|

FEATURE ARTICLE, MAY 2006

CHANGING THE RULES

The IRS is putting the thumbscrews on “Rules of Thumb.”

Steven J. Kurtz, MAI

The rules for property owners are changing. The IRS is taking a harder look at property owners and investors and they probably don’t know it yet. The climate is changing for a certain “rule of thumb” that has been used in the accounting profession for at least for the past 20 years. It is the “20 percent is land” rule.

When buildings are purchased, little thought is given to the portion of the purchase price that is attributable to land. Tax time usually precipitates greater consideration of land value. Developers think about land value all of the time and the successful ones have a solid grasp on it. However, when other investors are forced to think about it, the “rule of thumb” is pulled out.

The “rule of thumb” regarding land is that 20 percent of a purchase price is attributable to land. Despite the rule, this is rarely the case, and most developers would agree. The simple fact is that land values tend to lag behind changing market conditions. Land prices don’t move as fast as the prices of improved properties. This is especially true in areas where the barriers to entry are high and in markets where prices are changing rapidly.

Is the land portion of a purchase price ever 20 percent? Probably not. Land is more likely to account for 10 percent to 40 percent of the purchase price. Let’s see an example from each end of the spectrum.

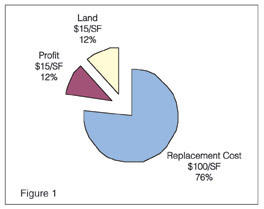

A developer has built and sold the first 300,000-square-foot power center ever to be built along the highway leading out of the central business district of a small city. The area is mostly residential or farmland, but it is up and coming. The developer has sold the building for $130 per square foot. After profit, the price is not much higher than replacement cost. The portion of the purchase price attributable to the land is 12 percent. (See Figure 1.)

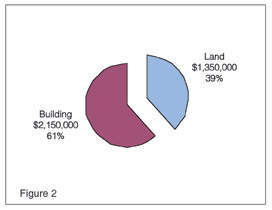

At the other end of the spectrum, an investor has just purchased two buildings that contain 20,000 square feet of additional showroom space for an adjacent car dealer along a major retail corridor. The investor will convert the buildings to retail and there is room to build another 10,000-square-foot building. The purchase price was $3.5 million and land is selling for $45 per square foot of buildable area. Therefore, the land value is $1.35 million. The portion of the purchase price attributable to the land is 39 percent. (See Figure 2.)

Investors may ask, “So what?” Regardless of whether they are taking advantage of the accelerated depreciation using cost segregation studies, they need to take a hard look at how they are depreciating property when filing tax returns. The IRS most assuredly will challenge the numbers they have filed.

Why now? Accounting scandals have dominated headlines in recent years. The IRS, the SEC, attorney generals and investors alike are demanding transparency and care in financial reporting. Assumptions that were once made using “rules of thumb” are no longer acceptable. The IRS’s guidance for auditing cost segregation studies highlights the issue. The support required is “a quality study [that] documents how a purchase price was allocated between land, land improvements, building and other assets,” according to IRS guidelines.

According to the IRS’s guidance, a “quality study” is one performed by “qualified” individuals or firms, such as those employing “…personnel competent in design, construction, auditing, and estimating procedures relating to building construction.”

Many ask that if their accountants are qualified, why can’t they use a “rule of thumb”? The reality is that they have done it and still do it, but they shouldn’t. The IRS tells us that “land included in the purchase price is valued first,” and, “the value of land should be determined at its highest and best use.”

This means that a real estate investor cannot back in to land value by using the purchase price as a guide. The land must be valued first. A qualified professional using widely accepted methods, such as comparable sales, is the optimal person to determine land value.

Investors may ask, “What if I use the property tax assessment as a guide?” This is a “rule of thumb” too. The method is: take the land assessment, divide it by the total assessment and apply this ratio to the purchase price. However, assessments are determined by the taxing authority for their use, not yours, and may bear no resemblance to reality. Occasionally the assessments do match up, but not often. A tax appeal lawyer can attest to how often the two numbers do not match up.

These issues are an immediate concern because the IRS has stepped up its enforcement efforts and has conducted audits for cost segregation studies. The IRS is checking to see whether or not investors/owners are using “rules of thumb,” which it will not accept as methodology for land use valuations. Public companies that are performing purchase price allocations under FAS 141 also are being asked to provide support for land values by their auditors.

Most property owners can benefit from a cost segregation study by realizing significant increases in after-tax cash flow by accelerating depreciation. The present value of the tax savings are typically multiples of the cost of such a study. The use of a qualified professional will ensure that the analysis will stand up to IRS scrutiny.

Steven J. Kurtz, MAI, is Director of Valuation Services for The Schonbraun McCann Group LLP, a national real estate financial consulting firm with offices in New York, New Jersey and Florida.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|