|

FEATURE ARTICLE, JUNE 2008

NEW SEC RULING COULD AFFECT YOU

Find out how a recent SEC ruling could affect you.

Stuart Eisenberg

In fourth quarter 2007, the Securities and Exchange Commission (SEC) voted unanimously to allow certain foreign companies to file financial results using International Financial Reporting Standards (IFRS) without reconciling the figures to U.S. generally accepted accounting principles (GAAP) as promulgated by the Financial Accounting Standards Board (FASB). This will hopefully attract more investment opportunities and stock listings to U.S. exchanges, however, it may also have unintended consequences for U.S. real estate businesses. While the decision to have U.S. companies stay with GAAP or move towards filing under IFRS is currently under review, U.S. real estate companies may have some challenges in dealing with inappropriate financial comparisons with these foreign companies.

The Revised Accounting Rules

Until this change, foreign private issuers preparing financial statements using a basis of accounting other than GAAP were required to include a reconciliation to GAAP in filings with the SEC. The SEC believes adoption of these amendments is consistent with its commitment to establishing a single set of high quality, internationally accepted accounting standards to enhance investment comparisons by investors and reduce regulatory burdens on issuers. The elimination of the reconciliation to GAAP is limited to foreign private issuers preparing financial statements using the English language version of IFRS as issued by the International Accounting Standards Board (IASB). Financial statements prepared on a modified version of IFRS or another basis of accounting would continue to require reconciliation to U.S. GAAP.

In a related release the SEC has issued a Concept Release seeking constituent views on allowing U.S. registrants to prepare financial statements in accordance with IFRS as issued by the IASB. In the Concept Release, the SEC acknowledged the growing number of jurisdictions mandating or allowing the use of IFRS, as well as the ongoing convergence projects between global accounting standard-setting bodies, including the FASB and the IASB.

While there are several differences in the rules for revenue recognition under IFRS as compared to GAAP, the primary areas that could create a significant competitive disadvantage for U.S. real estate companies are in the recognition of unrealized appreciation in the value of investments in rental real estate properties and certain other real estate related assets and the recognition of revenue from the structuring of lease agreements.

Value of Real Estate Assets

For Real Estate Investment Trusts and other publicly-traded real estate operating companies, real estate is generally required to be carried at historical cost whereas under IFRS it may be recorded at fair value. This difference could result in significant comparability and transparency issues for investors and analysts. Entities operating under IFRS would reflect in the unrealized appreciation or declines in the estimated fair value for rental properties in current earnings and equity, resulting in a “book value” per share that is more closely reflects the estimated market value of an entity’s underlying assets, U.S. real estate companies are required to recognize depreciation and, if applicable, impairment losses currently and can only recognize gains upon the sale of the assets. As a result, the book value (equity) per share for U.S. publicly-traded real estate does not reflect the market value of its investments.

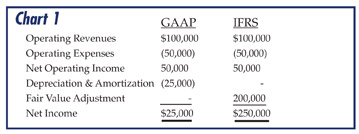

Take the following simple example. Assume that the operations of the property are the same under both GAAP and IFRS but that upon revaluation of the property an appreciation in value of $200,000 is determined (i.e. the historical net cost basis of the property is $2 million and the fair value is determined to be $2.2 million). For net income under current GAAP and IFRS see Chart 1.

The transparency issue for an investor in comparing the current market (stock) price to estimated book value per share also exists for real estate that is sold in the normal course of business (i.e. a real estate developer that constructs properties for sale to others). However, this situation is less problematic from an earnings comparability standpoint as IFRS requires that revaluation gains for real estate that is sold in the normal course of business be credited directly to equity, not through earnings, and losses are charged directly through earnings (unless they reverse prior credits to equity), which more closely matches the timing of income recognition under GAAP.

Revenue Recognition

The structuring of the lease agreements could create a significant competitive disadvantage for a U.S. company, since foreign competitors may have more leeway in structuring lease agreements in order to achieve revenue recognition objectives.

For example, under IFRS a lease for the majority of a leased asset’s economic life (i.e. 50.1 percent) may be treated as a finance lease, assuming other conditions are met, whereas under GAAP the lease must be for 75 percent or greater of the asset’s life to be accounted for as a finance lease. Using Chart 2 and assuming that the lease of the entire property is for 55 percent of the economic life of the asset.

Therefore, without the reconciliation of IFRS to GAAP for certain foreign companies, operational measurements such as funds from operations may be affected by the differences in revenue recognition policies and comparability will be affected.

Overall Impact

Although it is expected that the FASB and the IASB will achieve convergence between IFRS and GAAP by 2011 or 2012 the overall cost in terms of time, effort and financial resources will be significant to U.S. real estate entities. The impact will be greater on public, or listed, companies as they tend to be scrutinized by a wider user investor base. The financial impact will take the form of higher audit fees since the auditors will now need to opine on the fair values used by the U.S. real estate entities and in the time and costs associated with obtaining the valuations.

Also impacted will be the comparability and transparency between entities due to the subjectivity involved in preparing real estate valuations. This could affect the reliability and usefulness of the financial statements. For example, based upon the valuation methodologies employed (i.e. discounted cash flow analysis vs. comparables sales analysis) the value of a subject property can vary widely. The disparity in valuation methodologies could cause incomparability in analyzing the performance and value of real estate entities.

A potential rule change that could level the playing field would be to allow U.S. companies to adopt IFRS in lieu of U.S. GAAP. The SEC is currently reviewing comment letters and has already hosted roundtables addressing the issue. However this change, if it were to occur, has its own issues, including a lack of accountants in the U.S. that have expertise in IFRS. A convergence of the two frameworks may be the preferable long term solution; however, for the time being, U.S. companies will face challenges.

Stuart Eisenberg is a partner in the Real Estate and Hospitality practice of BDO Seidman, LLP in New York.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|