|

COVER STORY, FEBRUARY 2008

PRIME INVESTMENT OPPORTUNITIES IN THE NORTHEAST

While velocity slows, investors still eye prime investment opportunities in this viable region.

Edward Jordan

Despite a decline in commercial real estate transaction velocity throughout the Northeast in the wake of the summer 2007 credit crisis, there has not been a noticeable decrease in pricing, particularly for Class A product. While investors are still paying premium prices for top-tier product, declines have become more apparent in the Class B/C market. As a result, expect to see the continued cap-rate decompression for Class B/C assets this year. And when it comes time to sit down at the negotiating table, buyer and seller expectations for these mid- and lower-tier assets will be more closely aligned.

Apartment Investment Trends

Boston

Apartment investors are expected to stay active in Boston, attracted to the market’s steady pace of job growth and low housing affordability. Sales activity has receded from the elevated levels achieved in recent years but is still approximately 20 percent above the metro’s 5-year average. Institutional buyers are expected to continue to target well-located Class A assets in supply-constrained submarkets including Central City/BackBay/Beacon Hill. Boston’s apartment cap rates currently average in the low- 7 percent range, down slightly over the past year. Investor competition among large buyers could apply some additional downward pressure on cap rates for top-tier properties in the next 12 months. Private investors, eyeing opportunities for long-term revenue growth, may opt to extend holding periods, causing a reduction in velocity and placing upward pressure on cap rates for lower-tiered product.

New York City

Vacancy will remain low across the entire city in 2008, though the rate in Manhattan is expected to rise slightly to 2.5 percent. Supply growth in the borough is still minimal, but demand may be somewhat softer this year due to a projected slower rate of hiring in the financial services sector. Nevertheless, interest in apartment properties remains keen, as local private investors and an increasing number of foreign buyers are expected to be active. In other boroughs, multifamily permit issuance, an indicator of future construction activity, climbed 50 percent in Queens last year to more than 4,000 units. Housing demand in the borough remains elevated, which will encourage more investors to consider purchasing local properties. In the Bronx, as in all boroughs of the city, rent regulations assure steady growth for owners and promise considerable upside when buildings are removed from rent regulation. The borough has just begun its resurgence, a process that will pick up with the completion of the Gateway Center mixed-use project in 2009.

Northern New Jersey

In the investment arena, strong underlying fundamentals will help to support prices for local assets. As underwriting based on recent operating history becomes a more common practice this year, investment activity in Northern New Jersey may recover faster than in other markets. The metro’s predominance of Class B/C stock, where operating results are typically stable and fairly predictable, will likely experience fewer underwriting challenges. Additionally, on a trailing 12-month basis, rents in Northern New Jersey have increased at a rate somewhat above the long-term trend, which should support strong valuations for properties coming to market this year. Local buyers that know the nuances of specific neighborhoods and municipalities, however, will likely not stretch for purchases.

Philadelphia

From an investment perspective, local multifamily properties will remain attractive for their relatively predictable cash flow growth and the difficulties likely to be incurred in new construction. Property prices may grow only modestly in the months ahead, however, due to more conservative underwriting and the extreme contraction of the speculative- and conversion-related buyer pool. Still, the absence of rent controls in Pennsylvania counties, Delaware and several South Jersey communities will continue to draw buyers eager to add value by raising rents to market rates. Also, assets located near train stations will generate strong investor interest. Overall, Class A properties will continue to trade in the mid-5 percent to low-6 percent range this year, while there will likely be upward pressure on initial yields for lower-quality assets.

Office Investment Trends

Boston

The Boston office market remains strong, underpinned by stable economic conditions and an increasingly tight downtown market. Although employment growth is expected to decelerate modestly this year, employers will continue to add to payrolls, with some uncertainty in the financial sector mitigated by growth in Boston’s biotech industry. In the CBD, office space demand continues to be healthy, with vacancy falling below 10 percent and average asking rents soaring above $50 per square foot. As a result, development activity has increased, as robust fundamentals are providing an impetus for additional growth. Builders are expected to add nearly 1.6 million square feet of new office space to the market by year end, the largest annual completion since 2003. Despite strong office demand, elevated completions will lead to a minor uptick in marketwide vacancy. Stable economic conditions and building demand, however, will sustain rent growth at well above the national average.

New York City

Office vacancy is expected to remain low, and rents are projected to grow at a healthy pace this year in Manhattan, although evidence will continue to mount showing that demand-side momentum is not as robust as it was a few quarters ago. Leasing volume in 2007 was approximately 25 percent less than one year before, thereby weakening the prospects for further reductions in the vacancy rate. Firms in the financial activities sector specifically were trimming space needs or postponing searches at the end of last year, a trend that will continue as staffing requirements are reevaluated due to ongoing troubles in the capital markets. Despite near-term issues surrounding space demand, Manhattan has recorded some of the nation’s strongest revenue growth over the past 3 years, and investors’ interest in local properties had hardly diminished as 2008 began. Cap rates for top assets are in the high-4 percent to high-5 percent range.

Northern New Jersey

Operating conditions are expected to remains fairly stable in the Northern New Jersey office market this year, unlike conditions that are likely to prevail in some more volatile markets. Vacancy is forecast to rise modestly, but some pockets of strength still exist in the market. Newark, for one, has staged a decent turnaround in the past several quarters and is carrying steady demand-side momentum into 2008. North Bergen County is also expected to remain reasonably tight, despite the delivery of some speculative space this year. Submarkets such as the Meadowlands and Rutherford, on the other hand, are forecast to maintain vacancy rates in the mid-20 percent range, as demand is not anticipated to be strong enough to fill recently vacated spaces. Marketwide, rent growth will be modest and may not pick up appreciably until vacancy improves more significantly at high-end properties in Essex and Morris counties.

