|

FEATURE ARTICLE, MAY 2007

OFFICE BROKERAGE REPORT

Our experts weigh in on the state of the office market in their respective regions.

Downtown Boston Office Market

The downtown Boston office market is being squeezed. The last new office project in Boston was 33 Arch Street, a 600,000-square-foot tower that was completed in late 2004 at a time when the vacancy rate was nearly 18 percent. Today, with the vacancy at 10 percent, there are a number of large projects trying to get through the approvals stage in hopes of breaking ground in early 2008, or maybe even late 2007, to meet the pent-up demand. Despite the best of intentions, however, new product will likely not be delivered until 2010, and this will continue to put upward pressure on rents. The first three projects most likely to break ground are Two Financial Center, the Russia Wharf project, and the Fan Pier project. Lincoln Property Company acquired a permitted development site near South Station and plans to break ground on Two Financial Center, which is currently approved for 207,000 square feet. Boston Properties is hoping to get into the ground soon with it’s newly acquired Russia Wharf project, which it bought from Blackstone after the $39 billion Equity Office Properties portfolio sale. The 1 million-square-foot mixed-use project will feature a new 500,000-square-foot Class A office tower on the waterfront. In the expanding Seaport District, The Fallon Company announced it will kick off phase one of the long awaited Fan Pier project with a 480,000-square-foot Class A office building. Fan Pier will eventually offer more than 3 million square feet of office, residential, hotel and retail space. Boston Properties is close behind with another project and hopes to build 300,000 square feet at 888 Boylston Street in the Back Bay area of Boston. This site represents the final development parcel at the Prudential Center. Completion for Two Financial Center could happen in 2009, but all other deliveries will likely occur during the 2010 to 2011 timeframe. Several other large projects are also in the queue, including Hines’ South Station tower and TransNational’s 1,000-foot-high tower in the financial district.

The investment market in Boston has been “white hot” for the past 24 months. Investors are outbidding each other, and in turn, setting new pricing records. A wide range of investors including institutional funds, private equity funds, REITs, pension funds and foreign investors are chasing stabilized assets as well as assets with “lease rollovers” in the next few years. Beyond Blackstone’s $39 billion purchase of the Equity Office Properties national portfolio, the most significant sale transactions last year were One Lincoln Street and the John Hancock Tower complex. One Lincoln Street was purchased in late 2006 by Fortis Property Group for $889 million ($846 per square foot). What’s notable, however, is that the seller, American Financial Realty Trust, bought the property in 2004 for $705 million in what was then a record high price of $672 per square foot. Similarly, the John Hancock Tower complex was purchased and sold in a short time span. Broadway Real Estate Partners bought the Hancock Tower complex from Beacon Capital Partners in late 2006 for $1.74 billion ($600 per square foot). Beacon had purchased the 2.9 million-square-foot complex from Manulife in early 2004 for a “mere” $910 million ($314 per square foot).

Investor activity is currently being driven by the general pressure on institutional investors to place funds; commercial real estate assets being viewed as more stable than equities; plentiful private equity; Boston’s supply constrained market; and foreign investors leveraging the buying power of the euro.

The volume of sale transactions offers further evidence that local, national and international investors see Boston as a premiere city in which to commit capital due to its strong economy, its diverse tenant base, and the scarcity of developable land which creates the high “barrier to entry” that investors love. And, although Boston is not immune to market downturns, investors view it as one of the most stable markets over the long term.

Market conditions and statistics, have changed dramatically in the last 12 to 18 months. Vacancy has dropped by more than 25 percent while rents have increased by more than 25 percent. Several dynamics are attributable to this change. First, the aforementioned lack of any new construction since 2004, combined with a surging local economy, has caused supply to shrink, which opened the door for landlords to push rents higher. Second, investors are purchasing office buildings at record highs and are then aggressively increasing asking rents. This is due as much to their bullish view of future market conditions as it is to the fact that they may need to justify the investment they’ve just made. Finally, the recent purchase of the Equity Office portfolio by Blackstone put additional upward pressure on rents. While the portfolio was under agreement, Blackstone chose to reevaluate or withdraw many outstanding proposals, only to resubmit them later at higher rents. As a result, a number of tenants found themselves in positions with no leverage and were forced to renew at significantly higher rents, further fueling the perception of “skyrocketing rents.” Landlords appear to have gained the upper hand in lease negotiations in the last 6 months and are pushing rents upward on a regular basis. Tenants must now act very strategically in order to compensate.

