|

MARKET HIGHLIGHT, MARCH/APRIL 2010

CONNECTICUT OFFICE

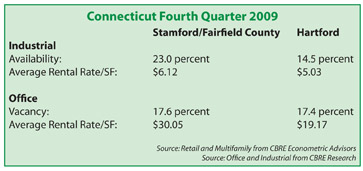

Recent news: Last year saw the Hartford office market overall vacancy rate increase by 426 basis points to 23.17 percent. Absorption was negative with 523,000 square feet of available space on the market owing to The Hartford Insurance Group vacating numerous buildings to fill its newly constructed premises on Day Hill Road in Windsor.

The picture for Class A office space was not much brighter. In fourth quarter 2009, the vacancy rates in Hartford County increased by 364 basis points to 22.2 percent — its highest level since the 1990s.

Year-end did, however, produce some significant deals in the CBD. Law firm Updike Kelly & Spellacy leased 25,000 square feet at100 Pearl Street (vacating space at One State Street). A new tenant to the Hartford market, the financial services firm of Stifel Nicholaus, signed a 4,700-square-foot lease at 90 State House Square. Bingham LLP renewed its 45,000 -square-foot lease at One State Street. Elsewhere, St. Joseph College School of Pharmacy signed a new lease for 35,000 square feet at Hartford 21, 241 Trumbull Street, Hartford.

Submarket update: Hartford’s CBD is struggling. Class A inventory totaled 6.24 million square feet and the overall vacancy rate increased by 174 basis points to 24.2 percent in the fourth quarter. There is more than 1.4 million square feet of vacant space on the market. Last year saw the overall vacancy rate for Class A space jump 508 basis points and negative absorption reach 313,000 square feet. The most noteworthy transaction of 2009 was UnitedHealth Group’s (UHG) long-term lease of 420,000 square feet at CityPlace I. The firm will vacate 473,000 sf at Connecticut River Plaza by July 2010.

Hartford’s strongest submarket is undoubtedly the Eastern submarket. Even with negative absorption reaching 57,198 sf last year, the Eastern submarket’s 11.13 percent vacancy is the strongest of any submarket owing to several renewals and relocations within the area.

Like the CBD, the Western submarket has been struggling over the last year. The overall vacancy rate in the Western market reached 20.52 percent. The overall vacancy rate increased 531 basis points in the fourth quarter, owing to The Hartford Insurance Group shedding third-party leased space in the Western market. In 2009, The Hartford vacated 38 Security Drive, Avon (38,000 sf) and 308 Farmington Avenue, Farmington (45,000 sf). The Hartford is also expected to vacate additional space in Southington at 100 Executive Drive (75,000 sf) and 200 Executive Drive (125,000 sf). Most of the jobs will be relocated to its corporate HQ in Simsbury.

Historically, the Southern submarket has been one of the strongest markets. With many large blocks of vacant space, we foresee the submarket will continue to secure tenants throughout 2010. Landlords are using aggressive tactics to land deals, including months of free rent and large tenant improvement packages.

The Northern submarket is just behind the Western submarket in terms of strength. Tenant activity improved during the second half of 2009 and this trend is expected to continue through early 2010. Landlords will continue to offer aggressive pricing and increase concessions in order to lure tenants from other submarkets. ALSTOM Power finalized a significant lease in 2009 by vacating its own building on the ABB campus in Windsor, which will be demolished. It subsequently leased over 340,000 sf in two buildings in Windsor: 200,000 square feet at 175 Addison Road and 142,000 square feet at 200 Great Pond Road.

Predictions for the next year: Although leasing activity was brisk in 2009, the number of finalized transactions was considerably less than in previous years. Tenants are analyzing their occupancy options carefully and are not rushing to complete deals. With transactions in the pipeline, coupled with positive hiring forecasts in the second half of 2010, we expect to see positive absorption of approximately 100,000 to 150,000 square feet over the year.

— Chris Ostop, senior vice president of office leasing with Jones Lang LaSalle’s Hartford, Connecticut, office

CONNECTICUT RETAIL

Recent news: The leasing activity in Connecticut has been very healthy in recent months as evidence by the new leases signed in the marketplace. Some junior anchor box examples include a 24,000-square-foot REI deal in Norwalk; a 37,000-square-foot Stop & Shop Supermarket in West Hartford; a 30,000-square-foot PC Richards deal in Milford; and numerous other deals. Also, the recent sale of the Shaw’s Supermarket sites to existing supermarket chains demonstrate that retailers feel that Connecticut is still a very healthy market.

Another trend, which has been very apparent in Connecticut, has been the surge in franchise concepts leasing smaller spaces within supermarket anchored shopping centers and community centers. Some franchises that are active include Massage Envy, Sport Clips, Robeks, Five Guys, Doctors Express and numerous others.

