|

COVER STORY, MAY 2011

RETAIL TRENDS

Experts comment on retail investment markets, retail real estate financing, luxury retail, sustainability and property management.

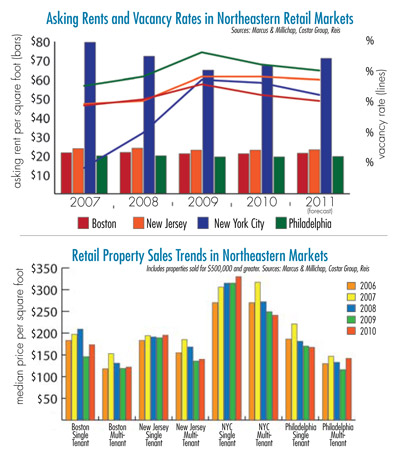

Two major Northeastern metros — New York City and Boston — have ranked among the top 10 in Marcus & Millichap’s annual National Retail Report. New Jersey and Philadelphia also staged strong performances in the annual rankings, placing 11th and 12th, respectively.

Investors in a Frenzy Over NYC Opportunities

Expanding employment and the continuing rebound in retail spending will drive improvements in retail vacancy and rents in New York City, making it one of the top markets in the country during 2011. Financing for mixed-use properties continues to improve, with loan-to-value ratios ranging from 50 percent to 55 percent. Investors remain attracted to assets in most of Manhattan, although properties in the Bowery, Lower Eastside and Financial District are commanding keen interest. In Brooklyn, transformation of the retail property market paused during the recession but appears to be gaining momentum, sustaining strong interest from national retailers for spaces along primary corridors such as Atlantic Avenue. In addition, more than 3,000 hotel rooms are slated for development, and demand for space to serve and entertain visitors will increase.

— J.D. Parker, vice president and regional manager of the Manhattan and Brooklyn offices of Marcus & Millichap Real Estate Investment Services

Boston: A Tale of Two Investment Markets

Buyers will gravitate toward both ends of the investment spectrum this year, focusing on stabilized, premium assets and distressed listings. Nonetheless, pent-up demand for properties will go unfilled due to the scarcity of owners willing to list assets. Top-tier single-tenant properties will command some of the highest prices in the country, as core locations are highly sought after. First-year yields for properties with creditworthy tenants such as Walgreens and CVS will average in the high 6 percent to low 7 percent range, attracting regional buyers with long-term hold strategies. Necessity-based multi-tenant assets, specifically grocery-anchored sites, will garner interest from syndicates attempting to achieve higher returns. Cap rates for these properties will average in the high 7 percent to low 8 percent range.

— Gary Lucas, senior vice president & managing director of Marcus & Millichap's Boston office.

Lack of Product Fuels Competition for New Jersey Assets

Property conditions and attractive pricing could generate additional transactions in the months ahead. Cap rates generally range from 7.7 percent to 8 percent for performing multi-tenant properties and from 7.2 percent to 7.5 percent for single-tenant assets. Potential rent reductions on expiring leases remain an issue in areas with high vacancy, such as Somerset County and sections of Camden County. Nonetheless, much of the demand for viable and performing multi-tenant properties goes unfulfilled, with deal volume suppressed by a lack of listed product. Owners who have maintained property performance through the recession and the early stages of the recovery will likely find strong demand and limited competition from other for-sale assets. These owners may contemplate dispositions and reinvestment into properties with greater upside potential.

— Michael Fasano, vice president and regional manager of Marcus & Millichap’s New Jersey office

Philadelphia is in the Initial Stages of a Recovery

Despite the challenges ahead this year, the market remains in the initial stages of a recovery, and investors will step up efforts to secure assets ahead of more robust improvements in property operations. In the multi-tenant sector, investors will seek anchored Class A centers with predictable income streams from credit tenants. Other active buyers are seeking assets that require repositioning either through improvement in tenant base or capital expenditures. Investors making offers not contingent on financing will command attention from motivated sellers. Distressed multi-tenant properties will continue to surface, although assets facing protracted recoveries in operations due to poor location or excessive vacancy will likely trade at steep discounts. In the single-tenant sector, properties with top-rated credit tenants remain in demand, and the expansion plans of well-known national brands will be followed closely.

— Spencer Yablon, vice president and regional manager of Marcus & Millichap's Philadelphia office

FINANCE YOUR CENTER: DARLING OR DOG?

Shoppers are back pounding the pavement, but because the commercial real estate cycle lags the overall economy, retail vacancies are higher now than they were in the darkest days of the recession. What does this “Catch 22” mean for financing in the retail sector?

Capital is available. Lenders today are assessing each potential project based on its own merits, and there is money for strong projects backed by borrowers with good credit. The CMBS market has made a near miraculous turnaround; life insurance companies are finding commercial real estate to be a desirable relative value investment, and large banks have been able to recapitalize themselves, providing more funds for commercial real estate lending.