Today’s overall vacancy rate for the downtown Boston office market is approximately 10 percent. Space is tightest in Class A towers where the vacancy averages approximately 8 percent. In fact, the vacancy rate shrinks to approximately 5 percent above the 20th floor. Class B vacancy is also tight, averaging approximately 12 percent. In the suburbs, the overall vacancy rate is nearly 20 percent with an average of 16 percent along Route 128 and 23 percent along Route 495. With respect to rental rates in downtown Boston, there have been a few “headline grabbing” deals in the first quarter of 2007 that were signed in the low $60s and even the low $70s per square foot. However, the average rental rate for leases signed in Class A office towers ranges from the high $40s to the high $50s per square foot. Class B buildings average in the high $20s to mid $30s per square foot.

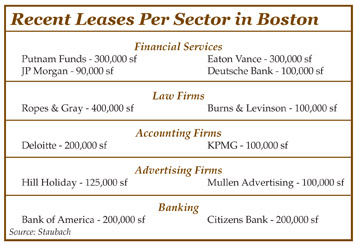

The current and recent leasing activity has come primarily from traditional industries in Boston including financial services, law firms, banking, accounting firms, and advertising companies. A number of tenants seeking 100,000 to 300,000 square feet are actually competing for the same Class A space options, with several in discussions with developers to kick off new projects. There is also much activity in the laboratory space market among life sciences users such as biotech companies, pharmaceutical, and hospitals, particularly in Cambridge, where high demand has rapidly reduced the available supply in the last 12 to 18 months.

Most would view the overall office climate in Boston as healthy, especially if you are a landlord. Tenants, on the other hand, are facing challenging times and must be creative by adopting a “defensive” leasing strategy in order to prevent higher rents from stifling their growth. The 2007 office market should go down as one of the strongest in Boston’s history in terms of both rental growth and investment values. History has shown, however, that real estate is cyclical and the looming question is: When will this current cycle begin to change? Many believe we may be at, or near, a peak in the market. Looking at just the sheer volume of properties on the market for sale today suggests that owners see this as a good time to cash out. The current shortage of supply will soon lead to several new construction starts, which in all likelihood will be delivered in the same general timeframe. Time, and the state of the economy in 2009 and 2010, will tell whether these deliveries will be viewed as welcome relief, a mild oversupply, or a glut of office inventory. In the meantime, owners and investors are enjoying their day in the sun.

Ted Wheatley is the senior vice president of the Corporate Services Division for The Staubach Company’s New England office.

Manhattan Office Market

As one of the most vibrant and diverse real estate markets in the country and the world, New York City continues to both defy and surpass expectations. Astronomical sale prices, rising rental rates and very low vacancy rates characterize the market, which is driven by a strong local economy and surging financial industry. The overall Manhattan office vacancy as of the end of the first quarter totaled 5.3 percent of the inventory, with the surrounding outer borough markets at 8.9 percent. Class A office vacancy was 4.5 percent, down from 5.5 percent just 12 months ago, while Class B space exhibited 6.5 percent vacancy, down from 9 percent a year ago. Given expected strong demand, continued positive absorption and corresponding decreases in vacancy, the Manhattan market looks to have the momentum for even more rental accretion through 2008. Further down the line, however, new construction at the World Trade Center site, in the Penn Station area and at other proposed sites could restore some equilibrium and provoke declines in rents when they come online.

High demand and little space returned to the market have driven pricing up all over Manhattan over the past year. Class A space has been especially impacted as competition among hedge fund and private equity firms, to whom even the highest rents are less important than the image conveyed, has pushed rates up over $100 in most top-shelf properties. Firms coming off 10- to 15-year leases in those buildings are finding themselves unable to afford the high rents and are choosing to relocate to lower cost neighborhoods. In addition to their affordability relative to Midtown, these new locations have great appeal because they are in many of Manhattan’s hottest areas and offer tenants access to unique restaurants, art galleries, and hip residential opportunities. Further, the space leased is often in vintage facilities with historic character, unique accoutrements and appealing interior and exterior aesthetics — quality of life factors desirable to many of today’s firms. High profile firms such as InterActive Corp., Google and Martha Stewart Living Omnimedia are among the companies who have taken space in non-traditional office areas. InterActive Corp. set up its headquarters in trendy Chelsea, Martha Stewart Living Omnimedia took space in the Starrett-Lehigh building and Google leased more than 350,000 square feet last year at 111 Eighth Avenue.

