|

COVER STORY, MARCH 2008

HOSPITALITY UPDATE

How is the hospitality industry faring in 2008?

Reed S. Woodworth

|

V3 Hotels recently broke ground on the Hotel Indigo Brooklyn in New York City. The 164-room hotel is set to open late 2009/early 2010.

|

|

Hotel performance in New England, as in the rest of the country, has enjoyed several years of improvement since the post-9/11 doldrums that ended in 2003. While the better times were not distributed equally throughout the region, in general all hotel operators saw some level of increased performance, particularly in average daily rate. Now as we move into the New Year, the looming specter of recession has further tempered what has already been forecast as a leaner year with slower growth. In this article, we analyze the historical performance of two major metropolitan areas within the region as compared to the nation, as well as offer insights as to where we are headed in the coming years.

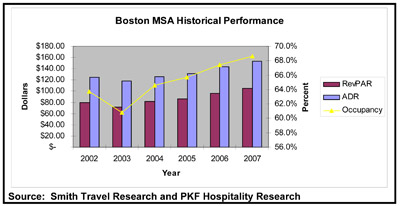

Boston MSA Hotel Performance

Between 2002 and 2006, and according to data compiled by Smith Travel Research (STR), hotels within the Boston Metropolitan Statistical Area (MSA) saw occupancy escalate from 63.7 percent to 67.4 percent, amidst a supply increase of almost 10 percent. At the same time, average daily rate (ADR) improved from $125.18 to $143.06, resulting in an increase in Revenue per Available Room (RevPAR) from $79.79 to $96.42.

This reflects a compound annual growth rate of 4.9 percent, which exceeds the historical annual growth rate of 3.4 percent nationally.

Occupancy in the Boston MSA for 2007 increased to a healthy 68.6 percent, while average daily rate increased by 7.3 percent over 2006 to $153.49. This yields a RevPAR of $105.36, approximately $9.00 more than that achieved in 2006. Overall, compound annual RevPAR growth since 2002 was approximately 5.7 percent.

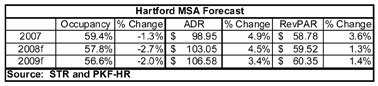

Hartford MSA Hotel Performance

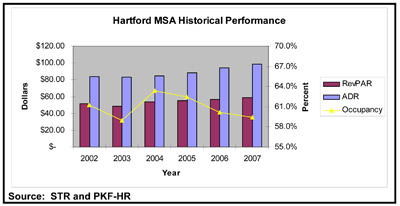

While the news has been good within the Boston MSA, performance within the Hartford region has not been as stellar. While the average Hartford hotel has improved, it has been at a much more modest pace than that observed in the Boston MSA and weighted more heavily toward average daily rate improvement more than occupancy. In 2002, the Hartford MSA achieved an occupancy level of 61.3 percent at an average daily rate of $84.16. By 2006, occupancy had declined to 60.2 percent, while average daily rate rose to $94.30. This resulted in RevPAR growth from $51.59 in 2002 to $56.75 in 2006, a compound annual increase of 2.4 percent, less than half of the RevPAR growth that occurred in the Boston MSA over the same period. A supply increase of more than 12 percent during the period significantly tempered performance.

For 2007, the Hartford occupancy declined once again, while average daily rate grew a modest 5.0 percent, tempered somewhat by a 3.3 percent increase in supply. By year-end, occupancy declined to 59.4 percent with average daily rate increased to $98.95, a 5.0 percent increase over 2006. The resultant RevPAR of $58.78 represents 3.6 percent growth over the prior year, which slightly increases the overall compound annual growth rate since 2002 to 2.6 percent. Struggles in the economy in tandem with a significant increase in supply have taken their toll on hotel performance in the region again in 2007.

National Hotel Performance

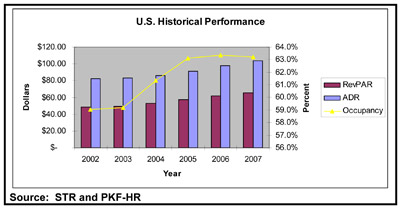

Looking across the nation, historical hotel performance during this decade is closer to that achieved within the Boston MSA more than the Hartford MSA. Nationally, occupancy in 2002 reached 59.0 percent, climbing to 63.3 percent in 2006. Average daily rate during the same period grew from $82.75 to $97.73, reflecting an increase of 4.2 percent. Combining these two metrics yields RevPAR growth during the period of 6.1 percent ($48.94 in 2002 increasing to $61.91 in 2006), far exceeding both the Boston and Hartford MSA RevPAR growth.

By year-end 2007, STR reports that the national hotel occupancy decreased slightly to 63.2 percent while average daily rate increased to $103.64. The resultant RevPAR of $64.57 reflects a 5.7 percent increase over 2006, still ahead of the historical average of 3.4 percent. This reduced the historical compound annual growth rate of RevPAR to 6.0 percent.

What will the Future Bring?

