|

COVER STORY, FEBRUARY 2009

WEATHERING THE CYCLES

A tough year is forecast for the hospitality sector in 2009.

Coleman Wood

When it comes to the hospitality sector in the Northeast, it is hard to find the silver lining right now. Most in the industry — and in many other sectors of commercial real estate — have already written off 2009 and are trying their best to prepare for what is looking to be a challenging year. As a leading industry, hotels often feel the effects of a recession first, as people cut down on recreational travel and look to save money on business-related travel. This month, Northeast Real Estate Business takes a look at what else this upcoming year holds for hospitality.

While 2008 marked the official beginning of the recession, it is important to note that the downturn did not begin until later in the year.

“If you look at markets like Boston, where I’m at, [the downturn] really didn’t begin until October,” says Reed Woodworth, vice president of PKF Consulting, a consulting and real estate firm that specializes in the hospitality sector. “Some properties had started to show signs in September, but October was the watershed month for a pretty significant revenue decline through the rest of the year.”

While the first two-thirds of the year looked good for Boston and many other Northeast markets, after October, everything turned around “significantly and catastrophically,” according to Woodworth.

Until that point, tourist destinations such as Boston had been buoyed for a while by, of all things, the dollar’s decline in 2008. Foreign tourists took advantage of a weak dollar and traveled to the United States in droves. Of course, once the recession spread past the confines of our country and became a global downturn, international travel ceased, most likely for the near term.

“Even if the dollar starts to strengthen overseas, we still expect the global economy is going to dampen the international traveler from coming back to the states,” Woodworth says.

One thing Boston does have going for it right now is its strong healthcare and education industries, which are typically lagging indicators during a downturn. In submarkets such as Cambridge, which has a strong presence in both, it was not until well into November that the market started to turn. Recession or not, people need both healthcare and education, which should help the city some. The same cannot be said for New York City, which contains a larger hospitality presence.

“We’re already seeing the dramatic rate turnaround that has occurred in New York City, as hotels scramble to try to capture what customers there are still available,” Woodworth says. “New York City, relative to where it’s been in the past couple of years, is having a significant downturn, as I see it. The bigger they are, in terms of the rates they’ve been able to achieve the past few years, the harder they’re falling right now, in what they’re having to do keep some semblance of business.”

One way to keep things in the black is to cut operating costs, and many hotels are doing that. Another way, is to lower room rates.

“One of the easiest ways to attract people to your hotel is to lower your price, and that’s what we’re in right now,” Woodworth says. “With so little demand around, relatively speaking, all hotels now have had sharp rate declines to try and entice people to come stay at their properties.”

Things may look dire, but all hope is not lost. Woodworth says that one thing he has noticed during this downturn is that there is still a heavy resistance from people to give up their vacations. The nature of those vacations is changing, though. When times were good, New Englanders flew out West or to the Caribbean for vacation. Now, they are more likely to drive to closer vacation destinations, such as New Hampshire or Maine.

“The fact that people still value their time away with their families is going to keep the hospitality industry in business when other industries will struggle more, because people are willing to give up other things before they give up their vacations,” Woodworth says.

Businesses in which travel is a necessity are also helping prop things up right now. Hotel rooms are being occupied, but even these companies are making adjustments, whether it be changing travel days to take advantage of lower airfares, or downgrading from a five-star to a four-star hotel.

“They still travel, they just don’t spend as much money as they used to,” Woodworth says.

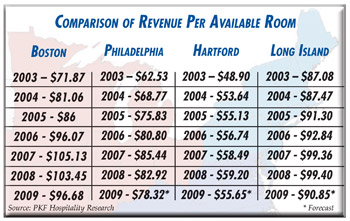

Because of these reasons, the Northeast will not do as bad in 2009 as some of the Sunbelt states, many of which depend on vacation travelers for a lot of their business. If there is a bright side to be found, it is that things could be worse.

“It differs from market to market, but the Northeast, in general, is going to weather the storm a little better than some of the other markets in the country,” Woodworth says, though he is quick to add that a market such as New York City would be hard-pressed to agree with that statement.

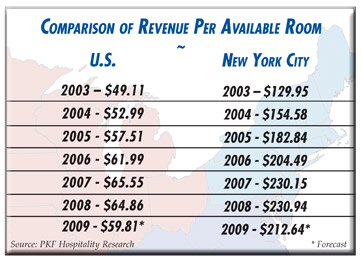

But the good news is always tempered with some bad news. According to PKF Hospitality Research, the research arm of the company, RevPAR is expected to see a nationwide decline of 7.8 percent in 2009, with declines posted in almost all of the 50 markets the company tracks. If this decline holds true, it will be the fifth largest RevPAR decline since 1930. Year-over-year declines are going to become the norm, but that has a lot to do with the strong numbers that have been posted over the past few years. Boston’s RevPAR decline year-over-year for November 2008 was 21.5 percent, fueled in large part to a good 2007, but the numbers were still much lower than expected.

“The question remains: Are we going to continue to see those types of declines continue into 2009?” Woodworth says. “I think, locally, the numbers that we’re seeing from properties show that the first half of the year is certainly going to be a struggle. I see some optimism later in the year for lessening the decline of 2008, but overall, certainly by the end of the year, we’re still going to be down on the order of 6.5 percent [in Boston].”

A room rate increase is all but out of the question for 2009. Demand is expected to drop 2.5 percent nationally, but supply is expected to grow 2.9 percent. Occupancy levels are forecasted to be 57.6 percent by year-end, also a decline.

“It really won’t be until 2010 when hotels are likely to be able to get that rate growing back again, and it’s our expectation that it’s going to be a slow process,” Woodworth says.

In the Northeast, and elsewhere, an upturn is not expected this year, but according to Woodworth, there is an end in sight, albeit some distance in the future.

“Looking across the national spectrum, our expectation is that we’re really not going to turn the corner until the middle of 2010,” he says.

HOLIDAY INN LONG ISLAND CITY OPENS

|

Holiday Inn Long Island City

|

|

The grand opening has been held for the new $31 million Holiday Inn Long Island City – Manhattan View, a 136-room hotel located at 39-05 29th St. in the Long Island City neighborhood of Queens, New York City. The hotel totals 75,000 square feet; amenities include an indoor swimming pool, a fitness center, and wireless Internet access throughout the hotel. Many of the rooms offer balconies with views of the Manhattan skyline. Dining options include the hotel’s dining facility, 39 Below, and Swirl, a lounge that includes an outdoor patio. The Holiday Inn also features 1,000 square feet of meeting space. The hotel is managed by Atlanta-based InterContinental Hotels Group (IHG) on behalf of Queens Plaza North. |

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|