|

MARKET HIGHLIGHT, DECEMBER 2008

NEW YORK CITY MARKET HIGHLIGHTS

New York City Office Market

Uneasy Times for Big Apple Office Market

Both end-users and owners of New York City office space find themselves in a holding pattern today. Concerned about the potential depth and severity of the present economic downturn, many tenants are simply postponing any occupancy decisions. But some must take decisive action: Those facing the end of their lease term, for example, may be more concerned with extending their existing lease rather than committing to a lease renewal.

What is driving this indecisive market? Many companies are worried about their future cash flow. If their revenues weaken over the next 6 to 12 months, many commercial tenants may find themselves struggling to cover their monthly rents.

This is largely due to the market tightening over the last few years. As tenant demand increased and available space dwindled, rents in many buildings ticked up dramatically. As a result, many tenants are still paying lofty rents for leases that they initially signed between 2005 and the end of last year.

To be sure, vacancy rates have yet to reflect downshifting demand on behalf of tenants. According to published reports, Manhattan office vacancy rates in late September were only slightly higher than they were just 12 months earlier. While very few reports indicate that office rents have considerably weakened, anecdotal evidence suggests that landlords are achieving lower rents in both Class A and Class B buildings.

How landlords react to softening demand will depend on where their properties are located. The Downtown office market is a case in point: even during the recent boom, office vacancy in Lower Manhattan was already higher than in Midtown. The Downtown market also hosts a highly concentrated pool of tenants, many of whom work in the financial services industry. As these businesses shed jobs, vacancy is likely to increase at a faster clip in Lower Manhattan versus Midtown. New sublease space also will enter both submarkets as a result of this downturn.

We anticipate that the fourth quarter will witness a slight increase in the total volume of sublease space that enters the market in both Midtown and Downtown, but the first few months of 2009 will likely see a noteworthy uptick in sublease offerings. For many tenants, however, a flurry of new sublease offerings could enable them to relocate into competitively priced space on a short-term basis. Sublease space typically leases at a sharp discount to average direct rents.

In the final analysis, the New York City office market will continue to adapt to the economic downturn going forward. Understandably, this will present both challenges and opportunities to tenants and landlords.

— Corey Abdo and Marc S. Miller are both executive vice presidents of Winoker Realty Corp.

New York City Investment Sales Market

Has the real estate market fallen into a giant sink hole?

There is not a day that goes by where there is not another casualty. That said, deals are still being done every day. Uncertainty in the market is making buyers more cautious, with the result that offers are being withdrawn and deals are falling out of contract, due to change in property valuation and market conditions. To keep deals from falling out of contract we are asking both buyers and sellers to shorten the closing time on deals as much as possible.

The big gorilla in the room is the credit crisis. The credit freeze has forced buyers to either come up with more cash in order to get financing or ask sellers to hold paper. There is no question that prices have dropped, and sellers that have been riding an up market are finding this difficult to adjust to.

There is always a silver lining. The bailout and its fallout will create buying opportunities to acquire distressed properties if buyers and institutions can put together strong cash positions. The question that buyers and sellers are now asking is what defines a good price and what properties are worth.

Partnerships are being formed to take advantage of the situation. It was recently announced that GFI Capital has formed a joint venture with the Carlyle Group, a private equity firm in Washington, that will provide GFI with $300 million in equity, leveraged to $1.2 billion to invest in real estate nationwide.

The average real estate investor is faced with uncertainty. Real estate sales volume is down by 30 percent at our firm, which specializes in mid-size properties. Other firms are posting similar numbers. Inventory of commercial properties on the market has been on the increase and will continue to rise. There are emerging trends that are changing the way real estate is financed and valued.

Pro forma projections for property valuation based on rent increases are all but gone. Properties that were bought at market highs or are over leveraged due to pro forma projections on income from higher rents are finding this trend to have stalled and have started to reverse. Until recently, low mortgage rates and easy financing made property acquisition very tempting. However, low interest rates have been offset in the current climate by financial institutions requiring higher cash down on loan-to-value before they will consider financing.

Rental rates across the board are down. Further trends indicate a push back in rents, and a property with a strong rent roll is no indication that rents will hold when vacancies occur. The decline in rents is making it difficult for many property owners to cover debt service. With the loss of jobs due to the economy, vacancies in office properties, as well as residential, will continue to put pressure on property income and values. Properties with little or no upside are finding it hard to attract buyers.

