|

COVER STORY, AUGUST 2005

TURNING THE CORNER

Cities in the Northeast are experiencing improving dynamics in the office leasing environment.

Kevin Jeselnik

Recently, Northeast Real Estate Business spoke with a collection of brokers working in various markets in the Northeast about the region’s office leasing environment. Across the board, a sense of controlled optimism seems to be the prevailing attitude. Despite unpredictable economic conditions, the consensus is that the office market will continue to improve steadily into 2006.

A number of common trends are occurring in each of the four markets highlighted. Sublet space — for the past 3 or 4 years the major obstacle delaying the market’s full recovery — is drying up across the board and vacancy rates are stabilizing or dropping. On the downside, leasing velocity is slowing, but brokers feel that this is inevitable after the flurry of significant deals and large-scale absorption experienced in 2004. All things considered, current conditions strongly suggest that the Northeast has turned the corner after a tumultuous period over the past 5 years.

Wilmington, Delaware

The office market in Wilmington, Delaware, is beginning to regain momentum after a flat period of activity from late 2004 to early 2005. “I would say that velocity is sluggish, but there are momentary bursts of activity,” says Leigh Johnstone, senior vice president with Grubb & Ellis in Wilmington. After a surge in activity in early 2004, Johnstone believes that there will not be many large lease transactions completed in the coming months. The real action is coming from smaller companies taking up space in many of the Class A and B+ buildings with an eye toward future expansion.

After three quarters of positive absorption, approximately 17,000 square feet of space was put back on the market in the first quarter of the year. While leasing activity is not exploding, a number of other factors give reason to believe that a significant uptick in activity is on the horizon.

According to Jessica Newhouse, research analyst for Grubb & Ellis’ Delaware office, simply playing the numbers game does not accurately reveal the state of the market. Even with the negative absorption, vacancy declined as explained by the tracking of additional pre-existing, fully leased product by Grubb & Ellis’ research team. In the past 12 months, total vacancy has dropped from 20.5 percent to approximately 16.4 percent.

Much of the vacant space left through the consolidations of DuPont, Hercules and PNC Bank from 3 to 4 years ago has finally been leased up. “After 3 or 4 years of nibbling at available space, vacancy has steadily worked its way down to where it should be,” Johnstone says.

Increased activity from local and regional law firms is primarily credited for leading this trend of small, steady absorption. “We are seeing a lot of movement from law firms; they are really growing in Delaware,” says Joe Capodanno, a member of Grubb & Ellis’ Delaware brokerage team. “We are also getting an influx of Philadelphia-based law firms that are growing their business here and expanding.”

The best indicator of the health of the Delaware office market is the significant speculative development occurring in both Wilmington’s central business district (CBD) and suburbs. More than 750,000 square feet of Class A office space is in the pipeline for the CBD. Buccini/Pollin’s Gateway Plaza will add 250,000 square feet when it comes on line in 2006. The Renaissance Centre and Two Christina Centre are also proposed for the downtown area and will add at least 550,000 square feet to the market. In the north Wilmington area, The Commons at Little Falls, a three-building project, could increase supply by 225,000 square feet.

Tenants still have the upper hand in lease negotiations and landlords are still packaging attractive, competitive offers to secure deals. Many users are moving into Class B buildings and receiving Class A build-outs as part of their deal. The option to grow within the building is often crucial in any potential deal.

Even as rental rates drop slightly, there is evidence that they are stabilizing across the market and growth is not that far off. Class A prices have dropped approximately $1 over the past five quarters, and now stand at $24.84 per square foot. This indicates that landlords are aggressive in pursuing tenants before the new product hits the market.

“One year ago, no one would have thought about doing any spec building in the CBD. Period. So the market is changing,” says Johnstone.

Though the new office product will increase availabilities when it comes on line, Wilmington is steadily re-establishing itself as strong competition for Philadelphia in attracting first-class businesses.

Philadelphia

According to Christian Dyer, first vice president, and Joseph Wolff, senior vice president, of CB Richard Ellis in Philadelphia, the office market in City of Brotherly Love is soft.

“I’d say that our market is active and that rates are fairly steady with a 1 to 3 percent drop [in rental rates] coming this year,” Wolff says.

|

Liberty Property Trust’s 1.2 million-square-foot Comcast Center (rising in the background) will add approximately 500,000 square feet of available space to Philadelphia’s office market when it opens for occupancy in 2007.

|

|

Current numbers wouldn’t indicate a soft market, but two expansive developments loom on Philadelphia’s skyline. The impact of Brandywine Realty Trust’s 727,000-square-foot Cira Centre has already been felt. The office building, which is located at 2929 Arch Street, is 93 percent leased. However, Liberty Property Trust’s 57-story, 1.2 million-square-foot Comcast Center will add approximately 500,000 square feet of new trophy office space to the market when it opens in 2007.

This new space, along with existing space that will soon be vacated by Comcast and ACE Insurance when they relocate to new offices, will bring the city’s vacancy to 17 percent from its current rate of 14 percent.