Submarket update: The luxury-oriented streets (Greenwich Avenue in Greenwich and Main Street in Westport) had a weak 2009. However, the outlook for 2010 is much more promising with recent signature stores openings, including Apple and Ralph Lauren. Leasing activity has increased dramatically and leasing inquiries are at its highest levels since the summer of 2008.

Predictions for the next year: The “Year of Fear” (2009) is over, thankfully, and the “Year of Caution” (2010) is upon us. The leasing activity in Connecticut over next 12 months will be dramatically better than the previous 12 months. Landlords will no longer be inundated with rent reduction requests/tenant defaults and will be turning their attention to making prudent real estate deals. Retailers, on the other hand, will be primarily focusing on profitability and not dramatically increasing store counts. In short, 2010 promises to put both landlords and retailers on the road to a healthy recovery.

— Dominick Musilli, executive vice president with Stamford, Connecticut-based RHYS Commercial

CONNECTICUT MULTIFAMILY

Apartment property fundamentals should stabilize this year after absorbing the demand shock of 2009. Tepid job creation and elevated unemployment will hamper renter household formation through most of 2010, delaying a more noteworthy improvement in apartment demand. National unemployment in the prime renter age cohort of 20- to 34-year-olds started the year more than 200 basis points above the overall rate and at the highest level on record since the early 1980s. Additional challenges to an apartment recovery in 2010 include competition from shadow rentals and the extended first-time homebuyer tax credit. By some estimates, the latter has already resulted in 350,000 home sales that would not have occurred otherwise. The extended forecast for the apartment sector remains bright, supported by a pullback in construction and permitting, burn-off of excess housing inventory, receding homeownership rates, and favorable demographics.

This year’s slow rebound in hiring, particularly in the professional and business services and trade, transportation and utilities sectors, will continue to dampen apartment fundamentals in southwestern Connecticut. Nevertheless, modest historical rent increases and average inventory growth of just 1.1 percent annually over the past 5 years have led to pent-up renter demand in many submarkets. In New Haven Harborside and North Haven/Wallingford/Meriden, for example, slight vacancy improvements are projected to persist in 2010, which should allow rent reductions in these areas to taper off by midyear. Alternately, owners in Fairfield County will continue to rely on concessions due to elevated rents. The largest rent cuts have already occurred in the county, and modest job creation will cause rent discounts to ease further as the year progresses. Construction will increase to an uncharacteristic high of 500 units in 2010. Completions will be limited to the New Haven core, however, where vacancy is the tightest in the metro area and unoccupied units fill quickly.

By the numbers, employment growth in New Haven is forecast to lag the national average. Employers are forecast to increase head counts in the New Haven metro area by 1,600 positions in 2010, or 0.2 percent, after shedding 26,700 jobs last year. Construction output is expected to increase to 500 units this year, following the completion of 280 apartments in 2009. In 2010, limited job growth and the delivery of new stock will contribute to raising vacancy 30 basis points to a still-healthy 4.8 percent. Vacancy increased 40 basis points last year. Asking rents will decline 1.6 percent to $1,497 per month this year, while effective rents will dip 2.5 percent to $1,405 per month. In

2009, asking and effective rents fell 4.5 percent and 6.2 percent, respectively. Class A rents in the downtown core New Haven market will be negatively impacted as the 360 State Street project comes online with 500 new units in spring of this year.

Continuing an investment trend that began during the second half of 2009, sales velocity in New Haven will accelerate in 2010, though the number of sales will remain well below peak levels. Buyers will be most active in New Haven and lower Fairfield County due to their historically strong rental demand and large concentrations of employers. Investment activity also will increase in the Wallingford/Meriden submarket, given the resiliency of area operating fundamentals through even the worst of the recession. In Bridgeport, expectations for still-soft rent and vacancy trends will likely limit an upswing in buying activity this year, though the possibility of cap rates nearing 9 percent will maintain some investor interest.

Apartment development in the years leading up to the recession fell short of historical norms, and tight credit markets have since cleared many planned projects from the pipeline. In 2009, multifamily permitting declined 60 percent from the previous year, and construction deferrals doubled. The lull in development will provide owners time to fill vacant units ahead of the next construction cycle, which is unlikely to reach meaningful levels until 2012 to 2013. Furthermore, apartment owners stand to benefit from echo boomers transitioning into their prime renting years, with the number of 20- to 34-year-olds projected to rise by approximately 5 million individuals in the next 10 years.

— Steve Witten is first vice president of investments in the New Haven office of Marcus & Millichap Real Estate Investment Services. He is also a senior director of the firm’s National Multi Housing Group.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|