|

MARKET HIGHLIGHT, JUNE/JULY 2010

PITTSBURGH

Pittsburgh Industrial Market

Recent News: Talisman Energy pre-leased a 52,500-square-foot flex facility that was under construction by Pennsylvania Commercial Real Estate, Inc., and the transaction reflects the transition the industrial market is experiencing in Pittsburgh.

This transition is spurred by the Marcellus Shale natural gas deposit that spans 95,000 square miles and covers approximately 60 percent of Pennsylvania’s land mass. After initial studies were reported on the production possibilities of the shale, drilling and service firms began looking for real estate to support local operations. Pittsburgh’s central location amidst the shale has made it a prime choice for many firms, benefiting its industrial market. However, due to the limited speculative development and lack of efficient warehouse facilities, multiple firms are pre-leasing new developments, like Talisman Energy. Pittsburgh’s local economic groups have been supportive of the new business generation and this is seen beyond natural gas exploration. FLABEG Solar picked Pittsburgh for its solar mirror manufacturing operation, constructing a 230,000- square-foot facility; and SEEGRID Corp. moved part of its operation out of Massachusetts and occupied 30,150 square feet in Pittsburgh.

Submarkets: The northern Pittsburgh submarket continues to outperform all other submarkets due to the proximity of two interstate systems, I-76 and I-79, which allow for efficient distribution around the region. The average asking rent for warehouse space in this submarket is $5.65 triple-net on a per-square-foot, annual basis.

The northern Pittsburgh market has lower vacancy rates (7.5 percent) than the overall market. These vacancy numbers have only fluctuated a few tenths quarter-over-quarter in the past year.

Market vacancy rates decreased slightly from 9.4 percent in the fourth quarter of 2009 to 9.2 percent in the first quarter of 2010. Year over year, the vacancy rate has not changed much compared with 9.3 percent in the first quarter of 2009.

Total industrial inventory in Pittsburgh consists of approximately 150 million square feet; 63 percent of that is industrial space, 32 percent is warehouse space, and 5 percent is flex space.

Predictions: Looking forward, demand for warehouse space will remain steady due to the gradual increase in economic activity and continued natural gas exploration. This will cause asking rates to increase, but at a slow pace. New construction will remain minimal due to tight credit markets.

— Amy Brocato is an industrial specialist with Pittsburgh-based Langholz Wilson Ellis Inc./CORFAC International.

Pittsburgh Office Market

Recent News: Pittsburgh has received numerous accolades for not only surviving a decade of economic turbulence experienced throughout the entire country but for standing out as a clear success story in the commercial real estate downturn. Pittsburgh’s success is not a result of any major relocation of a Fortune 50 company to the market. Rather, Pittsburgh’s envious commercial real estate market is home grown due to the strength of the region’s large employers already located in the region. The region is buoyed by job growth in the medical, financial and legal sectors as well as a few prominent retail headquarter locations, and the office market has remained strong.

PNC Financial Services’ continued acquisitions, including the company’s recent purchase of National City Bank has resulted in continued growth and absorption of office space in the central business district. The University of Pittsburgh Medical Center (UPMC) is Pennsylvania’s second largest employer with 49,000 employees, the majority of which are located in the Pittsburgh region. This is a 10-year growth of more than 10,000 employees.

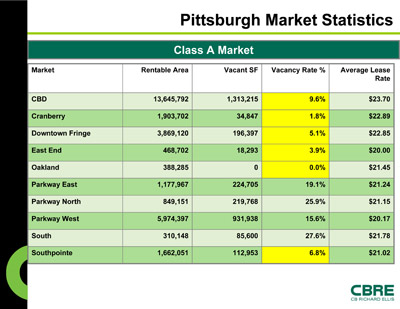

The Pittsburgh office market has experienced five consecutive quarters of positive absorption with the CBD Class A market vacancy at 9.6 percent.

Submarkets: The strength of Pittsburgh’s core is repeated in the outlying markets. The submarket of Oakland, which encompasses the heart of the University and Medical districts has a 0.0 percent Class A vacancy. To the north (Cranberry Submarket), the 1.8 percent vacancy is a result of Westinghouse’s 1.05 million-square-foot new World Headquarters’ facility at Cranberry Woods and 178,000 square feet in Keystone Corporate Campus. The south is experiencing tremendous growth due to the influx of companies pursuing natural gas opportunities through the Marcellus Shale gas field. The Class A vacancy at Southpointe, a 2 million-square-foot development located in Washington County is 6.8 percent. To the west, the airport corridor has been the beneficiary of Dick’s Sporting Goods, which has just completed an expansion of its new headquarters. This facility is comprises a 670,000-square-foot office complex with a master plan to accommodate 2 million square feet.

Predictions: Pittsburgh’s sound fundamentals consisting of reasonable office rents, strong work ethic, stable housing market, world-class institutions of higher education and premier medical and financial institutions will continue to provide resiliency in the office market over the next 12 months. PNC Financial Services appears primed to continue down the path of acquisitions, which will bode well for sustained growth in the region. Without any significant new office space targeted to be completed occupancy levels will continue to see positive upward movement.

— Andrew Wisniewski is an executive vice president with the Pittsburgh office of CB Richard Ellis.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|