|

COVER STORY, AUGUST 2006

OFFICE LEASING UPDATE

Northeast brokers discuss the varying climates of their respective markets.

Dan Marcec

Activity in the office sector across the Northeast is regaining strength, and many of the specific markets in the region are experiencing healthy conditions and reenergized growth. Northeast Real Estate Business recently spoke with four brokerage firms that cover four different major markets, all of whom share insight to the overall climate of office trends, investment and leasing activity in their respective sectors.

Philadelphia

Office activity in Philadelphia remains strong on the investment side, and when all is said and done at the end of 2006, numbers should have improved from the overall numbers in 2005. Several companies have been active in acquisitions, including Triple Net Properties, a tenant-in-common buyer. The company purchased a large office building in Center City Philadelphia in March 2006, and it also acquired a property in the suburban Southern New Jersey market. Keystone Property, a local private investor, also has been aggressive in acquisitions, buying properties in order to redevelop and reposition them. Finally, Pitcairn Properties also is a huge investor in both the downtown and suburban Philadelphia markets, acquiring the Glenhardie and Chesterbrook corporate centers totaling 1.3 million square feet earlier this year.

“We clearly are seeing an increase in leasing activity and absorption in the Philadelphia market this year, with the expansion of existing tenants causing and creating that increase,” says Bob Walters, senior managing director for CB Richard Ellis in Philadelphia. “Back in 2002, 2003 and 2004, we saw major tenants with leases expiring downsizing their operations. Conversely, today the activity shows tenants taking additional space, providing net growth in the market.”

According to Walters, one of the major trends in the Philadelphia office market is flight to quality. In both the downtown and the suburban office sectors, typical Class B space tenants are moving up to Class A space, and likewise, Class A tenants are seeking locations in some of the top Class AA buildings in the downtown market. This trend should continue at least into 2007.

From a leasing perspective, 2006 has been a recovery year. There has been a significant increase both in the number of transactions and in number of tenants in the market. A number of tenants were active in the market during 2005, but they weren’t consummating renewals or relocations, while in 2006, there has been a net absorption. Overall, the market is seeing challenges from a rental rate growth standpoint, but those rents have stabilized, and the increase in activity is encouraging.

“With regards to lease negotiations, Philadelphia is still a tenant’s market; as tenants retain multiple alternatives and options, landlords are very anxious to retain their existing tenant base,” says Walters. “There have been some very good lease transactions completed or set to be completed from a tenant perspective this year, and certain Class A buildings are offering benefits such as free rent and tenant improvement packages. This trend should continue into 2007.”

In general, the Philadelphia office market continues to see strong activity across the board, as properties are being purchased at significant levels below placement costs. In addition, residential and retail development in Center City has created a positive energy across that sector, and the suburban markets have remained steady.

“There’s been a nice balance in the market and rents should show some growth,” says Walters. “There’s so much capital continuing to chase real estate, and Philadelphia is enjoying attention from local, national and offshore investors. The prospects of this activity should remain strong through this year and into 2007.”

Manhattan, New York City

Across the Manhattan, New York City, office sector, investment activity continues unabated following a record-setting year in 2005. Premier office buildings still are attracting the most attention; for example, 522 Fifth Avenue and 1211 Avenue of the Americas both sold during the second quarter. Overall, private investors have accounted for 42 percent of the activity in the market this year, while foreign investors also are acquiring product aggressively throughout the market. Recent examples of this type of investment include the acquisitions of 1466 Broadway and 250 West Street.

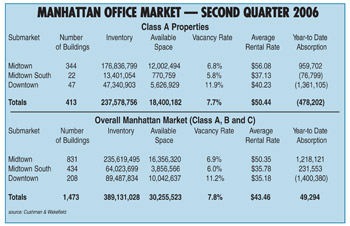

In 2006, rising rental rates, declining vacancy rates and an increase in leasing activity in the second quarter indicate the prominent activity in the Manhattan market at midyear. Manhattan experienced positive absorption throughout the area, mostly due to several large deals consummated during the second quarter, coupled with a shortage of new space coming online.