Retail assets are once again attracting lender interest—but two major challenges persist. The first major challenge to the retail sector today is that spending has not yet returned to pre-recession levels. Retail sales have yet to rebound after plunging during the recession due to income and wealth losses, compounded by families’ desire to rebuild their balance sheets by increasing savings. As one might expect, food and other essential goods have been spared the dramatic declines seen in other discretionary retail categories.

The second major challenge to the retail sector is the deterioration of credit within the retail industry’s anchor tenant population. Numerous retailers, including Borders Group Inc. and Blockbuster Inc., have moved forward with game-changing restructuring plans prompted by bankruptcy filings. Consequently, the lack of available credit for marginal tenants combined with cautious consumer behavior has left a constrained supply of retail tenants to grow into increasing vacancy across the retail landscape.

Based on the current landscape, lenders have their favorite retail properties (“darlings”) and those that are less appealing (“dogs”).

Darlings: The easiest deals to finance are fortress malls and grocery-anchored retail. Fortress malls are considered destination locations that will survive in any economic environment. Likewise, grocery-anchored retail is considered recession proof. Grocery retail will be scrutinized heavily with an emphasis on store sales and market share of the supermarket operator since the credit of almost all retailers is generally suspect at this point — but those considerations are assessed within the context of the fact that everyone still needs to eat. Strip retail, similarly, is still attractive to lenders if it is well located with service-type tenants.

Dogs: Weaker malls are extremely suspect and a lender’s downside on a failed mall is a catastrophic loss. Real estate research company Reis Inc. reports that mall vacancies hit their highest level in at least 11 years in the first quarter of 2010. In the top 80 U.S. markets, the average vacancy rate was 9.1 percent, up from 8.7 percent. Lifestyle centers are problematic, as the demand for higher-end goods has decreased, leading to downward pressure on rents. Power centers are a mixed bag based on the tenancy, location and lease terms. Centers that feature unfilled holes from previous tenant losses or which have been backfilled with weak replacement tenants will be difficult to finance. On the other hand, centers that feature the better retailers with strong sales and good lease maturity dispersion will attract considerable lender interest.

— Warren Higgins, senior vice president with Berkadia Commercial Mortgage's Horsham, Pennsylvania, office.

LUXURY RETAIL

As the Economy Rebounds, High-End Retail Sees New Activity

Europeans flocked to New York City in 2009 expecting great opportunities with drastically reduced retail lease rates on the “High Streets.” Some retailers were a little disgruntled that the rents for luxury retail spaces weren’t more affordable.

On Madison Avenue, rents did correct themselves, with spaces from 1,200 to 1,600 square feet dropping to the mid-$600 to $700 per square foot range. Along Madison Avenue below 72nd Street, asking rents today are $700 to $1,000 per square foot. However, rents along Fifth Avenue never really corrected themselves. Up to 54th Street, asking rents are still up to $2,500 per square foot. Near 49th Street, asking rents are around $1,000 per square foot.

Rents aside, economic uncertainty stalled high-end retail activity over the last few years. After the Lehman bankruptcy filing in 2008, the luxury world came to a standstill. Some brands were doing well but there was little expansion.

Retailers that offer “affordable luxury” have seen the greatest opportunity during the downturn. For example, where projects might have signed Gucci before the recession, they signed Michael Kors during the downturn. Louis Vuitton, also considered more of an affordable luxury, did well through the downturn.

In the last 12 months, activity in the luxury retail market has started to pick up. We’re seeing retailers like Prada and Burberry on lease plans, and these companies are starting to do deals.

|

Hublot Genève has opened a store at 692 Madison Avenue.

|

|

Activity is picking up on Madison Avenue and along Fifth Avenue between 49th and 57th streets. High-end retailers are moving around or opening their first stores in the market. Jewelers and luxury watch companies are some of the first to move as the economy improves. Hublot Genève opened a store at 692 Madison Avenue in February. This is the third U.S. location for the Swiss watchmaker, which has two stores in Florida.

In SoHo, there is some activity along Mercer, Greene and Prince streets. On Spring Street, we just completed a lease with U.K.-based Mulberry for a flagship store. We represented the landlord, two private investors; Isaacs and Company represented the tenant. The space includes 5,400 square feet at ground level and 5,000 square feet in the basement. The space had been on the market for 2 years, occupied intermittently by pop-up stores during the recession. This tenant is a perfect offering for the location, which is across from Chanel, Burberry and Diesel.

Investment interest is picking up, too, and a recent deal brought a record $8,361 per square foot. Spain-based Inditex Group purchased a 38,750-square-foot condo, formerly occupied by the NBA Store, at 666 Fifth Avenue for $324 million, for a relocation of its Zara store currently at 689 Fifth Avenue at 54th Street.

Little by little, we will continue to see improvement in the high-end retail market as more luxury brands look to expand. Luxury brands will continue to look for space on Madison Avenue and Fifth Avenue and in SoHo. These retailers will also look to fill in the Meatpacking District, and over the next 3 years, some luxury retailers will expand into Lower Manhattan. Known areas, like the World Trade Center, will always attract a smattering of luxury brands.