Philadelphia

Philadelphia appears poised for a few more quarters of steady demand-side momentum in its office market, as the region remains largely unaffected by the decrease in mortgage-related finance employment currently afflicting other metros. Entering 2008, the Class A segment in areas such as Center City, Montgomery and Bucks counties was posting vacancy at approximately 10 percent. Slower job growth will curtail absorption of Class A space, especially in the second half of the year, but the limited availability of top-end space will support rent growth of approximately 5 percent. In the market’s Class B/C sector, recent vacancy improvements are partly attributable to a decrease in office inventory, as some properties were converted to owner-occupied buildings. More modest economic growth this year, however, will discourage building purchases by small firms and send some space seekers to the rental market instead. Accordingly, submarkets with a preponderance of Class B/C properties, such as South Jersey and North Philadelphia, should record either a flat or modestly lower vacancy rate, and a decent pace of rent growth.

Retail Investment Trends

Boston

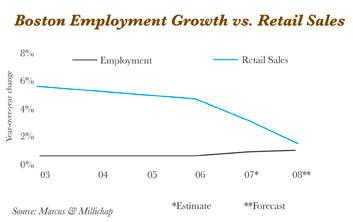

The outlook for Boston’s retail market remains bright, supported by healthy development activity, strong leasing trends and an active investment market. The metro’s retail supply is expanding, as redevelopment of older shopping centers and malls is being generated by consumer and retailer demand for a unique “live, work, play” experience. These revitalization efforts are transforming the area’s outdated shopping destinations such as the Natick Mall into mixed-use lifestyle centers that are attracting top retailers including Neiman Marcus and Gucci. New retail construction is expected to increase inventory more than 1 percent by year end, causing a short-term uptick in the metrowide vacancy rate, which has remained essentially unchanged over the past 5 years. With vacancy fairly stable and demand healthy, owners will be able to implement steady rent increases again in 2008. Continued employment growth will generate demand, and retail sales are expected to advance at a slower pace than last year, following the national trend.

New York City

The retail property sector in New York City will remain vigorous in 2008, as existing properties continue to record respectable vacancy and rent growth, and new retail trade areas rapidly emerge. One of the best examples of current trends in the city is Lower Manhattan. New residential developments are enlarging the population and altering the profile of shoppers. The population south of Chambers Street, for example, has increased 30 percent since 2001, and the median annual household income has soared to $165,000, nearly three times as great as the median for the entire borough. Consequently, a different set of retailers is rapidly moving into the area, helping to double asking rents over the past few years to more than $100 per square foot. In the other boroughs, the rezoning of Jamaica and Willets Point in Queens will bring in new retailers, while the scheduled completion of the Gateway Center in 2009 is expected to accelerate a revival of the Bronx.

Northern New Jersey

The Northern New Jersey retail property market is expected to post another year of solid results in 2008, although demand drivers will ease somewhat in conjunction with a reduced rate of consumer spending. Overall, the vacancy rate is forecast to rise slightly to a still-tight 4.8 percent as retailers curtail expansion plans. Vacancy will be modestly higher, however, in Class B/C properties in need of repositioning, as well as in older trade areas, such as the southern section of Route 17 in Bergen County. With retailer demand projected to soften and a few more vacant spaces on the market, rent growth in Northern New Jersey will slow from the aggressive rates recorded as recently as early 2007. Waterfront communities in Hudson County, meanwhile, may record slightly greater rent growth in the near term. National retailers are likely to intensify demand for space in county towns such as Jersey City, where new housing is transforming the consumer profile.

Philadelphia

Philadelphia’s retail market is positioned to post solid results in 2008, bolstered by modest retail sales growth and the metro’s relative immunity to the steep housing market downturn, which is afflicting other regions. Vacancy is expected to improve for the fifth consecutive year, and rents will grow modestly, particularly among Center City properties and Class A shopping centers in supply-constrained areas. Supply growth, meanwhile, will be minimal as owners and builders focus on the redevelopment of older properties and reclamation of vacant industrial locations. The developers of Uptown Worthington, for example, will reconfigure a former manufacturing site in Chester County into a mixed-use property with 750,000 square feet of retail space. Additionally, local authorities have authorized the redevelopment of a large area in Norristown that includes the Logan Square Shopping Center. Finally, the face of Center City is changing, with the planned development of 120,000 square feet of retail space on Vine Street and the continuing migration of national chains to Chestnut Street.

Looking ahead to 2008, the market will be sensitive to how this capital crisis is going to impact job growth, or net job loss across the Northeast, and in turn, how that will impact the demand for office space. For instance, losing 10,000 finance sector employees in Manhattan who occupy an average of 250 square feet per worker could result in the placement of 2.5 million square feet of office space on the market for sublet in 2008.

The anticipated slowdown in the Northeastern commercial real estate market means that brokerage and real estate services companies will have to return to the basics in terms of underwriting and valuating properties. Marcus & Millichap welcomes that trend, which will allow us to continue to underwrite transactions based on real NOI. In 2008, properties will be valued based on their current or achievable pro forma income. By all accounts, that translates into a healthy market, a positive trend that we embrace in the New Year.

Edward Jordan is the regional manager of the Manhattan and New Haven offices of Marcus & Millichap Real Estate Investment Services. Jordan wrote this article in conjunction with J.D. Parker, Gary Lucas, Michael Fasano and Spencer Yablon.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|