“Large deals and a lack of available office space are fueling the market right now, as tenants are seeing rising rents that are forecasted to go even higher,” says Joe Harbert, chief operating officer at Cushman & Wakefield for the New York metro region. “In efforts to lock in space for future growth, tenants are renewing and expanding sooner instead of later. Thus, with few new buildings coming online in the near future, and with a substantial list of tenants in the market for space, we do not see these trends changing in the second half of 2006.”

The vacancy rate in Manhattan currently stands at 7.8 percent, remaining within the 7 percent to 9 percent range that is typically described in the industry as equilibrium. In this model, neither tenants nor landlords are believed to have the upper hand. However, despite the current equilibrium, vacancy rates have declined drastically in the last several years, falling from 11.8 percent only two years ago.

“With improving economic conditions, we expect vacancy rates to continue to fall, and once vacancy falls below 7 percent, the balance begins to shift,” says Harbert. “This is currently the situation in Midtown Manhattan, where vacancy has dropped to 6.9 percent, and where Class A space is at a premium as prices are rising quickly at the top end of the market.”

Manhattan continues to be a prime destination for companies and corporations worldwide. However, there also has been a renewed demand for suburban space from firms that find the pricing attractive. In the city, though, financial firms have accounted for 34 percent of second quarter 2006 activity. Generally, these firms seek high quality, Class A office space, evidenced through statistics highlighting which tenants will pay the most for Manhattan office space. Twenty deals were completed in the first half of 2006 that commanded more than $100 per square foot, compared to only 10 of such deals in all of 2005, and 12 of those 20 were completed by financial services tenants. Legal firms and the public sector also have been active throughout the market.

Northern New Jersey

The New Jersey office market continues to see robust investment activity given rising interest rates. While the Class A office market remains favorable, the Class B market is in fact experiencing an increase in attention, as Class B office owners are renovating and upgrading their product to gain wider appeal to tenants and reposition these assets in the market. Overall, local and regional players are dominating the investment market, with companies such as Mack-Cali Realty Corporation and BPG Properties undertaking major acquisitions.

Several submarkets are experiencing different trends throughout the New Jersey office sector. In Morris County, office space is in high demand, though the Interstate 78 corridor is seeing more activity. The Princeton market is seeing activity in the pharmaceutical and life sciences industries, and may see some large acquisitions and mergers. In Newark, more deals have been closed than there is available space, and the Jersey City/Waterfront market continues to attract business due to its proximity to New York City. Finally, across northern New Jersey, the market is healthy, and many developers are optimistically constructing speculative projects.

So far in 2006, northern New Jersey is seeing a proliferation of mid-size leases of more than 100,000 square feet. In fact, approximately 1.5 million square feet of deals are expected to take place at the end of the third quarter. Overall, the market continues to show slow yet continual improvement, as the markets with the lowest vacancy rates experiencing rental growth in the first and second quarters. However, concessions are shrinking.

“Looking at northern New Jersey overall, the pendulum swing sits evenly between landlords and tenants; surpluses in one market are most often being absorbed by overflows in neighboring markets,” says Kenneth Flynn Jr., senior vice president for Trammell Crow Company. “For instance, the Route 24 submarket has one of the lowest vacancy rates in the area, and tenants are being forced to settle on quality, match asking rents for the submarket or begin venturing into nearby markets. The latter trend has impacted the leasing momentum in the once slow I-78 market, which has seen a significant increase in activity since the 24 submarket has tightened.”

Other drivers influencing the New Jersey office market include a number of companies transitioning with mergers and acquisitions across a broad span of industries including pharmaceuticals, telecom and technology, which could produce some consolidation of assets opening up large blocks of space in key submarkets. In addition, a decrease in tenant improvement concessions as construction costs rise, and extended lease terms and rising rental rates in key markets leading to decreasing vacancy rates are both trends that are affecting the market.