In anticipation of a continuation of this trend, the search for new sites for development has taken on yet another level of competition — creativity and cost — and expanded into areas once considered taboo for office development. Cooper Union, for example, is selling its 99-year ground lease at 51 Astor Place, a large site capable of supporting a 350,000-square-foot building, and proposals have been made to redevelop Lord & Taylor’s legendary Fifth Avenue store. Related Properties and Boston Properties have proposed an office development for a site at 8th Avenue and West 46th Street, and Boston Properties alone has another office development site at Eighth Avenue and West 54th Street. Extell Development also plans to build a commercial building in the Jewelry District.

These developments are just the beginning, however, as the frenzy of residential condominium construction of the past few years, which discouraged commercial development initiatives and contributed to the current low vacancy/high rent situation, is ending. The market is finally beginning to swing back in favor of commercial real estate as condominium buying slows and commercial demand continues strong. The increasing demand is in large part due to New York’s ongoing global appeal for businesses. The financial services, legal and media sectors are among the many industries that offer a plethora of jobs, prompting more young professionals to make the move to Manhattan every day. Access to the energy, enthusiasm and intelligence of this labor pool is highly appealing to companies of all kinds.

Construction planned or currently underway will aid in the continuation of this appeal, given the design efficiencies and technical and operational advantages built into most of the developments. One Bryant Park, a 52-story skyscraper located on Avenue of the Americas between West 42nd and 43rd Streets, has already landed Bank of America, Akin, Gump, Strauss, Hauer & Feld, and Marathon Asset Management, among other firms looking to take advantage of its marquee Midtown location near the headquarters of most major global companies. The excitement is not limited to Midtown, though. As already demonstrated by the success of the new 7 World Trade Center, the proposed Freedom Tower and 2, 3, and 4 World Trade Center will add to the renewal and re-affirmation of Downtown as a viable office location already underway due to price disparity-driven tenant demand. The four new towers will include 8.8 million square feet of Class A office space as well as 500,000 square feet of interconnected retail. Rumors have also circulated that JPMorgan Chase and possibly others are interested in building a 1.3 million-square-foot office tower on the site of the Deutsche Bank Building (WTC 5) following its razing by the end of 2008. Transportation improvements, continuing growth of the area’s affluent residential population and capital improvements across all property segments will also bolster the appeal of both of these buildings and Downtown in general.

Office investment activity continues strong in Manhattan as well. New global players from Asia, Europe, the Middle East and Russia are bidding up values on everything. In just the first 3 months of 2007, the total volume of dollars paid for office properties has doubled the volume traded as of midyear 2006. And in Midtown, prime Class A product is selling at more than $1,000 per square foot. Much of this outcome came about as a result of Macklowe Properties’ purchase of the eight-property Blackstone portfolio. In total, investment volume has reached $13.7 billion already this year, with another $6.1 billion under contract.

Joseph F. Harkins is the executive managing director at Grubb & Ellis New York, Inc.

Philadelphia Office Market

Rising rental rates, lower concessions and a shortening supply of larger blocks of space (100,000 square feet or greater) characterize the current office market in Center City Philadelphia. Developments such as Cira Centre and the Comcast Center are supercharging the office market. The Cira Centre, which is currently being developed by Brandywine Realty, is a 727,725-square-foot office building located at 30th Street. Currently 100 percent leased, this premier office building is unique in its location and because it has a Key Opportunity Zone designation. The Comcast Centre, a 1.3 million-square-foot building located at 17th and JFK Boulevard and developed by Liberty Property Trust, is not even complete and it is almost 100 percent leased.

