend upward in 2006 reaching an average of $35.18 per square foot gross, 8.5 percent above the price in 2005. The overall Class A average asking rent also increased to $41.44 per square foot gross. Asking rents in Boston’s premium towers have also shifted upward and the first $60 per square foot gross lease rate of this cycle was achieved during the third quarter. Drafting off of the Class A market, the Class B market has also started to see some improvement. Asking rents had increased by more than 10 percent to $28.95 per square foot gross during the first half of 2006.

As the third quarter came to a close, high quality space options for large tenants became scarce, and as a result, asking rents continued to inch upward. While high construction costs and rent levels have kept the historically active development pipeline at bay, the prospect of new development beginning on one of a handful of approved and viable downtown locations has certainly become a reality. Large tenants in an active search for space options in the 2010 to 2012 timeframe are looking at pre-leasing space in new construction, thereby kicking-off a new wave of office projects. The overall level of potential new construction that could hit the market during the next 6 years is very small in comparison to previous development cycles in Boston in the late 1980s and late 1990s.

The financial district will continue to lead Boston as companies seek additional space and availability in the city's premium towers becomes limited. With only a few large blocks of 100,000 square feet or more available in the financial district and no new construction underway, large tenants will face escalating competition and rents in the coming months.

To date, 2006 has been a quiet year in the Back Bay with two consecutive quarters of negative net absorption. Underlying demand, however, continues to be solid, and the slowdown in net absorption has failed to intimidate landlords. As a result, the Back Bay continued to command the highest average asking rent of all of the city's submarkets. During the second quarter the average asking rent increased to just less than $40 per square foot gross. Activity remains strong for availabilities in the Back Bay, and the space recently made available by P&G/Gillette will be a factor in many large tenant decisions in the near future.

Along the South Boston Waterfront, the availability rate declined to 12.5 percent at mid-year 2006, a 6 percent point drop over the past 12 months and the lowest level recorded in 6 years. As space options in the core financial district and Back Bay submarkets continue to dwindle, the waterfront is poised to be the site of the first area of new construction with several new developments such as Fan Pier and the World Trade Center South taking shape.

— Bill Motley, senior vice president, Jones Lang LaSalle

Boston Industrial Market

The greater Boston industrial market, which has generally been idle for the past several years, is now experiencing development activity in certain submarkets due to an availability of land and high-quality highway access. The overall vacancy rate for the almost 68 million square feet of industrial space has remained at around 16 percent. The Route 128 West belt is the most active submarket at 8 percent and the Route 3 North belt is the least active at 26 percent. Depending on the submarket, the rental rates are currently in the $4.50 to $6.50 per square foot range on a triple-net basis for warehouse and distribution space. These rates are down from 2005. Tenants in the market can find the lower end of this range to the South of Boston with the upper end to the Northeast.

The industrial space in some of the submarkets has shrunk due to conversions to retail, office, or residential development. As an example, a former Raytheon facility on Route 128 in Burlington was demolished to make way for a lifestyle shopping center totaling 195,000 square feet. Some of the most active developers in the area include Condyne, Campanelli Company, National Development, The Gutierrez Company and Nordic Properties.

Much of the development has been focused in the Route 495 South submarket, as many of its municipalities have been actively pursuing companies to settle there. Within this submarket, Freetown, Massachusetts, appealed to two companies due to the availability of rail. Stop & Shop Supermarkets built a 1 million-square-foot distribution site in Freetown and the Boston Beer Company, makers of Samuel Adams beer, has purchased land to build a 250,000-square-foot brewery. Another large development of interest in this submarket is the 900,000-square-foot distribution site that Jordan’s Furniture built in Taunton, Massachusetts.

Though the Northern section of Route 3 has struggled in the recent past, it is the one to keep an eye on in the future. As technology companies started cutting back in 2001, the demand for this submarket subsequently dipped. However, as companies hone in on the economic benefits, attractive opportunities exist and rejuvenation can be expected in this submarket, as well as in the greater Boston area as a whole.

— Lori Sharton, marketing director, GVA Thompson Doyle Hennessey & Stevens

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|