— Karen Bellantoni, executive vice president, New York City-based Robert K. Futterman & Associates

PROPERTY MANAGEMENT

“Show Me the Money”

The economic challenges over the past 24 months have created opportunities for retail real estate property managers. Retailers at the front line have felt the downturn as fewer disposable dollars are available for customers to ‘invest’ in retail purchases. Lower sales create fewer dollars to pay rent and the result is that payments have slowed dramatically and past due receivables have increased. Requests for rent relief, whether temporary or permanent, are frequent. Under the worst circumstances, the tenant has vacated, either through a ‘midnight move out’ or bankruptcy. Added to these challenges is the intense scrutiny of every common area maintenance charge for current and past years, which exacerbates what is an already difficult financial climate.

Over the past couple years, financial management of shopping centers is where property managers have felt the most significant demands. Managing cash flow, collections, expense belt-tightening, deferred maintenance, and minimal capital dollars are the name of the game. Day-to-day operations have not changed dramatically as maintenance of the center is an on-going requirement to preserve a clean, safe, and attractive property. But enormous amounts of time are now dedicated to tenant hand-holding and cajoling, coupled with the occasional firm call and face-to-face meeting to collect rent. Managers must also work closely with leasing and ownership so that every vacancy is ‘market ready.’ Critical capital dollars invested in tenant improvements require the manager to solicit and negotiate fit out costs so that the leasing agent has the tightest budget numbers possible to enable the deal to close.

Vacant stores — both anchor and small shop space — reduce customer foot traffic, with a ripple effect on the remaining tenants. Occupancy thresholds and co-tenancy provisions are of significant concern, as the loss of the anchor can often trigger events, including kick outs that allow a tenant to close their store if the co-tenancy default is not cured. The loss of the anchor (and other stores with co-tenancy language within their lease) will likely result in lower retailer sales, which opens the door for those remaining tenants that may have a sales ‘kick out’ clause, allowing them to close if specified sales volumes are not met.

What is the bottom line? Tenant retention supports tenant attraction. Do (almost) whatever is necessary to keep the shopping center as full as possible. As needed, and only after research and verification of information, reduce rent temporarily, utilize forbearance agreements, and be willing to restructure a lease with a good tenant to help that tenant survive. Success breeds success — and tenants need each other. The property manager typically plays at least two positions: the quarterback calling and executing the play and the defensive lineman, protecting his client. The property manager’s objective is to maintain the property, drive occupancy, enhance cash flow, and create value for the client.

— Larry Zipf, president, Fameco Management Services Associates

The 4 R’s: Reduce, Reuse, Recycle … Retail

The retail industry in general is becoming more aggressive in its approach to sustainability. Retail property owners and operators as well as tenants are implementing environmentally friendly initiatives — and enjoying cost savings associated with some of these changes.

From a management perspective, the most important actions to reduce a center’s environmental impact are reducing energy and water consumption in common areas, as well as providing an infrastructure for waste recycling.

At many Regency Centers’ properties, we are installing networked lighting controls for outdoor lights. These controls allow us to precisely schedule individual lights, thus optimizing the on-off schedule and maximizing energy savings. We can ensure a safe, well-lit parking lot while reducing our electricity costs 25 to 50 percent. This is a tremendous savings, and the typical payback for these systems ranges from 6 months to 3 years. These systems are controllable from anywhere with an Internet connection, and also provide alert notifications for any outages at the property. Networked lighting controls are a great example of a technology that’s cost effective and environmentally beneficial.

We are also installing smart irrigation controls that use real-time weather data to adjust water use. The smart controllers use local weather data along with information about plant type, soil conditions, and even sun exposure to adjust irrigation schedules and run-times and provide the right amount of water — no more and no less. The smart controllers automatically adjust the irrigation schedule daily based on local weather forecast. On average, these systems have reduced our water consumption by 25 percent, and typical payback is around 2 years.

Tenants and owners alike are also looking to replace old toilets with water-efficient toilets. If you replace a 4.5-gallon flush toilet with a high efficiency toilet that uses 1.1 gallons per flush, you’ll see a 75 percent reduction in water use. In some areas, the water districts provide rebates that will pay for 50 percent or more of the costs of these efficiency improvements.

From the tenant side, we are fielding calls from retailers that want to install solar panels and electric vehicle charging stations.

There is a lot more attention to rating systems these days. The U.S. Green Builidng Council’s Leadership in Energy and Environmental Design (LEED) is the most well known and comprehensive green building rating system. But, there are also programs such as the EPA’s Energy Star and WaterSense programs. Retailers can benefit from the Energy Star for Retail program as well as by looking for Energy Star-labeled products, such as lighting and HVAC units.

When economically feasible, Regency believes there is value in third-party certifications, whether LEED, Energy Star or WaterSense. These certifications validate retailers’ and property owners’ sustainability efforts, and help investors measure sustainable actions.

— Mark Peternell is vice president of sustainability for Regency Centers, which owns, develops and manages 400 grocery-anchored shopping centers nationwide.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|