As we enter 2008 and beyond, economic uncertainty has taken hold and future hotel operating performance looks less bright, though still shining. Expectations for the national economy show continued growth but at a much slower pace, according to Moody’s Economy.com. As of the 4th quarter of 2007, the U.S. economy had sustained healthy growth. The Federal Open Market Committee (FOMC) does not expect this positive performance to be sustained in the near term, mostly due to the impaired market for nonconforming mortgages. Recent actions by the FOMC to loosen credit are an attempt to minimize the effects of the downturn; however, it remains to be seen whether rates have declined enough.

Within the New England region, the economic outlook is expected to underperform the nation as a whole. According to the November edition of the Federal Reserve Bank Beige Book, businesses within the region are reporting continuing revenue gains, but rising caution. Staffing firms report steady growth with particular strength in the Boston area, while software and information technology services firms indicate a slowdown in revenue growth. Residential real estate with the New England region shows double-digit declines, particularly in Massachusetts. Commercial markets overall are also softening.

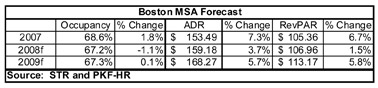

Boston MSA Forecast

In light of the waning economic environment, the hotel performance forecast for the Boston MSA shows a temporary weakening in 2008, with improvement in 2009. Occupancy in 2008 is expected to decline to 67.2 percent while average daily rate improves to $159.18, a 3.7 percent increase over 2007. RevPAR growth should reach 1.5 percent, well below the 6.7 percent growth experienced between 2006 and 2007. By 2009, occupancy is expected to increase slightly to 67.3 percent while average daily rate growth accelerates to 5.7 percent yielding a 2009 figure of $168.27. This results in a RevPAR gain of approximately 5.8 percent over 2008.

Hartford MSA Forecast

While the Boston MSA hotel performance is expected to continue to outpace long term averages, the Hartford MSA will begin to lag. In 2008 and 2009, occupancy is expected to continue to decline, while average daily rate will continue to grow. Projected occupancy of 57.8 percent in 2008 reflects a -2.7 percent decrease from 2007. Occupancy will further decline in 2009 to 56.6 percent. Average daily rate, however, will increase to $103.05 in 2008 over the $98.95 achieved in 2007 and increase again to $106.58 in 2009. RevPAR growth of 1.3 percent in 2008 will lag the nation, but slightly increase in 2009 to 1.4 percent. A 3.1 percent increase in supply in 2008 followed by another 5.4 percent increase in 2009, coupled with modest economic activity in the Hartford area, are the predominant reasons for modest overall growth.

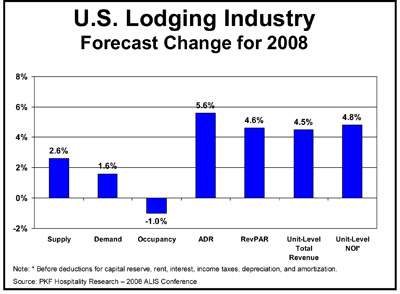

National Forecast

Similar to the New England region, PKF Hospitality Research (PKF-HR) is forecasting a slowdown in the pace of annual RevPAR growth for the next few years. For the year, PKF-HR is projecting occupancy levels to experience a slight decline (-1.0 percent), while average daily room rates should grow 5.6 percent. The net result is a 4.6 percent gain in revenue per available room, the slowest pace of RevPAR growth since recovering from the 2001 to 2003 industry recession. While the PKF-HR forecast calls for a deceleration in the pace of revenue growth, it should be noted that the 4.6 percent RevPAR growth rate is still above the Smith Travel Research long-term average of 3.4 percent.

New England hotel performance, as measured by the two largest MSA’s within the region (Boston and Hartford), will continue to grow, though not at the rates achieved in each MSA during the recent past and behind that of the nation. In short, the outlook is still very good, but not great.

Reed S. Woodworth is vice president of PKF Consulting, Inc.

Hotel Development Surges in Lower Manhattan

Hotel developers are staying active in Lower Manhattan to keep up with the area’s resurgence. Currently, Lower Manhattan is home to 10 hotels that offer a total of 2,474 rooms, all of which are operating at near peak capacity. Fourth quarter 2007 statistics indicated that Downtown hotels were 85 percent occupied with many hotels experiencing occupancy rates of more than 90 percent for each month of the fourth quarter. Due to the area’s thriving economy, approximately 20 hotels are under construction or on the drawing board. These new facilities will offer visitors many options, ranging from large branded facilities to limited-service hotels to small boutique style hotels.

Upcoming projects include:

• 50 West Street -— hotel/condominium

• 217 Pearl Street — 53-story building with two hotels totaling 660 guestrooms as well as a public plaza, a rooftop bar, ballrooms and conference facilities

• 123 Washington Street — 55-story hotel/condominium with a high-end restaurant, a sky lobby, meeting rooms and an ancillary spa and fitness center

• 124 Water Street — 26-story limited-service hotel with ground-floor restaurant

• 99 Washington Street — 36-story hotel with restaurant and retail space

• 100 Greenwich Street — 39-story hotel with meeting rooms, a spa, a fitness center, a restaurant and meeting rooms

• 50 Trinity Place — 35-story limited-service hotel with retail space

• 20 Maiden Lane at Nassau Street — 20-story Wyndham Garden hotel

• 8 Stone Street — 42-story, full-service luxury hotel with extensive conference space and restaurants

• 33 Beekman Street — 39-story hotel |

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|