Defaults are expected on commercial property, and the thinking is this will continue. Surprisingly, there are still sellers that are in denial about pricing their properties. The question they are asking is: Do I hold out or wait it out? The indications suggest it may be at least until this time next year or longer for confidence and prices to turn the corner. Until then, companies with strong income property portfolios seem to be taking a wait-and-see position.

Submarkets such as the Bronx, Harlem and Brooklyn show more activity than the Manhattan market,

but have also been affected. The residential sector still shows the greatest strength of the metro real estate market.

Investors are looking for upside. I am increasingly being asked by buyers to show them a deal that makes sense. As the stock market has shown, what makes sense on Monday may not make sense on Tuesday.

— Rick Helfand is an associate broker at GFI Capital Resources Group.

Harlem Multifamily Market

Fueled by Manhattan’s real estate boom, Harlem has undergone a renaissance over the last decade. Investors have poured into the area — stretching from 110th Street through 155th Street, river to river — to buy, build, work and live. Harlem was ripe for new investment, with its many historic buildings, a rich cultural heritage, available development sites and strong transportation access. And investment it did receive.

New Development

Few would dispute that Harlem’s revitalization was long overdue, as Eastern Consolidated’s chairman and CEO Peter Hauspurg describes: “Harlem is the last of the undeveloped neighborhoods in Manhattan now that the Lower East Side has finally ‘matured.’ It is getting its well-deserved full restoration.”

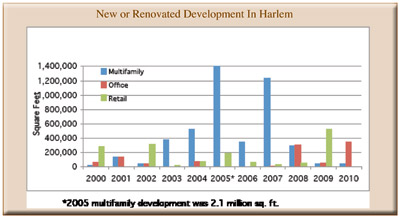

Harlem has added 6.2 million square feet of new or renovated housing, retail, office buildings and even hotels, and is further slated to add another 1.7 million square feet of real estate in addition to Columbia’s planned 6.8 million square feet of buildings.

Since 2000, Harlem has seen the addition of 24 new multifamily apartment buildings, as well as 67 renovated apartment buildings for a total of 4.83 million square feet of new housing (approximately 5,000 new units). Moreover, another nine new apartment buildings are in various stages of construction that will add another 390,000, square feet of housing or approximately 400 more units.

“There is steady improvement of the housing stock in Harlem attributable to the ongoing investments of owners in building-wide improvements, as well as unit-specific renovations,” according to Eastern Consolidated’s executive managing director Stuart Gross.

New retail construction underway will continue to transform the neighborhood just as the Times Square neighborhood was remade in the late 1990s.

Building Sales Highlights

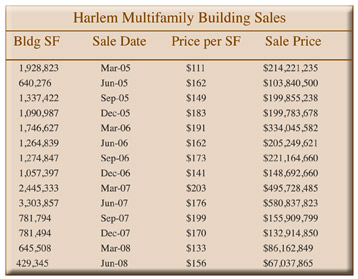

Sales of multifamily buildings in Harlem averaged $200 million per quarter in 2005, but then grew 14 percent in 2006 to $228 million per quarter. In the first half of 2007, total sales volume soared to $500 million and $580 million in the first and second quarters, respectively, but activity in these two quarters was heavily weighted by two portfolio transactions: an East Harlem package of 47 properties that was sold in bulk for $225 million in the first quarter; and a second package of Mitchell-Lama buildings, three of which are in Harlem, that sold for a total of $421 million in the second quarter. Following these two blockbuster transactions, sales fell precipitously as the finance market started to constrain investors in the third quarter of 2007.

The average price paid per square foot has also fallen back to $150 per square foot where it had been throughout most of 2005 and 2006. It had jumped to $200 per square foot through most of 2007.

Of all the many positive attributes that are mentioned in the discussion of Harlem’s renaissance, the one that is consistently overlooked is the Metro North commuter station at Park Avenue and 125th Street. Renovated in 1999, the station offers the only other Manhattan access point for all Metro North trains other than Grand Central, offers one-block access to the 4, 5 and 6 subway trains, and is well within walking distance of the other subway lines. While thus far many new residents and businesses have taken advantage of this significant access, clearly the area is ripe for more.

— Barbara Denham is chief economist for Eastern Consolidated.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|