|

COVER STORY, NOVEMBER 2005

OFFICE MARKET STEADY

An increasingly positive office sector marks a return to better days.

Nicole Thompson

Perceptions of the office market for sales and leasing range from wait-and-see in New York City to a strong market outlook in Northern New Jersey, marking another quarter of increasingly positive views of the market after years of downturn and caution.

In New York City, while some submarkets are still seeing leasing activity, others remain flat. “As far as the office leasing market, overall in 2005, there continues to be a wait-and-see attitude out there,” says Greg Taubin, a corporate managing director with New York City-based Studley who specializes in tenant representation in Manhattan, particularly in Midtown. “There are specific buildings within submarkets that still continue to receive a good level of activity, but as a whole, the market remains a bit flat. One specific submarket within Midtown, called the Plaza District — approximately the 50s, along Park, Madison, and Fifth avenues — is one of those submarkets that continues to be active. Much of the activity in this submarket is a result of the leasing of pre-built office space.”

|

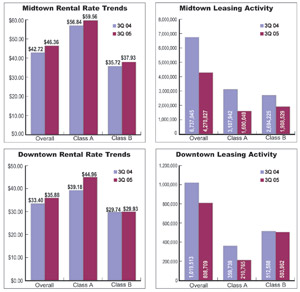

The above graphs, provided by Studley, show a year-to-date third quarter comparison for leasing in Downtown and Midtown Manhattan.

|

|

Office owners in New Jersey are seeing increased activity thus far in 2005. “The last 2 months, it has picked up quite a bit,” says Jeffrey Greenberg, a princpal with Ridgewood, New Jersey-based Heritage Management Companies, an investment, development and management company properties in New Jersey, New York, Massachusetts, Florida, Texas and Arizona. “I judge the economy and the office market by one simple factor, and that's how often my phone rings for space. If my phone's not ringing, things are slow, and it's ringing, things are picking up. Starting in late June, things started to pick up, because my phone's been ringing.”

Ira Bloom, director of commercial real estate for Kushner Properties, the commercial management and leasing arm of Kushner Companies, located in Florham Park, New Jersey, has seen a similar uptick in leasing activity. “We're definitely a lot more optimistic in the office sector, particularly in Bergen County, where right now we have very limited vacancy. In Newark, we've seen a lot more activity as well. In addition, we've also seen people coming who may have offices in New York and are looking for satellite offices in an urban environment,” says Bloom.

Brokers in New Jersey report a stable market. “There's a lot of cautious optimism among all my peers, myself included, about where the office market is going,” says J.C. Giordano, principal with the New Jersey office of Staubach. “Prior to this year, for the preceding 3 years before that, there was a lot of sluggishness, post-9/11 kind of stuff, which resulted in significant blocks of space available in just about every submarket throughout the state. In 2005, we're starting to stabilize. Many of these blocks of space have been leased, and I think everyone would agree that that vacancy rates are going down, absorption is modest, but steady, but is not the result of anything that exciting by way of new growth in employment. I think it's many companies taking advantage of opportunities and just upgrading their facilities, or just renewing in place.”

An increased confidence level by office users has helped drive current activity in the market. “One thing that we've been finding is that our current tenants are renewing, and in many instances, they're actually expanding,” says Bloom. “So it's kind of coming together, not just new tenants, but also existing tenants.”

Other factors driving activity include diversity of sectors occupying office space and pent-up demand from businesses. “In the Northern Jersey suburbs, the diversity of industries drives activity,” says Peter Blanchard, a principal with the Garibaldi Group/Corfac International in Chatham, New Jersey. “The insurance companies are here, the pharmaceutical companies are here, the banks are here, the Wall Street companies are here, and of all the suburbs of NYC, Northern Jersey has a strong, diverse mix of major corporate industry types. When communications or IT takes it on the chin, pharmaceuticals are creeping ahead; the insurance companies are down, the banks are up. Coupled with the people that live here, the middle- to upper-management who live in these suburbs, there is a great wealth of corporate talent and diversity.”

Demand from past years has been building, says Greenberg. “Primarily, I think there's been some pent-up demand. Certainly in 2003 and 2004, and probably part of 2002, there was very little activity, because I think decision makers have really been hesitant to make decisions, to see which way the economy is going, so they would veer on the side of not taking more space,” says Greenberg. “After a couple of years, that pent-up demand meets more confidence in the economy, and people start looking for space.”