“So vacancy is going up, but our rental rates are set predicated on anticipation,” says Dyer. “The owners and brokers know that Comcast is going to leave Centre Square, that ACE is going to leave Two Liberty [for 375,000 square feet at 436 Walnut Street and 150,000 square feet at the Penn Mutual Building] and that Cigna is downsizing to 450,000 square feet in Two Liberty. So, that has all been taken into consideration as we have priced available space and future vacancies.”

“Approximately 2 million square feet of new product is currently under construction. And we don’t need it,” Wolff adds. The market is growing and space is being absorbed, but there will simply be too much space to absorb. The vacancy will increase, but companies will still be expanding and entering the marketplace. So, the office market in Philadelphia is in a dichotomous position, where absorption is occurring but not showing in the data.

|

Brandywine Realty Trust’s Cira Centre is already approximately 93 percent leased. Construction of the 727,000-square-foot office building, which is located at 2929 Arch Street in Philadelphia, is expected to be complete by the end of the year.

|

|

Rental rates for Class A space are in the $21 to $22 range per square foot. Trophy space is priced at $23 to $25 per square foot. However, Liberty Property Trust is asking in the $35 to $40 range per square foot in Comcast Center, which could make it difficult to fill the remaining space not occupied by Comcast.

The good news in the city’s 14 percent vacancy rate is that only 1.5 percent of that is sublet space. As in most major Northeast markets, the amount of available sublease space is rapidly declining, with only 600,000 or 700,000 square feet currently available. This means that landlords are placing a majority of the tenants into direct space at standard rents. With all the space that will soon be on the market, tenants still have the upper hand in negotiations.

The most active user in the marketplace is the healthcare industry. The University of Pennsylvania is seeking between 110,000 and 120,000 square feet; Children’s Hospital of Philadelphia is looking for approximately 50,000 or 60,000 square feet; and Temple University is in the market for more than 200,000 square feet.

A current trend in Philadelphia has hospitals seeking large blocks of space in the CBD for non-medical operations. “The space is for their billing operations, call centers and back office operations,” Wolff explains. “What they are doing is freeing up space for more beds in the hospital.”

“They are looking and will probably take advantage of some of the remaining sublease space, which is very advantageous for the market,” Dyer adds.

Though vacancy is increasing in the near future, leasing activity is moving along at a steady pace and, even taking the new space into account, major regional and national companies will continue to absorb space in the market.

New York City

Nowhere is the improving office leasing environment more apparent than in New York City, specifically Manhattan. With approximately 350 million square feet of product, it is impossible to compare New York City’s office market to any other. But when compared to the Big Apple’s performance in the peak years of 2000 and 2001, it is clear that the current market is strong.

At 9.8 percent, vacancy is at its lowest point since the fourth quarter of 2001 (see sidebar below). Rental rates for all of Manhattan have climbed $3.25 since mid-year 2004 to $46.27 per square foot. In Midtown, Class A space is fetching rents as high as $54.97 per square foot, $5.13 more than this time last year.

While leasing velocity has slowed, it was to be expected, says Richard Bernstein, the New York Area president of Trammell Crow Company. “I think this can be attributed to several factors,” Bernstein says. “One is that when you have robust leasing velocity and robust decreases in vacancy [as in 2004], there will always be a point when the trend lines lapse.”

The number of large leases completed in 2005 is significantly lower than last year. At the close of the second quarter, only 6.6 million square feet of space was leased in Manhattan, 3.6 million square feet less that what was recorded during the previous quarter.

“I think that some of the larger tenants are sitting and waiting for opportunities,” Bernstein explains. “One of the effects of an improving market is that you see large blocks of space disappear.”

So now, the 500,000- or 600,000-square-foot user has few options in Manhattan, so there will be very few transactions of that size in the near future. Those users will secure space in the interim until the requisite opportunities become available.

The most active users are still in the financial and legal sectors, but Bernstein sees that changing over the next few years. “Financial companies and law firms have exhibited large appetites for expanding in the last 2 or 3 years. Growth over the next couple of years will be diversified. It will include the not-for-profit sector, the service sector and government users.”

One glaring difference setting the New York City market apart from other Northeast cities is that landlords have firm ground on which to stand in lease negotiations. With demand still high, they continue to have the upper hand when negotiating for larger blocks of Class A space.

“Though pricing in this asset class has increased significantly over the past 2 years, many tenants see value in the Class A market and continue to take advantage of its desirable conditions,” Bernstein says.

Tenants still have the upper hand when it comes to smaller blocks of space under 15,000 square feet. According to Bernstein, these spaces are plentiful and often offer the best deals in Manhattan.

Leasing activity in Downtown has yet to pick up as companies exercise greater caution in managing their growth. This is keeping many businesses from entering the Downtown market, despite great opportunities. That coupled with the quality of life issues that Downtown always faces, is causing that submarket to suffer when compared to Midtown and Midtown South.

The Big Apple Bites Back

There has been lots of talk about the Northeast commercial real estate market moving back on track. About the improving national economy spurring growth in development. About growing confidence in the market’s stability.

