|

NORTHEAST SNAPSHOT, FEBRUARY 2006

Boston Office Market

The Boston office sector recently has seen stabilization in rental rates, and along with a favorable interest-rate environment continuing, the market is ready to see the commencement of new construction. According to Boston-based commercial real estate firm Meredith & Grew, the current rental rates for Class A office space in Boston range between approximately $33 per square foot and $47 per square foot. The vacancy rate stood at approximately 13.3 percent at year-end 2005.

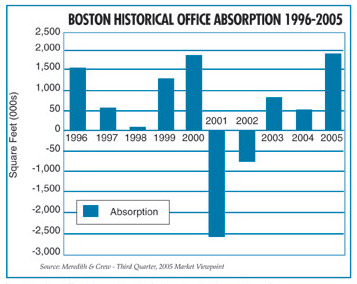

“Boston began 2005 with a 17 percent vacancy rate, and maybe the most important trend in the market this year was a net absorption of 1.9 million square feet,” says Ron Perry, an executive vice president and the head of the Boston Brokerage Group at Meredith & Grew in Boston. “In addition, one of the big trends we pinpointed in our market overview is that Boston should be ready to see a groundbreaking or two in 2006. I would not have been able to make that statement over the last couple of years.”

In the wave of new construction that Boston should see this year, two significant projects stand out ready to be developed. Russia Wharf, located at 530 Atlantic Avenue in the Boston Financial District, is in the pipeline from Equity Office Properties. Including 500,000 square feet of office space as well as a residential and retail component, Russia Wharf will total 1 million square feet upon its completion, which is expected in 2009. Furthermore, Joseph Fallon and Cornerstone Realty Advisors are planning Fan Pier, a 3 million-square-foot project that will feature a 1.3 million-square-foot office component. This project is located at 28-70 Old Northern Avenue on the South Boston Waterfront, an area currently undergoing a revitalization.

“The area for growth will be the South Boston Waterfront,” Perry explains. “There are a lot of new players in that market, and there is a lot of new land to be developed; I see a combination of retail, residential, hotel and office. We're going to see everything happening there.”

The South Boston Waterfront is transforming from a predominantly industrial sector to a dynamic, mixed-use hub surrounding the Boston Convention and Exhibition Center, a project that was completed in June 2004. According to the Boston Redevelopment Authority's South Boston Public Realm Plan, 17 million square feet currently exist in this submarket, with more than 22 million square feet of new development envisioned. As a direct result, this submarket will experience the majority of new construction seen throughout the Boston office market. More than 2.5 million square feet of office development already has been approved for this sector, with another 500,000 square feet under review or in the planning stages.

In 2005, the majority of absorption came from firms in the legal, financial and professional services fields; these are the types of tenants that typically dominate the downtown market. Tenants occupying space in the 20,000-square-foot range were on the heavy side of last year's leasing activity. However, several significant leases were signed that absorbed large quantities of space. Investors Bank & Trust Company leased 500,000 square feet in the Back Bay submarket; Bingham McCutchen, a law firm, signed on for 320,000 square feet in the Financial District at One Federal Street; and publishing company Houghton Mifflin also leased 320,000 square feet, occupying space in the Back Bay. In addition, Partners HealthCare absorbed 191,000 square feet in Charlestown as well as 35,000 square feet in the Back Bay.

“In terms of where the Boston office market is going, if I were to characterize 2005, I would call it a turning point year,” Perry says. “The market is now recovered since 2001, when there was a major drop off after the success everyone experienced in 2000. In 2005, a lot of the indicators moved in a positive direction. Vacancy rates fell due to high net absorption, rental rates have stabilized, and in the next couple years, the Boston office sector will continue to tighten. In particular, the Class A vacancy rates appear as if they will drop to single digits, steady net absorption should continue, and rents will go up, specifically in the high-rise section of towers. The trends support an improving marketplace, one that will favor the landlords again over the next 3 to 5 years.”

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|