Developments of this magnitude and quality are bringing higher rental rates to the Philadelphia office market. Triple net rental rates are sitting at approximately $32 per square foot. Current trends in the office leasing markets are increasing rental rates, the shortening supply of blocks of space (100,000 square feet and greater), increasing construction costs, diminishing concessions and the migration of tenants from University City to the Central Business District (CBD).

The vacancy rate in the CBD is approximately 10.5 percent and the suburban vacancy rate is sitting around 12 percent to 14 percent. Due to the decreasing supply of product in Center City Philadelphia, the office market is quickly becoming a landlord’s market. Law firms, accounting firms and healthcare related companies are aggressively seeking well located Class A space with ample parking, mass transit opportunities and amenities such as restaurants and retail.

The majority of Philadelphia’s growth is organic, meaning it comes from existing tenants. Thus, the activity within City Center Philadelphia is more about a matter of which existing tenants are growing and expanding their current office space. For the remainder of 2007, absorption is projected to reach 1 million square feet, rental rates will most likely grow approximately $2 per square foot and vacancy rates are expected to approach 9 percent.

David Jarjisian is a senior vice president at CB Richard Ellis.

New Jersey Office Market

Much of the New Jersey office market has been experiencing fairly static activity during the last several years. In general, outside of a few markets that are doing well, the majority of the state is not doing as well as Manhattan, and it has a relatively high vacancy rate compared to the other major office markets around the country. New Jersey has an overall vacancy rate of approximately 18 percent, which is attributable to the lack of office employee job creation in the state. From 2001 through part of 2005, the state exhibited negative growth and absorption in the office market; however, in 2005, the market began to experience renewed slow and steady growth and absorption. For example, in 2005 there was 2.5 million square feet of positive net absorption and in 2006 there was approximately 1.5 million square feet of positive net absorption. It is anticipated that by the end of 2007, 2 million square feet of positive net absorption will occur. The majority of the demand has been for back-office operations, business continuity centers and data centers. The financial industry and other major companies are looking to move their data centers or have alternative data centers and business continuity centers outside of Manhattan. Other industries actively looking for space in the New Jersey market include life sciences companies, software companies, law firms and accounting firms.

Due to is proximity to New York City, the Jersey City market is experiencing good leasing activity and rental rates averaging $34 per square foot. Newark has been a little sluggish in terms of office activity, but there are not many opportunities available in this area. Newark is expected to rebound towards the end of the year in terms of space absorption because of its proximity to New York City and the general lack of product. The Newark market is attractive to professional service firms that want to be close to Manhattan, but don’t want to pay $80 to $100 per square foot in Midtown. These type of tenants would consider moving portions of their operations there, but not complete a total relocation. The Metropark market is one of the strongest markets in New Jersey right now. Rents, which are currently in the high $30s per square foot, have increased 15 to 20 percent over the last year in this emergent market.

The lack of job growth, high vacancy rates and the rising cost of construction have impeded speculative office development in New Jersey. However, a relatively low vacancy rate and its accessibility on the train line, has warranted some new construction in the Metropark office market. The Atlantic Realty Development Group intends to break ground this summer on a 250,000-square-foot, 10-story office building, Metrotop II, at Metrotop Plaza at 115 Wood Avenue South in Metropark. In addition to new construction, much of the older product throughout the market has been undergoing extensive renovations to increase the value of the product and increase demand as tenants look for space. For example, Edison Square is currently undergoing an extensive $3 million renovation to improve its mechanical systems, common areas and landscaping.

Investment sales activity is still strong in the state as investors are looking for value-add product that is well located. Tishman Speyer recently acquired Metropark Corporate Center, which includes three buildings and a total of approximately 850,000 square feet, from Ivy Equities for $227 million.

Throughout the rest of 2007, the New Jersey job market will most likely continue to be lackluster with only moderate gains. There will be slow and steady growth, but not a dramatic shift or a dramatic drop in vacancy for 2007. As rates increase in Manhattan, and companies expand, they continue to look to New Jersey as an alternative to accommodate expansions. The demand in New Jersey for the majority of 2007 will be from companies seeking less costly alternatives for either back-office, business continuity or data centers. The balance of the demand, which would be on a smaller scale, would be moderate employment gains in the white-collar industry.

Paul Giannone is the executive vice president of Jones Lang LaSalle in Iselin, New Jersey.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|