Talk is great, but it’s certainly validating when numbers come along that speak far louder to the rebound underway in the Northeast after the lows of 2002 and 2003. According to Cushman & Wakefield’s mid-year market report, the mid-year numbers for Manhattan’s office market clearly indicate that the nation’s largest city is once again a booming real estate scene.

At 9.8 percent, Manhattan’s vacancy rate is at its lowest since the fourth quarter of 2001. This is reason enough for optimism. Even with modest leasing the rest of the year, the vacancy should drop below 9 percent by the start of 2006. A 9 percent vacancy rate is typically the point of equilibrium in the Manhattan market where neither the landlord or tenant is perceived to have the upper hand in lease negotiations.

Even Downtown vacancy rates have dropped significantly, down 2 percentage points from mid-year 2004 to 11.5 percent. Asking rents remain low in Downtown, nearly $17 less than comparable space in the Midtown Manhattan market. For the first time since third quarter 2001, Downtown saw positive absorption.

Another indicator of the market’s health, sublease space, is decreasing. Available sublease space is at a 3-year low, and asking rents, at $47.47 per square foot, are up more than $6 since the end of 2004.

Though the flurry of large leases may have subsided, the trend of companies unloading space, particularly Downtown, has waned as well.

As a result of the still-low interest rates, the investment market is headed for a record-breaking year, highlighted by Tishman Speyer’s $1.7 billion purchase of 200 Park Avenue from Met Life, the largest single-building office sale in history. Other notable acquisitions include SL Green’s purchase of One Madison Avenue, also from Met Life, for $918 million and Equity Office purchasing 1095 Avenue of the Americas from Verizon for $505 million.

— Kevin Jeselnik |

Boston

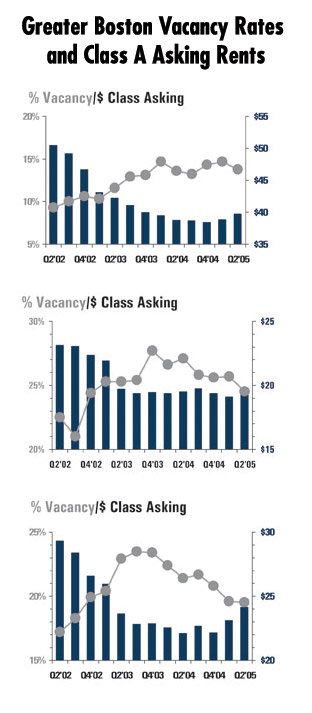

Landlords in Boston have reason to be excited, as signs of rent growth are evident throughout the city’s downtown, Route 128 and Interstate 495 North submarkets. This would indicate substantial strides for the Boston office leasing environment, a market that was hit particularly hard by the economic troubles of the past 4 or 5 years.

A majority of the leasing velocity in greater Boston is coming from smaller companies growing and expanding into significantly larger spaces.

“A lot of space [in downtown Boston] that has been sitting vacant for some time is starting to get chipped away at,” says Thomas Ashe, a vice president with Boston-based Richards Barry Joyce & Partners that specializes in the downtown market. “I think that there is going to be a continued trend of smaller companies growing larger, and you’ll slowly start to see some rent growth in the Class A market.”

Rob Friedman, a vice president at Richards Barry Joyce & Partners who focuses on the Route 128 corridor, believes that the area will also soon experience rent increases in the top-tier buildings and throughout the coveted marketplaces in Waltham and Lexington.

Likewise, smaller tenants are driving activity along the Interstate 495 North corridor, notes Jamey Lipscomb, vice president at Richards Barry Joyce & Partners and specialist in the I-495 market. “There is going to be continued decreased vacancy in all markets and at the same time there are going to be a couple of big transactions ahead, simply because larger tenants are sophisticated enough to say, ‘Okay, we [need to] strike now before the smaller tenants make us move somewhere else.’”

In downtown, leasing activity is primarily concentrated in the Back Bay, a more vibrant 24/7 market than its neighbor, the Financial District. There have been a few recent transactions in the Hancock Tower in the Back Bay in the $50 per square foot range, whereas deals for Class B+ and Class A space are typically in the low $30s per square foot.

Though tenants still have the advantage in negotiated leases, Richards Barry Joyce & Partners see the pendulum swinging towards the landlords over the next 12 months.

“The sublet space has really dried up in the Back Bay and what is left is not the deeply discounted sublet space that was so prevalent a couple of years ago,” Ashe says. The existing sublet product is fetching rental rates only slightly below the price for direct space.

Along the Route 128 corridor, the degree of leverage held by tenants is changing, Friedman adds. “We have seen some rent growth, so landlords are beginning to push rent a bit, especially in the premier properties. The main drive for this is that the landlords are no longer competing with discounted sublease space within their own buildings.”

The improving dynamics signal that Boston is steadily regaining its place as one of the top business hubs in the nation after 4 or 5 years of struggles. As optimism grows and vacancies drop, expect prices to continue to rise through 2006.

Throughout the Northeast, signs are pointing to continued growth in the major office markets. Real estate is a cyclical market and the current slowdown in velocity is a result of the considerable action completed in 2004. Brokers and landlords are working diligently to fill vacancies and guide the leasing community along its current path back to the highs of 2000.

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|