|

MARKET HIGHLIGHT, JANUARY 2007

NEW JERSEY MARKET HIGHLIGHT

Industrial Market

The industrial market in New Jersey is very strong with a large amount of development underway. The leading industrial trend is big box development — warehouses larger than 100,000 square feet. This type of development thrives along highways with easy access to the ports, which are very desirable for companies that need to distribute goods along the eastern seaboard and to populations east of the Mississippi River. The most sought after road for big box development is the New Jersey Turnpike due to its close proximity to Port Newark. While traveling the Turnpike from Port Newark, all land sites have been developed up to and including exit 8A. Exit 8 has two or three large parcels left and exit 7A is on its way to becoming a big box exit as well. Development of smaller industrial buildings — 2,500 to 20,000 square feet — has slowed due to the high costs of land, material and the lengthy permit process. This size industrial development has become less desirable to build throughout New Jersey.

The industrial oversupply of the 1980s is long gone and the demand for industrial space keeps pace with supply. New construction has had a large impact on the market. Features such as better efficiencies and safety components have set new building standards, forcing older buildings to remodel and update. Landlords are being forced to evaluate the standards of its buildings in an effort to compete with new development.

With the lack of available land and the effort to compete with new development, New Jersey industrial developers are now redeveloping. Urban cities are a common redevelopment area, because the infrastructure already exists, resulting in less impact on surrounding areas. Perth Amboy is currently undergoing a fair amount of industrial redevelopment. Matrix Development is redeveloping Perth Amboy Business Park, a two building park totaling 450,000 square feet. The Morris Companies is redeveloping Amboy Corporate Center, and Panattoni Development Company is redeveloping the State Street Property. Other active industrial developers in New Jersey include Federal Business Center, Summit Associates, First Industrial Realty Trust, Inc., Heller Industrial Parks, Inc., Lee & Klatskin, and ProLogis.

The overall industrial market in New Jersey is thriving with both new development and redevelopment. New Jersey’s location is conveniently located between Philadelphia and New York City, which attracts a multitude of developers and companies. This central location presents many business opportunities, and addresses companies’ needs to distribute along the most densely populated corridor in the United States. New Jersey is also known for the new technologies that are reshaping the way storage and distribution of goods are handled. Whether it is new development or redevelopment, New Jersey’s industrial market is ready to meet the demand.

— Jonathan Glick is a senior vice president at Sheldon Gross Realty

Office Market

As we embark on a new year, it is critical to recognize current trends and significant developments within New Jersey’s office market. With little new office construction in 2006, office leasing activity is anticipated to remain steady, and vacancy rates are expected to decrease.

Current Trends and Development

With New Jersey’s relatively high vacancies, the scarcity of new development throughout the state is expected to continue through 2007. With the exception of some unique situations, new office developments will continue to be based on pre-leasing commitments by tenants. Many developers and investors are positioning themselves so that they have quality sites with approvals in place should an opportunity present itself. Many noteworthy office developers active in the New Jersey marketplace are focusing on pre-leasing and thereafter beginning construction immediately.

Significant Recent Developments

There are a few developments that are expected to have a significant impact on New Jersey’s office market. The most notable is the overall redevelopment of the entire Hudson County waterfront. This area is an excellent first step for major New York tenants looking to provide quality facilities at a substantial cost savings. This first step will lead to greater activity throughout the entire suburban New Jersey marketplace.

Also significant to the office market is the renovation and/or repositioning of older office buildings. There are currently 3 to 4 million square feet of office buildings being repositioned, redeveloped or completely renovated. Most of these buildings should be considered new buildings as the redevelopments are often complete gut renovations with all new interiors and mechanical systems.

Other recent activities [not necessarily specific to office space development] include Harrison Metro Center, the Devils’ Arena in Newark, Xanadu, the Secaucus Transfer [15X], and the Jets’ practice facility in Florham Park. All of these projects will spur significant office space development within the immediate surrounding areas. Also, one of the most significant developments that we have yet to feel the affects of, and likely have little ability to anticipate, is Manhattan’s Freedom Tower.

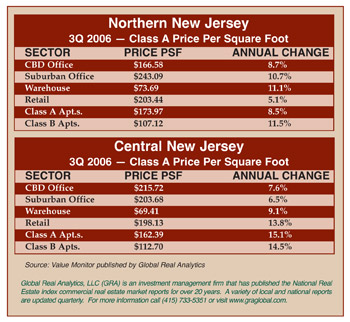

Vacancies and Rental Rates

The overall vacancy and rental rates have been relatively stable and flat for the past 3 or 4 quarters. Overall, a vacancy rate of 15 to 16 percent is rather accurate; however, rental rates vary dramatically based on location and building class. Most rents of A or B quality space in this market range from $23 to $35 per square foot on a gross-plus-tenant- electric basis. Looking forward, there are many notable tenants currently looking in the New Jersey market who have requirements large enough that if a majority of them should make a commitment, vacancy rates could decrease substantially in 2007.

Submarkets to Watch

The submarkets that are likely to be most successful are those that are accessible by car and mass transportation. This includes The Meadowlands, Princeton Corridor, the New Jersey Waterfront, Newark, and Metro Park.

— W. Joshua Levering, SIOR is a senior vice president at NAI James E. HansonNew Jersey Multifamily Market

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|