|

MARKET HIGHLIGHT, NOVEMBER 2004

BOSTON’S COMMERCIAL REAL ESTATE

OUTLOOK

PROMISING

Commercial real estate in Boston is experiencing ups and downs.

Retail is outperforming the office and industrial sectors,

but future prospects are promising.

The industrial market faces high vacancy rates. The second

quarter of 2004 saw increased vacancy and negative absorption,

but there continues to be demand for new, high-bay warehouse

space. Boston’s office market continues to recover slowly.

Vacancy rates have risen slightly throughout the year and

a large amount of sublease space has been placed on the market

recently. The redevelopment of Class B office buildings into

residential properties is helping counter the new influx of

sublease space, and the market is continuing its gradual recovery.

The retail market throughout downtown Boston has experienced

none of the troubles seen by the office and industrial sectors,

as steady demand from retailers new and old spurs great rental

rates and new developments.

Office

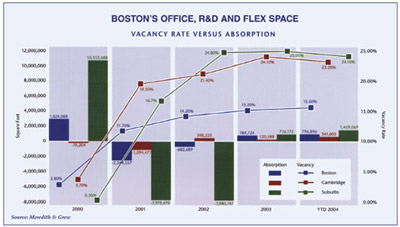

The Boston office market, consisting of more than 56 million

square feet of inventory in eight submarkets, is showing gradual

signs of recovery. The vacancy rate rose slightly in the second

quarter to 15.6 percent, compared to 15.4 percent at the end

of the first quarter 2004 and 15.2 percent at year-end 2003.

The lowest vacancy rates are in the Fenway/Kenmore submarket,

a 1.8 million-square-foot market, at 5.2 percent, and the

highest are in the 4.1 million-square-foot South Boston Waterfront

submarket, which is at 20.2 percent.

Net absorption for the first half of 2004 was strong at 796,896

square feet, which can be attributed to the opening of 100

Cambridge Street, a 550,000-square-foot building, in the first

quarter 2004. This building is more than 80 percent leased

to American Student Association, Barron & Stadfeld, Rogers

Law Firm LLC, and specialized agencies of the Commonwealth

of Massachusetts. The 650,000-square-foot 33 Arch Street building

opened in the second quarter of 2004, with approximately 62

percent of the building leased to Digitas, the Securities

and Exchange Commission (SEC), and the Massachusetts Department

of Education.

The sublease market will prove to have a significant impact

on the Boston office market through the remainder of the year.

Available sublease space has declined at a steady rate of

approximately 1 million square feet a year over the past 2

years; sublease space totaled approximately 1.5 million square

feet at the end of the second quarter. However, since July,

approximately 1.4 million square feet of sublease space has

been placed on the market by some of the city’s major

corporations. After its merger with John Hancock, Manulife

is shedding approximately 700,000 square feet of space onto

the sublease market. Additionally, Deutsche Bank is placing

300,000 square feet on the market and State Street is adding

250,000 square feet on the market within several different

buildings.

Another trend that appears to be developing in the Boston

market is the selling of Class B office buildings to developers

for residential conversions. This is being driven by the abundance

of capital from various buyers looking to buy residential

properties in a low interest rate environment. With office

vacancy around 15 percent and the need for new office developments

on the decline, the condominium market appears to be one of

the hottest segments in Boston.

There are two Boston submarkets that stand out as areas to

watch for future growth. The South Boston Waterfront area

has seen the largest amount of growth recently. This is highlighted

by the opening of the new Boston Convention and Exhibition

Center in June 2004 and the pending sale of the Fan Pier property

and the McCourt sites. With the removal of the elevated MBTA

(Massachusetts Bay Transportation Authority) lines, the completion

of the Central Artery sites, redevelopment of Lovejoy Wharf

and future development of the old Boston Garden site into

luxury residences, the appearance of the North Station market

is changing rapidly as well.

Overall, as we wrap up 2004, several indicators are showing

that the Boston office market is slowly recovering as the

economy continues its steady rebound. Vacancy rates in the

15 percent to 16 percent range and flat net absorption today

should hold rental rates flat for the year. However, because

of the significant additions to the sublease market, the rate

of recovery will slow down as we head in 2005.

— Suzanne L. Sullivan, Research Manager, Meredith

& Grew, Inc.

Industrial

Boston’s industrial inventory year-to-date totals 375

million square feet,of which 112 million is flex and 263 million

is warehouse. The market ended the second quarter of 2004

with increased vacancy and negative absorption. The vacancy

rate was 14.6 percent, compared to 14.3 percent at the end

of the first quarter and 13.3 percent at year-end 2003. Flex

projects reported a vacancy rate of 19.2 percent with warehouse

properties reporting a 12.6 percent vacancy.