“The urban markets had a very busy first half of the year as several deals were either completed or are pending completion in the Newark and Jersey City submarkets; Jersey City has several deals out there that are expected to go through by the end of third quarter,” says Flynn. “Many of these tenants shopping in the urban markets are business lines (law and accounting) that historically have gravitated toward the urban New Jersey submarkets for the proximity to New York City, and competitors have either re-signed or moved within their current submarket to retain this status.”

Pittsburgh

Throughout Pittsburgh, the unemployment rate edged up one-tenth of a percentage point to 5.1 percent (seasonally adjusted), yet the area still added 8,400 jobs (not seasonally adjusted). Construction, retail, leisure, hospitality and professional and business services all saw a gain in employment, where manufacturing and private colleges and universities saw a decline. “If the professional and business service industries continue to add jobs as they did in May 2006, the market could see more demand for office space,” says Kristyn Siwiec, director of research & marketing communications for GVA Oxford in Pittsburgh.

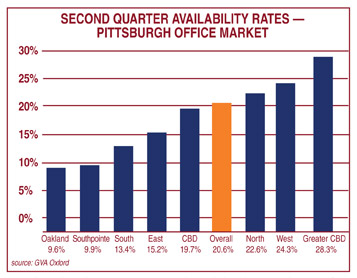

Availability was down in both the central business district (CBD) and the suburban markets this quarter. The fledgling greater CBD posted a 0.2 percent increase in availability this quarter. Overall asking rents are down a mere $0.64, but absorption was positive for both the quarter and the year to date.

Pittsburgh’s CBD posted positive absorption of 54,000 square feet this quarter, and the Class A sector of the CBD also posted positive absorption of 64,000 square feet. Two renewals and expansions in One Mellon Center — Pepper Hamilton and KPMG — helped to solidify the positive absorption. Overall, rents in the downtown market remained steady, as did the availability.

The Make-A-Wish Foundation of Western Pennsylvania is moving from Omni William Penn to Gulf Tower, expanding from 5,300 square feet to 7,500 feet. Fox Sports Network also is relocating, moving its offices to the DelMonte Center on the North Shore. Fox is taking 6,500 square feet on the first floor of the building for studio space and 12,000 square feet on the second floor for administrative and management offices. The location is appropriate for a sports media company, since the building sits directly between two of Pittsburgh’s largest sports venues, PNC Park and Heinz Field. Fox is leaving approximately 15,000 square feet at Two Allegheny Center.

On the investment side, American Eagle finalized the sale of its new home in South Side Works, Quantum II. The 186,000-square-foot building was purchased for $15 million ($80.64 per square foot). At the same time, the company purchased a parcel of nearby land for future expansion, but it will not move to its new headquarters until 2007. In addition, the Boggs Building was purchased by a private investor for $1.47 million, or $43.76 per square foot. The 33,634-square-foot building is located directly across the street from PNC Park on the North Shore. The property has an average asking weighted rent of $17 per square foot and is currently 69 percent vacant.

“With a 28.3 percent availability rate, the Greater CBD has the highest availability rate of all the submarkets in the Pittsburgh area,” says Siwiec. “The high availability is due in part to the large amounts of new construction that has yet to be absorbed.”

The Pittsburgh suburban office markets have posted positive absorption both this quarter (63,000 square feet) and year-to-date (228,000 square feet), while availability is down 1.6 percent from the same quarter last year. With free parking and newer buildings, the suburbs continue to steal tenants from the city. New speculative construction started on a 106,000-square-foot building in the Cranberry Woods Business Park. The park itself has low availability — of the three existing buildings in the park that total approximately 347,000 square feet, there is only 18,765 square feet available (5.4 percent). One building came online this quarter in the South submarket — the 21,500-square-foot Offices at Claire Boyce.

“Companies are taking advantage of and betting on the historically low availability in the South submarket,” says Siwiec. “A new business park is being planned in the South Fayette area, and the Alpine Pointe Professional Business Park is proposed to bring 250,000 square feet of office and flex space to the market in eight buildings, which will range from 15,000 square feet to 60,000 square feet. Great access to Interstate 79 and Washington Pike makes this location highly desirable.”

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|