Companies, however, have remained mindful of costs when considering real estate decisions. “On the leasing side, I think end-users are always opportunistic,” says Giordano. Factors that he reports as driving leasing decisions include economic benefits, facility upgrades, and accommodation of employees and customers, although he notes that companies are undertaking relocations for sound business reasons because of costs.

As demand increases, available quality space has disappeared rapidly. “The better quality buildings always seem to get the attention of by end-users first,” says Giordano. “And as that segment of the supply gets dwindled down, that's when the other segments of supply will see attention, and if anything, Class A space is getting harder and harder to find in New Jersey, particularly in bigger blocks of space of 50,000 square feet and up.”

Readily available and inexpensive capital has helped to drive investment activity. “I think that buyers of commercial real estate today have had an unprecedented time, and still somewhat unprecedented time of cheap money that they could rely upon to acquire assests, and as a result, the activity has been and continues to be significant in the investment sector of the business,” says Giordano.

Taubin reports in 2004, and the beginning of this year, many of the mergers and acquisitions from the legal industry contributed to a lot of activity. “That activity has tapered off just a bit,” says Taubin. “However, law firms continue to be active in leasing space in the market. A trend that we've been tracking is out-of-state law firms looking to set up shop in New York. Typically these law firms from out of town require approximately 20,000 to 30,000 square feet, and they're specifically looking for built spaces, with short-term leases. Since they can't gauge their growth, they don't want to commit long term, and thus seek to secure office space whereby they don't have to spend much capital to improve the space. With that demand from law firms, a lot of the sublet space that's been sitting idle on the market has been absorbed over the last quarter.”

Even throughout the downturn, the Northeast as a region for the most part struggled less than the rest of the country, partly because of the proximity of New York City. “I think part of what advantage that we have as opposed to other places in the country is our proximity to New York,” says Bloom. “So much feeds off of New York, in terms of business in New York, the business capital of the world, and having that close proximity is a huge advantage.”

Blanchard agrees that New York's success is the source of the success of the dense suburban areas of the city. “As long as NYC is where it is, the suburbs of Manhattan — Northern Jersey, Westchester, and downstate Connecticut — will flourish,” says Blanchard. “We're here because it's there. And we're very diverse. All of those industry types that need to be near the financial capital of the world.”

The wide range of businesses that need to be in New York City and throughout areas of the Northeast has helped many areas of the region through the past few years, according to Greenberg. “Specific to the Northeast, I think that the market here has been relatively stable throughout the prior downturn,” says Greenberg. “There were not huge flucuations that you'd see on the West Coast, in terms of vacancies. So I don't think we dipped as far as other markets, so we didn't have as far to come up. The market, relatively, stayed strong. It flattened out, but it didn't really take a nose dive.”

Reports of industries seeking space range from everyone in the market, to the New York City and New Jersey industry stand-bys of financial services, pharmaceuticals and communications companies, although it often depends on the building, submarket and timing. Greenberg also notes that his company is seeing media, architectural and engineering firms seeking space. In addition to the increase in law firms in New York City, Taubin says that financial services companies with smaller size requirements, such as hedge funds and asset management firms, are driving the market, especially in Midtown, for space in the 10,000 square foot or below range.

“I think that just about everybody is in the market,” says Blanchard. “I think that if you and I had this discussion a year ago, I would be cautiously optimistic about the economy.”

Bloom adds that medical-related fields have also been seeking space. “It is very much dependant upon where ourbuildings are located,” says Bloom. “For instance, in the Newark area, you tend to have many medical offices, as well as lawyers. In Bergen County, it's financial institutions, also lawyers as well. Also, we've seen activity with things like quasi-medical office use, like firms that do medical journals.”

Most agree that promising submarkets are very dependent upon the specific building, considering the lack of new product and developable land in the area, although some areas are doing well as a whole.

In New York City, Taubin lists the west side corridor of Manhattan stretching from the 30s to the 40s.

Bloom is optimistic about the Newark area in the coming years as infrastructure in the market improves and more companies look to urban areas.

Another promising area, according to Blanchard, is the Lehigh Valley in Pennsylvania, which has seen tremendous residential growth. “The state of Pennsylvania has an extremely strong economic development program and the costs out there are a fraction of what they are here,” says Blanchard. “I think you're going to see, much like in California, where Long Beach and Los Angeles have grown together, Interstate 78 and Allentown, Pennsylvania, and New Jersey are going to come together. Initially just at the intersections, and it's going to take 10 years before you see anything dramatic, but it's starting. You got to get the people to live there first.”

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|