|

NORTHEAST SNAPSHOT, FEBRUARY 2005

Westchester County Office Market

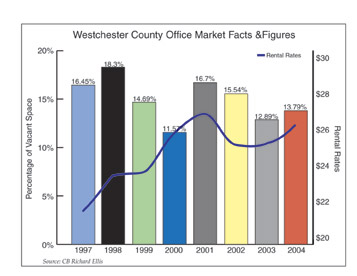

During the nation’s recent economic downturn, New York’s

Westchester County found its office market dealing with high

vacancy rates and limited activity. However, in 2004 there

was significant recovery in the market and conditions have

steadily improved.

“The Westchester market has a vacancy rate that is

just under 14 percent,” says Sal Carrera, director of

the Westchester County Office of Economic Development. “That

is almost the lowest rate in the past 4 or 5 years. The market

had been in the upper teens for many years, but it is doing

very well now.”

Businesses throughout New York and in bordering towns in Connecticut

are finding the reasonable rates that exist within Westchester

County to be attractive alternatives to those in more established

markets such as New York City or Greenwich, Conn. “The

typical rental rates in Westchester County are in the mid-

to high $20s,” Carrera says.

There are many quality properties in Westchester, and the

Office of Economic Development can assist businesses seeking

to enter, or relocate within, the county. Increases in leasing

velocity and less negative absorption are responsible for

the improved statistics over the past year. And there is no

reason that the office market’s fortunes will not continue

to increase in 2005. Although, according to Carrera, there

is very little office development occurring in this crowded

market — the county houses 32 million square feet of

existing office space — one major mixed-use development

is making an impact.

“The city of White Plains is constructing more than 2,000

apartments units and has just completed a new downtown retail

center called the City Center, with 500,000 square feet of

entertainment and retail,” explains Carrera. This new

development activity is spurring interest from businesses

and, coupled with the city’s already improving office

market, White Plains is poised to experience increased activity

in coming months. The White Plains central business district

is an up-and-coming area for office activity, notes Carrera.

“The CBD’s vacancy rate in 1998 was 30 percent.

It is now down to 14 percent.”

Three major corporations maintain offices in the county. IBM

has a large presence in various cities; Pepsi and MasterCard

occupy offices in Purchase, Harrison and Somers.

Other companies are actively seeking and finding properties

throughout Westchester. Two new companies have moved into

Westchester and established offices, and a number of businesses

have relocated within the county from existing spaces. Nokia

recently purchased a 105,000-square-foot building in Harrison,

and Triarc Companies, the franchisor and owner of more than

200 Arby’s restaurants, moved its headquarters from New

York City to Rye Brook. Dannon Company has moved its Westchester

operations from Tarrytown to a 55,500-square-foot facility

in Greenburgh, and Lillian Vernon Corporation has relocated

to 52,712 square feet in White Plains.

Major brokers in the area include Reckson Associates, Mack-Cali

Realty Corporation and the RPW Group, a new player in the

market that has just purchased the 600,000-square-foot former

Philip Morris headquarters in Rye Brook, which it is going

to try to subdivide and fill with smaller tenants.

Carrera forecasts a successful coming year for the county’s

office market, most notably because of competitive rates,

improving economics and the region’s strong population.

“I think that the market will continue to perform strongly,”

he says. “Three out of five workers in the county live

in the county, as well. There is a strong link between people

that live here and people that work here.”

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|