There was a net decrease in occupied space totaling 1.3 million

square feet year-to-date. This is compared to negative 805,000

square feet of net absorption at year-end 2003. Significant

transactions took place during the first half of the year:

Rolf C. Hagen Corporation USA has decided to remain in the

Route 495 South market, leasing 302,032 square feet at 305

Forbes Boulevard in Mansfield; and Straumann USA is expanding

from its office in Waltham into 164,000 square feet at 100

Minuteman Park in Andover.

The sales activity for industrial product has decreased year-to-date

as compared to last year. The current average price per square

foot is $66.69 for industrial buildings. Cap rates have been

lower in 2004, averaging 8.72 percent, compared an average

of 10.88 percent during the same period last year. One of

the largest transactions in the Boston market this year is

the sale of Devens Commerce Center in Ayer to Mass Development.

This 660,000-square-foot industrial building sold for $45.5

million, or $68.94 per square foot.

New developments this year will total 585,000 square feet.

Two projects have been completed, including 55 Lyman Street,

a 130,000-square-foot warehouse in Northborough recently committed

to McKesson Corporation, and 165 Grove Street, a 55,500-square-foot

warehouse in Franklin that is occupied by several tenants.

Expeditors International has leased 44 percent of 3 Technology

Drive, a 180,000-square-foot facility. In Littleton, GFI Partners

is constructing a 240,000-square-foot warehouse, with a similar

building to be constructed following its completion. A few

of the major industrial property owners/developers in the

Boston market include AMB Property Corporation, Campanelli

Companies and Equity Industrial Partners. Tenants continue

to favor new, well-located high-bay warehouse space with a

reduced footprint and improved cubic storage capacity.

Average industrial rental rates have decreased to $7.06 per

square foot, a 1 percent decrease in quoted rental rates from

the end of the first quarter 2004, when rents were reported

at $7.13 per square foot.

The forecast for the remainder of the year includes few additional

large blocks of space being offered to the market. Overall

availability will continue to increase and rental rates will

decrease with the exception of high quality, efficient buildings

increasing in rent.

— Leslie A. Ouellette, Vice President and Director

of Research, Meredith & Grew, Inc.

Retail

The downtown Boston retail leasing market is still experiencing

steady demand from a variety of retailers. From apparel, financial

and service tenants to small chain restaurants, the downtown

area is not lacking for tenants. Newbury Street and Boylston

Street, both in Boston’s Back Bay, have rents as high

as $150 per square foot. Washington Street, considered the

most expensive street in Boston’s Central Business District,

has rental rates well north of $100 per square foot.

There has been consistent demand from retailers that are new

to the Boston market. Exhale, an exclusive New York spa, signed

a 14,000-square foot lease at Heritage on the Garden for its

first Boston spa. BoConcept, a Denmark-based furniture retailer,

is opening its first Massachusetts showroom and will occupy

6,500 square feet in Putnam Square on Massachusetts Avenue

in Cambridge. Another exciting new retailer coming to Boston

is the high-end lighting company from Italy, Artemide, which

will be opening a 4,500-square-foot store at 343 Congress

Street.

Restaurant chains are also entering the Boston market. Qdoba,

the fast-casual Mexican restaurant chain based in Colorado,

just opened three high-profile locations. New Orleans-based

Ruth’s Chris Steak House will open its first Boston restaurant

at a 12,000-square-foot site in Old City Hall.

Boston is also experiencing activity from existing retailers.

Long’s Jewelers, after leaving the downtown area 4 years

ago, is returning to Boston this fall with a prominent 5,500-square-foot

store in the Financial District. The Canadian-based Shreve,

Crump and Low jewelry store will relocate to a two-floor,

22,000-square-foot space formerly occupied by FAO Schwarz

on Boylston Street.

Development in the Boston area, specifically the Seaport District,

is beginning to flourish. The area is fast becoming a vital

and exciting part of Boston. New developments include the

new Boston Convention and Exhibition Center; the Channel Center,

a high-end mixed-use development with more than 80,000 square

feet of new retail; the pending Fallon Company’s 465

luxury apartments and hotel project; the relocation of The

Institute of Contemporary Art Museum; and Intercontinental’s

new luxury hotel and condominiums at 500 Atlantic Avenue all

coming on line.

With steady demand and limited amounts of prime space, the

retail market has continued to be a bright spot. Cushman &

Wakefield expects this trend to continue as more retailers

enter the Boston market and developments are completed.

— Emily Ou, director, Brokerage Service Group, Cushman

& Wakefield

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|