|

MAKRET HIGHLIGHT, JANUARY/FEBRUARY 2010

UPSTATE NEW YORK MARKET HIGHLIGHTS

Albany Industrial Market

Recent news: All industrial news in the New York Capital Region starts with the Global Foundrie’s project in Saratoga County. This approximately 1.2 million-square-foot chip fabrication plant is under construction; the more than $4 billion facility is expected to be ready for occupancy by 2012. There is great expectation that dozens of suppliers and vendors will be seeking to locate near the chip fab plant. Existing available inventory in Saratoga County is limited (4.4 percent); therefore, new construction will likely be required to satisfy the increased demand. Empire Merchants North will occupy its new 250,000-square-foot office/distribution facility in northern Greene County. Also, Hero/Beech Nut has effectively completed construction on its new 585,000-square-foot production facility in Montgomery County and will be producing baby food products by mid-2010.

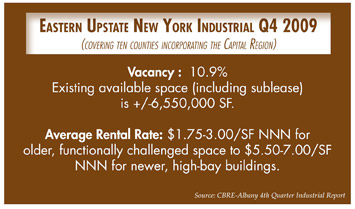

Submarket update: The larger industrial market counties of Albany, Schenectady, Rensselaer, and Saratoga continue to hold a reasonably strong occupancy with vacancies hovering in the 8.8 to 9 percent range collectively. The more rural counties have a collective vacancy factor of 16.1 percent, but a closer inspection indicates the continued availability of several large facilities in these markets such as the 500,000-square-foot former Guilford Mills facility in Cobleskill (Schoharie County) and the Kaz Manufacturing and L&B Furniture buildings (Columbia County). Although the demand for warehouse and industrial space certainly slowed in 2009, the lack of new construction kept vacancies in Class A buildings from rising considerably.

Predictions for the next year: It is expected that vacancies for the first half of 2010 will remain stable within a slight range of 10 to 11 percent. As the economy picks up steam, there should be an increased demand for high bay space as wholesalers and retailers expand inventories. There is little new construction in the planning phase at this point so space inventories will remain steady as well. Leasing rates that softened throughout 2009 will likely find a plateau in early 2010 and experience some moderate increase later in the year reflecting increased demand.

— Richard Sleasman, executive vice president of CBRE-Albany in Albany, New York.

Upstate New York Retail Market

Predictions for the next year: A turnaround in retail fundamentals will take several quarters to gain traction in Upstate New York. Retail sales are expected to tick up slightly this year, with the total volume of retail sales anticipated to be similar to levels achieved in 2005 and 2006. Consumer credit, which could be used to prime the retail pump, is in a unique supply/demand imbalance: lending standards to individuals continue to tighten, while consumer demand for credit is waning. The savings rate has dipped from its recent peak but, at 3.4 percent, is still well above pre-recession levels. In addition, revolving debt, which is made up largely of credit cards, has declined in each of the past 12 months, including an annualized drop of 12.5 percent in September 2009. Consumer demand for debt is expected to fall at a fairly significant rate until the labor market firms in the second half of 2010.

Upstate New York may become the next retail hot zone for many of the national brand retailers looking to expand cautiously in 2010 through 2012. Such quality retailers will be looking for populated markets where rents aren’t as inflated in comparison to the rest of the United States. Unlike markets such as Bergen County, New Jersey, and Long Island’s Nassau, where rents sometimes exceed $85 per square foot, markets such as Greece (Rochester) and Buffalo offer retailers comparable population densities and vehicle counts on major highways, but at a fraction the cost per square foot.

Out-of-state investors have shown interest in Upstate New York properties. A San Diego buyer recently purchased a single-tenant asset in Niagara Falls, for instance. Many national and regional real estate investors prefer some of the Upstate markets primarily due to the lower risk associated with lower rents in comparison to the rest of the nation. In addition, these retailers are achieving very similar store sales as they are in some of the primary markets in California, Texas and New Jersey. Along with higher levels of sustainability as a result of lower rents comes the room for value-added opportunity in the future. Many of the primary markets have seen their peak, where Upstate New York has not grown as quickly with little justification — leaving more room for increased net operating incomes in the upcoming years.

The U.S. and local economies showed signs of improvement in late 2009. By the end of the third quarter, an end to the technical recession was announced. In November, the national employment picture showed signs of improvement as the unemployment rate dropped to 10 percent from its 2009 high of 10.2 percent. Accelerating exports and stabilized consumer spending fueled further growth through the end of the third quarter. The dollar’s weakness against foreign currencies coupled with a recovery of global demand, should support further export gains. Government programs and tax incentives, such as the first-time homebuyer credit, drove the rise in spending in the third quarter. As the impact of government action abates; however, traditional demand drivers such as job growth and improved consumer sentiment will be needed to sustain an economic recovery. Companies should resume hiring in 2010, albeit at a modest rate, starting well into the year. When hiring gains momentum in late 2010 and in 2011, demand for well-located, single-tenant and multi-tenant retail properties in Upstate New York will begin to increase.

— Jeffrey Verchow is a retail investment specialist in the New Jersey office of Marcus & Millichap Real Estate Investment Services.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|